Managing investment properties can be a challenging task, especially when it comes to tracking expenses, calculating tax obligations, and ensuring compliance with Australian Taxation Office (ATO) requirements. While many property investors still rely on traditional investment property spreadsheets to manage their finances, TaxTank offers a smarter, more efficient solution that outshines even the most meticulously maintained spreadsheet. Here are five compelling reasons why TaxTank is a superior choice for investment property management.

1. Comprehensive Automation for Seamless Property Management

Investment property spreadsheets require manual data entry, constant updates, and frequent troubleshooting to ensure accuracy. TaxTank eliminates these inefficiencies through automation that streamlines the entire property management process. With TaxTank, you can:

- Link directly to your bank accounts using secure Open Banking technology, automatically importing and categorising transactions.

- Set up custom automation rules to handle recurring expenses and income, saving you hours of manual input.

- Access real-time financial data, ensuring that your records are always up-to-date without the risk of human error.

This level of automation not only saves time but also ensures you’re less likely to overlook deductible expenses or misreport income—issues that could lead to penalties from the ATO.

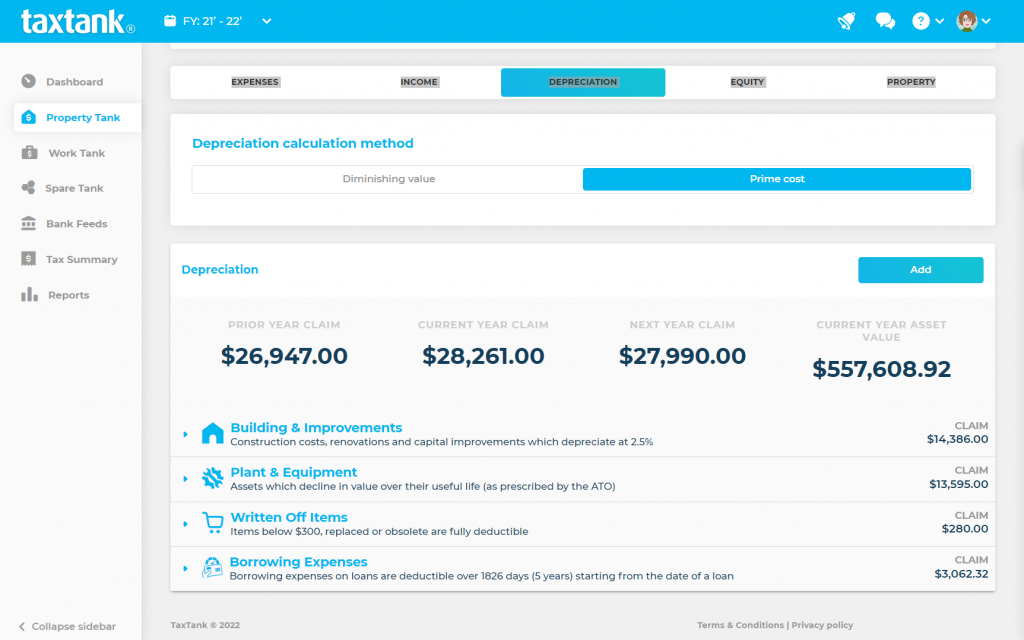

2. Built-In Tax Tools Designed for Australian Investors

Investment property spreadsheets may help you record your expenses and income, but they can’t handle the complexities of Australian tax law. TaxTank is specifically designed for Australian property investors, offering tools that simplify tax compliance and maximise your deductions. Key features include:

- Depreciation schedules: Adding existing depreciation schedules, new builds, and renovation projects for a property is relatively fast and painless in TaxTank. The better news? Once added, the schedules automatically allocate to future years to ensure nothing is missed year after year.

