The best alternative to Pocketbook

Pocketbook was once a popular choice for Australians looking to manage their personal finances, but with the app discontinued, it’s time to explore alternatives that can offer more advanced features and better control over your financial future.

Enter TaxTank – a cutting-edge platform that not only simplifies tax management but also integrates powerful personal finance tools. Here’s why TaxTank is the best alternative to Pocketbook for savvy Australians looking to take control of their financial health.

Why choose an alternative to Pocketbook?

As the app is no longer available, users need to find an alternative that not only replaces Pocketbook’s core functions but also provides enhanced tools to help manage both personal and investment finances with ease.

While Pocketbook offered basic budgeting tools and a user-friendly interface, it fell short in areas like real-time tax tracking, comprehensive financial reporting, and advanced features for investors. TaxTank offers all of this and more, making it the perfect alternative for those who want to take their financial planning to the next level.

TaxTank offers more than just a budgeting tool

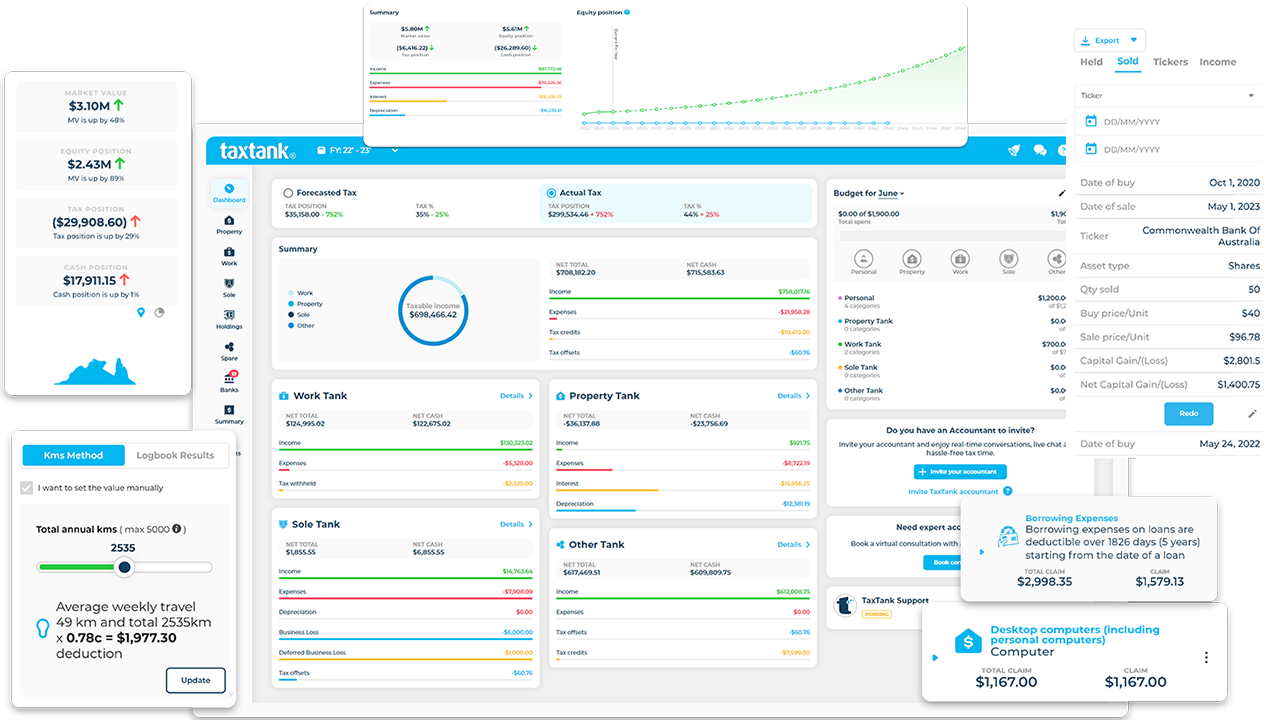

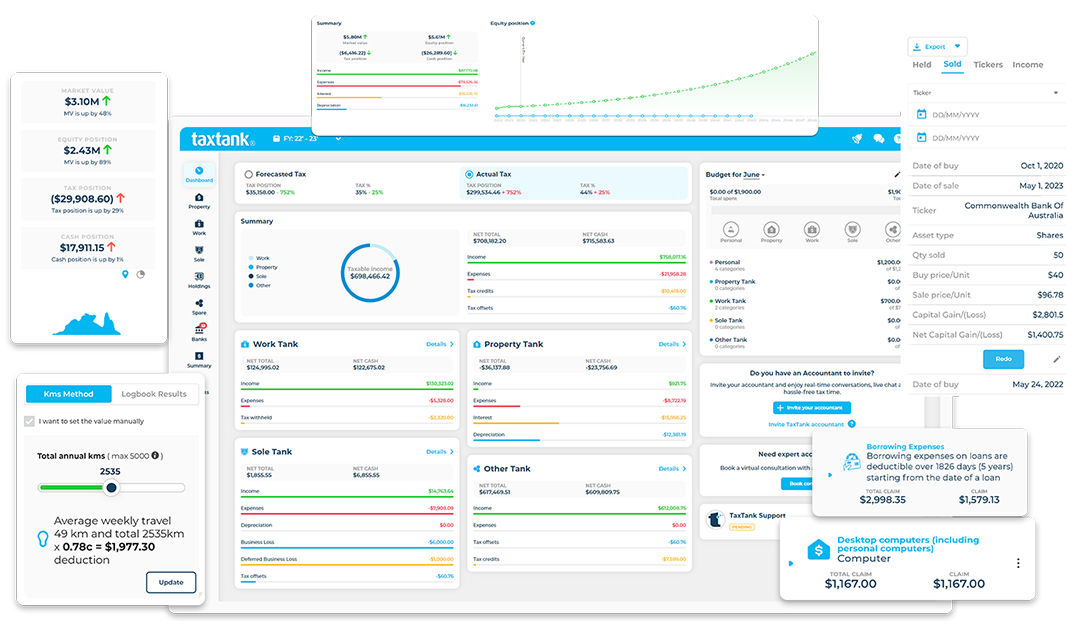

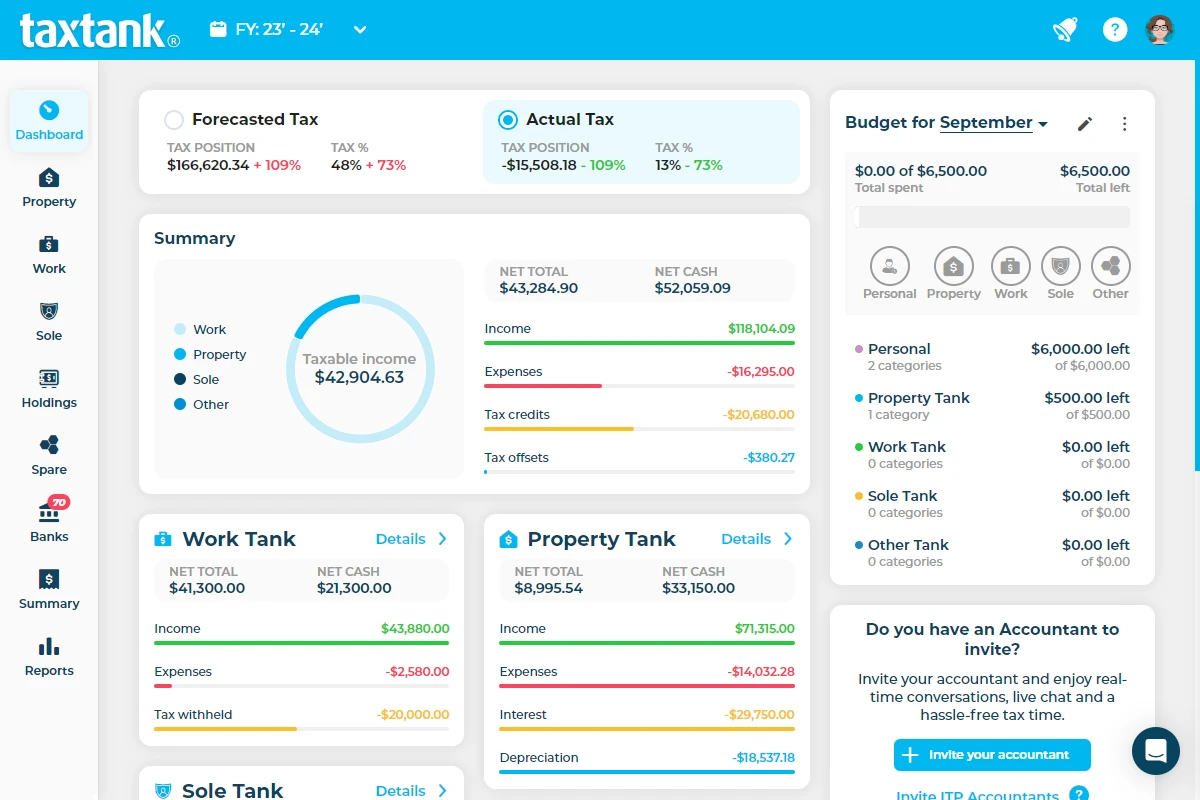

TaxTank stands out as more than just a replacement for Pocketbook’s basic budgeting features. It is designed to give you a holistic view of your finances, incorporating everything from income and expenses to investment management and tax tracking.

