The best alternative to YNAB

When it comes to budgeting and financial management, many people turn to YNAB (You Need A Budget) for its structured approach to budgeting. However, YNAB’s envelope-style budgeting and lack of integrated tax tools leave a gap for individuals managing more than just everyday spending, especially those balancing investments or property.

For Australians looking for a more comprehensive, automated alternative, TaxTank offers superior financial oversight.

Why choose an alternative to YNAB?

TaxTank offers more than just a budgeting tool

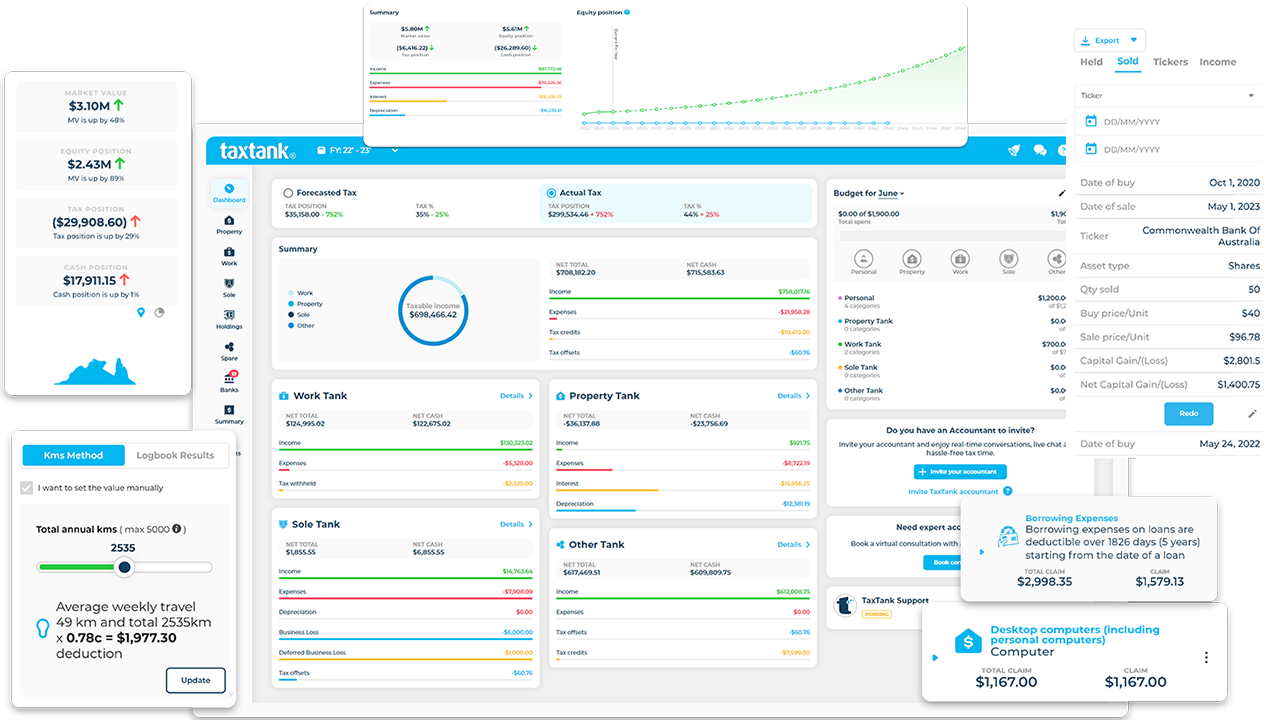

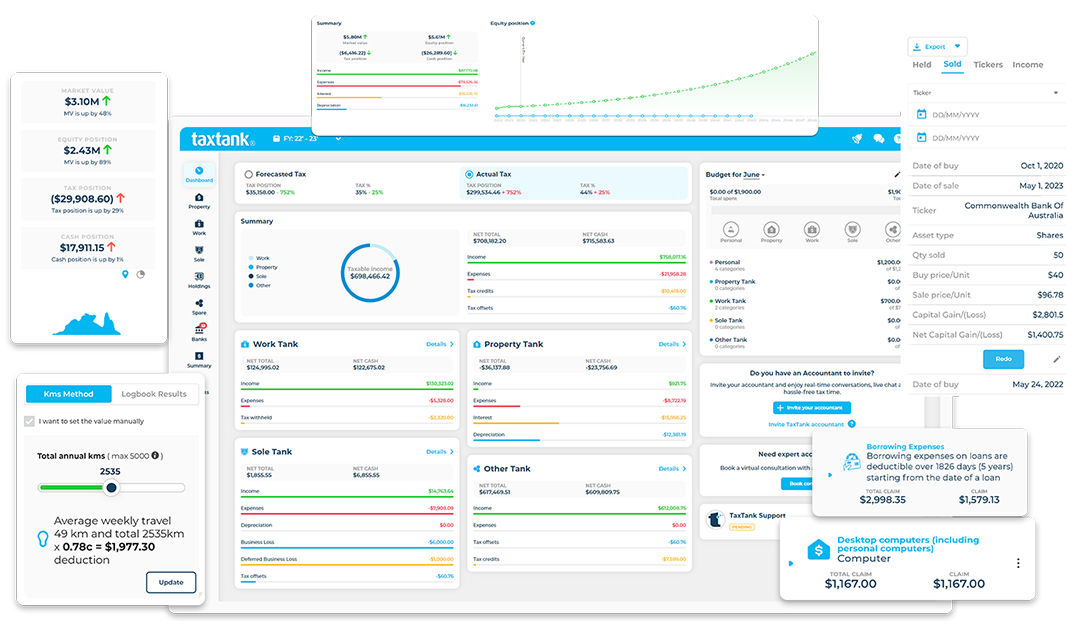

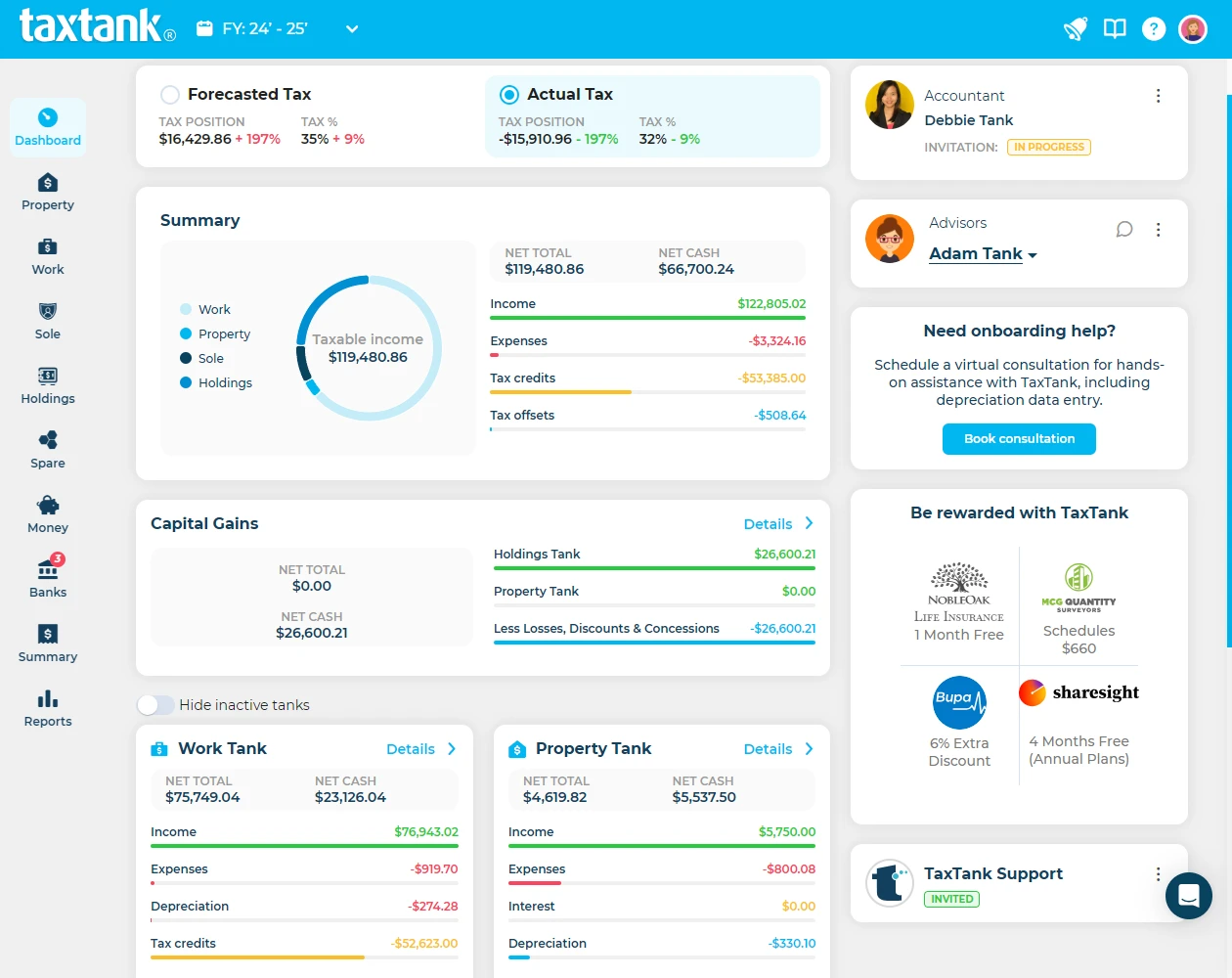

TaxTank stands out as more than just an alternative for YNAB’s budgeting features. It is designed to give you a holistic view of your finances, incorporating everything from income and expenses to investment management and tax tracking.