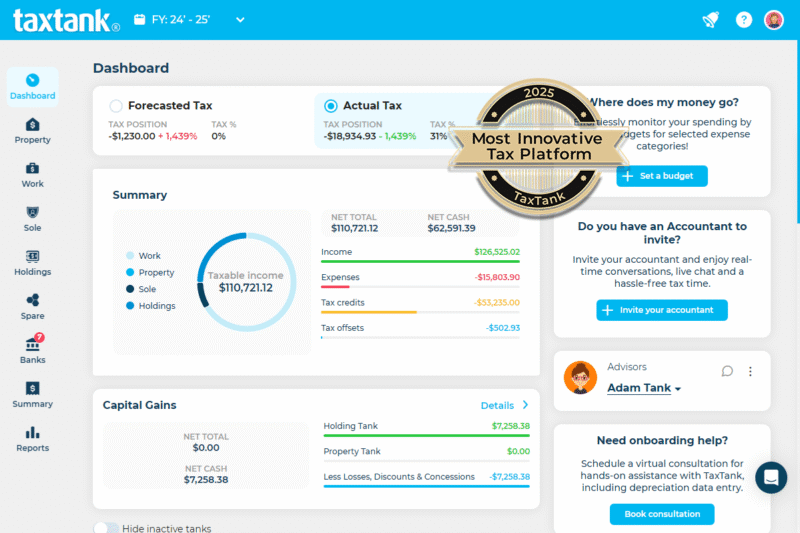

- Capital Gains Tax calculator: TaxTank has a built-in Capital Gains Tax (CGT) calculator so you will always know how much you need to pay in just three simple steps. You can also scenario test to see the financial outcomes of potential sales.

- ATO-compliant reporting: Generate reports that meet ATO standards, making your tax return lodgement faster and stress-free.

These built-in tools ensure you never miss a deduction while maintaining full compliance with Australian tax regulations.