Real-Time Tax Management

One of the key areas where Pocketbook lacked is tax management. With TaxTank, you can track your tax liabilities in real-time throughout the year. No more waiting until the end of the financial year to see your tax position – TaxTank allows you to monitor everything as it happens, making it easier to manage your budget and tax planning simultaneously.

Comprehensive Budget Management

TaxTank offers powerful budgeting tools like Pocketbook. With easy-to-use features that allow you to categorise your and automate expenses, track your spending habits, you can maintain control of your finances effortlessly. TaxTank’s budgeting feature integrates seamlessly with your tax data, allowing you to see the bigger financial picture in one place.

Detailed Financial Reporting

TaxTank gives you access to a range of detailed reports that go beyond simple income and expense tracking. Whether it’s forecasting future tax obligations, tracking the performance of your investments, or calculating potential capital gains, TaxTank offers insights that can help you make informed decisions about your financial future.

Automation to Save Time

While Pocketbook offered limited automation with only 24 live bank feeds—requiring manual entry for many other financial institutions—TaxTank automates most of the process. Using Open Banking ensures that your income and expenses are automatically tracked without the need for time-consuming data entry. Additionally, TaxTank allows you to set automated bank rules, so you can “set and forget” the allocation of recurring transactions, making the process even more streamlined.

It's literally about 10 minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”

Tailored for Property Investors

If you are a property investor, TaxTank is the ultimate solution. It’s designed with features like automated live bank feeds, capital gains tax calculations, and depreciation schedules, all tailored to help investors manage their portfolios effortlessly. Pocketbook didn’t offer such specialised tools for property investors, making TaxTank the superior choice for those looking to maximise their returns and minimise their tax obligations.

Why TaxTank is the best alternative to Pocketbook

If you’re looking for an alternative to Pocketbook, TaxTank is by far the most comprehensive and user-friendly option available in Australia today.

Not only does it cover everything Pocketbook once offered, but it goes much further, providing tools that help you manage your personal finances, track your investments, and stay on top of your tax obligations in real-time.

1. Affordable Pricing

Starting from just $6 per month, TaxTank offers incredible value for the features it provides. Whether you’re managing a personal budget or a property portfolio, you’ll find that TaxTank delivers everything you need at an affordable price.

2. ATO Compliance

TaxTank’s integration with ATO guidelines means you can manage your tax obligations with ease, ensuring compliance and minimising the risk of penalties.

3. User-Friendly Interface

Just like Pocketbook, TaxTank’s interface is simple and intuitive, allowing you to manage your finances without needing to be a financial expert.

Ready to take control of your finances? Sign up for TaxTank today and see for yourself why it’s the best alternative to Pocketbook for Australians.

How TaxTank compares to Pocketbook

If you’re looking for an alternative to Pocketbook, TaxTank is by far the most comprehensive and user-friendly option available in Australia today. Not only does it cover everything Pocketbook once offered, but it goes much further, providing tools that help you manage your personal finances, track your investments, and stay on top of your tax obligations in real-time.

TaxTank

- Real-Time Tax Management

- Comprehensive Budgeting Tools

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of assets

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

Pocketbook

TaxTank

- Real-Time Tax Management

- Comprehensive Budgeting Tools

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of business assets

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

Pocketbook

TaxTank

- Real-Time Tax Management

- Budgeting Tools

- Live Bank Feeds

- Automated expenses

- Automated depreciation

- Capital Gains Tax Calculator

- Complete tax oversight

- Document storage

- Tax deductible fees

TaxTank

Pocketbook

It's easy to get started

Our pricing starts from as little as $6* per month and is customisable so you only pay for the Tanks that suit your individual needs. TaxTank is also 100% tax deductible 😉 so it’s a win, win.

- Free Trial

- No Credit Card Required

- Cancel Anytime

PROPERTY TANK

Manage property income and expenses

$15/month*

WORK TANK

Manage work income and expenses

$9/month*

SOLE TANK

Manage sole trader income and expenses

$9/month*

MONEY TANK

Manage budgets, cash flow and financial goals

$6/month*

HOLDINGS TANK

Manage CGT for shares, crypto and other assets

$6/month*

SPARE TANK

Upload important documents and receipts

FREE WITH ANY PAID TANK

Frequently asked questions

Yes! TaxTank offers everything Pocketbook once did and more, including real-time tax management, automated bank feeds, and tailored features for property investors.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

Can I add more than one business into TaxTank?

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.

Getting started with TaxTank is easy. Simply sign up for a 14 day trial, connect your bank accounts, set up your automated bank rules and let TaxTank do the work!