Built for Australians

TaxTank is specifically designed for the Australian market, offering tailored tax management tools that ensure compliance with ATO regulations. Whether you’re managing work-related expenses, property portfolios, or investments, TaxTank helps keep everything in check.

Comprehensive Financial Oversight

Unlike YNAB, which is limited to budgeting, TaxTank offers a broader scope that includes tools for managing work-related income, expenses, property investments, and even capital gains on shares and cryptos. It’s a one-stop solution for all your financial needs, not just budgeting.

Real-Time Tax Management

While YNAB focuses on budgeting, TaxTank integrates real-time tax management throughout the year. You’ll always know where you stand in terms of tax liabilities, deductible expenses, and upcoming obligations. This means no surprises at tax time—TaxTank gives you a clear picture of your financial position at all times.

Automation for Effortless Tracking

YNAB requires manual input for many transactions, while TaxTank uses Open Banking to automate your financial tracking. With connections to over 140 banks and financial institutions, TaxTank automatically tracks your income, expenses, and transactions, allowing you to focus on what matters most—without worrying about data entry errors.

It's literally about 10 minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”

Detailed Financial Reporting

TaxTank gives you access to a range of detailed reports that go beyond simple income and expense tracking. Whether it’s forecasting future tax obligations, tracking the performance of your investments, or calculating potential capital gains, TaxTank offers insights that can help you make informed decisions about your financial future.

Why TaxTank is the best alternative to YNAB

TaxTank is designed to provide not only a smarter budgeting experience but also comprehensive financial and tax management. Whether you’re a property investor, a sole trader, or just looking for a way to manage your finances more effectively, TaxTank ensures everything from your income and expenses to tax liabilities and investments is managed seamlessly.

By offering real-time tracking, automation, and tax compliance features specific to Australian users, TaxTank outshines YNAB in almost every category.

1. Affordable Pricing

Starting from just $6 per month, TaxTank offers incredible value for the features it provides. Whether you’re managing a personal budget or a property portfolio, you’ll find that TaxTank delivers everything you need at an affordable price.

2. ATO Compliance

TaxTank’s integration with ATO guidelines means you can manage your tax obligations with ease, ensuring compliance and minimising the risk of penalties.

3. User-Friendly Interface

TaxTank’s interface is simple and intuitive, allowing you to manage your finances without needing to be a financial expert.

Ready to take control of your finances? Sign up for TaxTank today and see for yourself why it’s the best alternative to YNAB in Australia.

How TaxTank compares to YNAB

If you’re looking for an alternative to YNAB, TaxTank is by far the most comprehensive and user-friendly option available in Australia today. Not only does it cover everything YNAB offers, but it goes much further, providing tools that help you manage your personal finances, track your investments, and stay on top of your tax obligations in real-time.

TaxTank

- Real-Time Tax Management

- Comprehensive Budgeting Tools

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of assets

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

YNAB

TaxTank

- Real-Time Tax Management

- Comprehensive Budgeting Tools

- Live bank feeds through Open Banking

- Automated expenses allocation on bank transactions

- Automated depreciation of business assets

- Capital Gains Tax Calculator

- Complete oversight of your whole tax position

- Permanent document storage

- Tax deductible fees

TaxTank

YNAB

TaxTank

- Real-Time Tax Management

- Budgeting Tools

- Live Bank Feeds

- Automated expenses

- Automated depreciation

- Capital Gains Tax Calculator

- Complete tax oversight

- Document storage

- Tax deductible fees

TaxTank

YNAB

It's easy to get started

Our pricing starts from as little as $6 per month and is customisable so you only pay for the Tanks that suit your individual needs. TaxTank is also 100% tax deductible 😉 so it’s a win, win.

- Free Trial

- No Credit Card Required

- Cancel Anytime

PROPERTY TANK

Manage property income and expenses

$15/month*

WORK TANK

Manage work income and expenses

$9/month*

SOLE TANK

Manage sole trader income and expenses

$9/month*

MONEY TANK

Manage budgets, cash flow and financial goals

$6/month*

HOLDINGS TANK

Manage CGT for shares, crypto and other assets

$6/month*

SPARE TANK

Upload important documents and receipts

FREE WITH ANY PAID TANK

Frequently asked questions

TaxTank is the best alternative to YNAB in Australia, offering automated bank feeds, real-time tax and money management, and powerful tools for budgeting and all your finance needs.

TaxTank is tailored to the Australian market with features like real-time tax tracking, integration with ATO regulations, and automated bank feeds.

Absolutely! TaxTank includes specific tools for managing property portfolios, shares, and even crypto investments, making it more versatile than YNAB.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.

Getting started with TaxTank is easy. Simply sign up for a 14 day trial, connect your bank accounts, set up your automated bank rules and let TaxTank do the work!