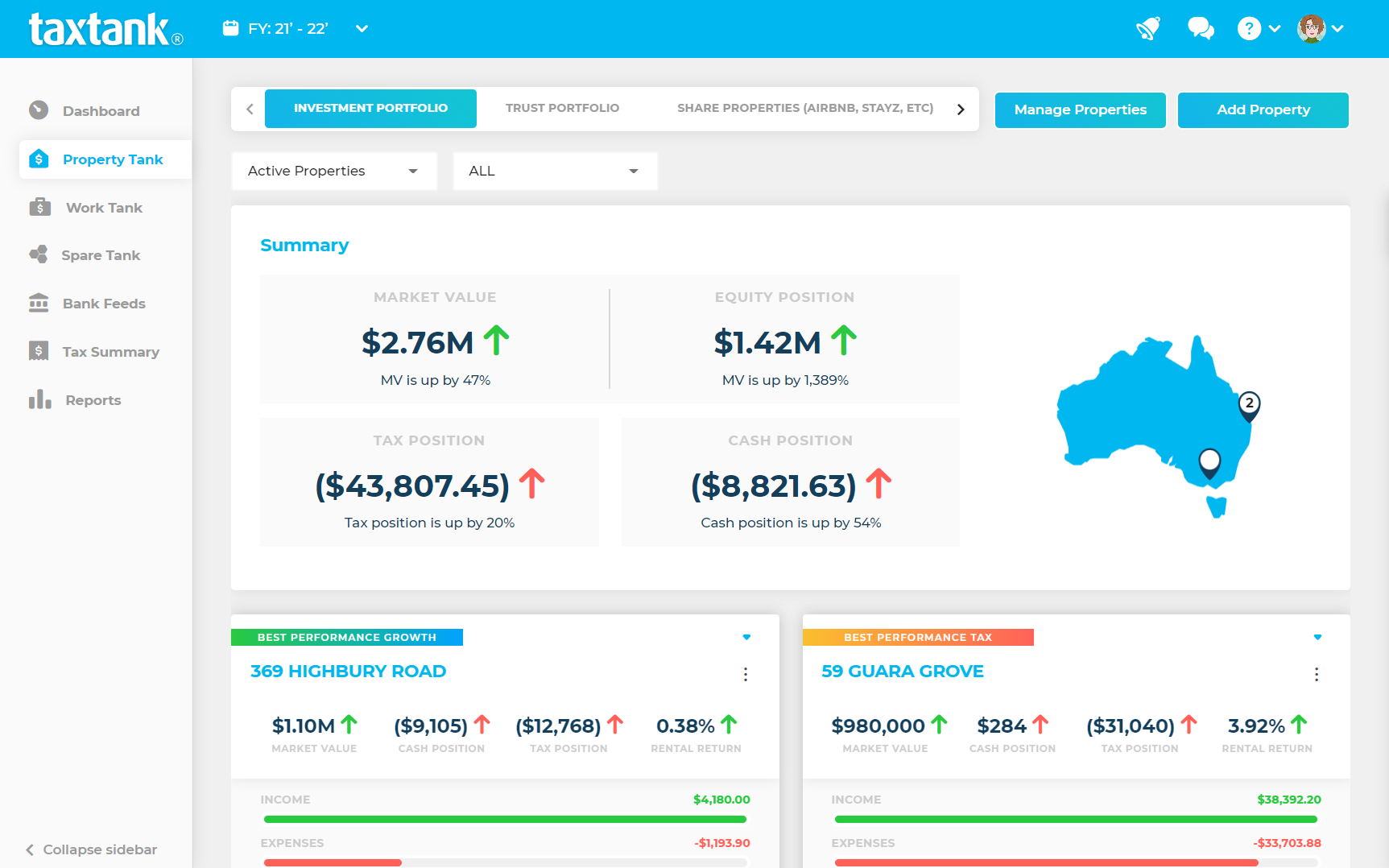

3. Real-Time Insights and Forecasting

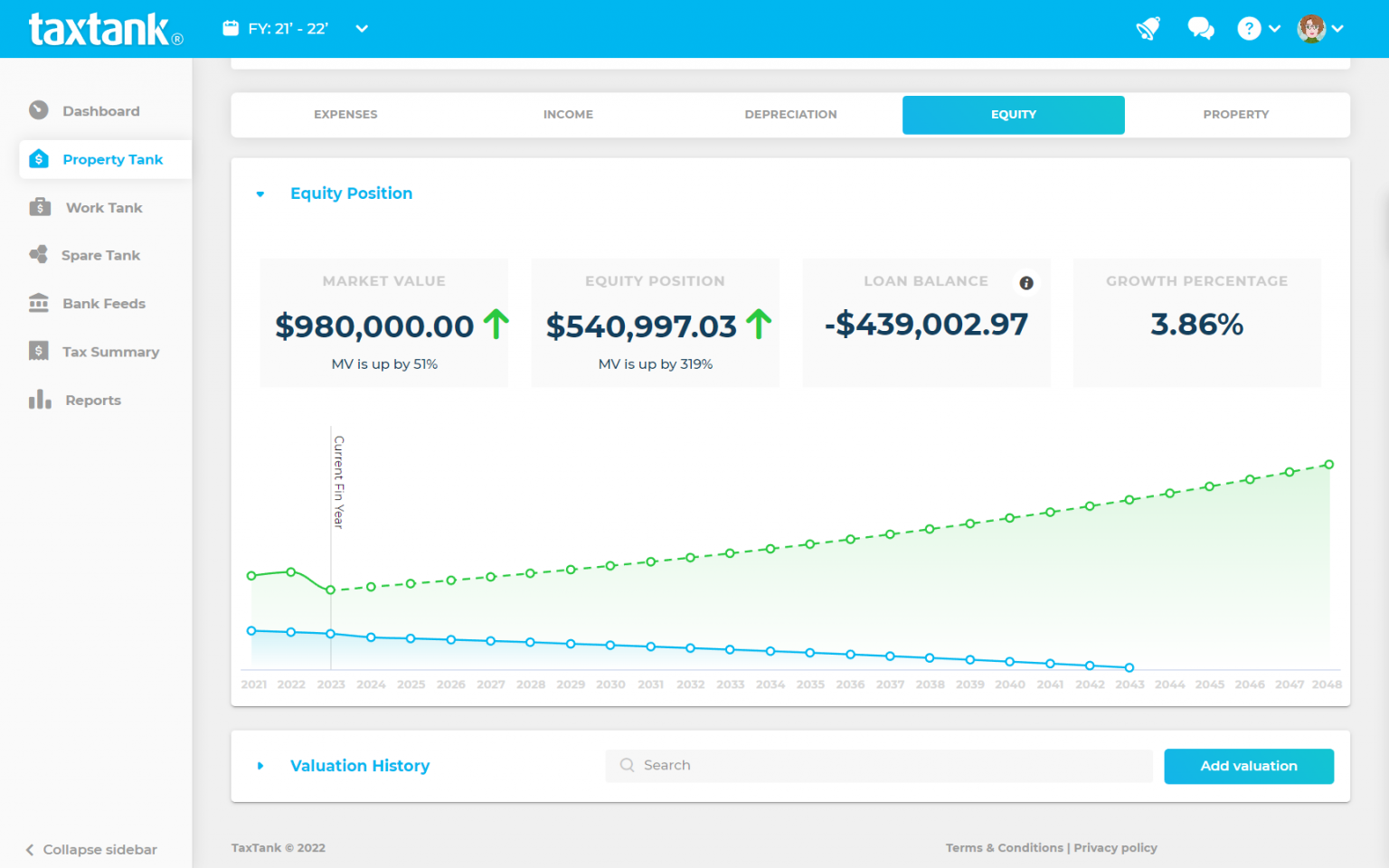

Unlike investment property spreadsheets, which offer a static snapshot of your finances, TaxTank provides dynamic, real-time insights to help you make smarter decisions. With TaxTank, you can:

- Monitor your portfolio’s performance with detailed dashboards displaying key metrics like rental income, expenses, and overall cash position.

- Access forecasting tools powered by CoreLogic to project growth and equity over time. This allows you to better plan future investments and understand property performance.

- Compare interactive reports and rental returns, ensuring you’re always armed with the right information when needed.

By offering these advanced forecasting tools, TaxTank empowers you to stay ahead of the game and maximise your property’s profitability.

4. Simplified Collaboration With Professionals

One of the significant limitations of investment property spreadsheets is their inability to facilitate effective collaboration. Sharing files with accountants, mortgage brokers, or financial advisors can be cumbersome and prone to version control issues. TaxTank simplifies this process by enabling:

- Direct access for your accountant or advisor, allowing them to review and update your financial data in real time.

- Seamless document sharing, ensuring that all stakeholders have access to the latest information without the need for email attachments or manual updates.

- Centralised data storage, so you never lose track of critical documents or reports.

This streamlined collaboration ensures your financial team can work more effectively, ultimately saving you time and reducing stress during tax season.

5. User-Friendly Interface Designed for Everyone

Investment property spreadsheets, especially those laden with complex formulas, can be intimidating and error-prone for many users. TaxTank’s intuitive interface makes property management accessible to everyone, regardless of their technical expertise. Key benefits include:

- Simple setup: Start managing your properties in minutes, with guided tutorials and easy navigation.

- Mobile-friendly design: Access your data anytime, anywhere, from your smartphone or tablet.

With TaxTank, you don’t need to be a tech wizard or a finance expert to take control of your investment portfolio.

Bonus: Security and Compliance You Can Trust

When managing financial data, security is paramount. Investment property spreadsheets stored on your computer or in the cloud are vulnerable to data breaches, accidental deletions, or unauthorised access. TaxTank offers enterprise-grade security features to protect your information, including:

- Encryption of sensitive data, ensuring your financial records are secure from prying eyes.

- Regular backups, so you never lose important information.

- Compliance with Australian data protection laws, giving you peace of mind that your data is handled responsibly.

By prioritising security and compliance, TaxTank safeguards your financial information while keeping you aligned with regulatory standards.

Conclusion

While an investment property spreadsheet has been a long-standing tool for managing finances, it pales in comparison to the capabilities of TaxTank. By offering comprehensive automation, built-in tax tools, real-time insights, simplified collaboration, and a user-friendly interface, TaxTank transforms the way property investors manage their portfolios. Add to that its superior security and compliance features, and it’s clear why TaxTank is the smarter choice for modern Australian investors.

If you’re ready to move beyond the limitations of spreadsheets and embrace a more efficient, accurate, and stress-free way of managing your investment properties, it’s time to make the switch to TaxTank. Your future self will thank you!