Calculating Capital Gains Tax (CGT) can feel like navigating a financial maze, confusing, time-consuming, and filled with unexpected tax traps. Whether you’re selling property, shares, crypto, or business assets, keeping track of cost bases, exemptions, and offsets is no small task.

Enter TaxTank, Australia’s first fully automated Capital Gains Tax calculator, designed to take the stress out of tax time. With real-time tracking, automated cost base calculations, and seamless integration across all asset classes, TaxTank ensures you never overpay CGT while staying fully compliant with ATO rules.

In this guide, we’ll break down what CGT is, how it works, and how TaxTank automates the process to save you time, money, and unnecessary headaches.

Plus, we’ll share expert tips to legally reduce your CGT bill. Let’s dive in!

What Is Capital Gains Tax (CGT)?

Think of Capital Gains Tax (CGT) as the ATO’s way of sharing in your success, whenever you sell an asset for more than you paid for it, they want a slice of the profit. That profit, aka your capital gain, gets added to your taxable income for the year and is taxed at your marginal tax rate.

How Does Capital Gains Tax Work?

Unlike a flat tax, where everyone pays the same percentage, CGT scales with your earnings. The more you make, the more you pay. But don’t worry, there are ways to reduce CGT, and we’ll cover those soon!

📌 Quick Example:

- You buy shares for $10,000 and sell them for $15,000.

- That $5,000 profit (capital gain) is added to your taxable income.

- If you’ve held the shares for over 12 months, you may be eligible for the 50% CGT discount (meaning only $2,500 is taxed).

Bottom line? CGT isn’t a separate tax—it’s just part of your overall taxable income.

What Assets Are Subject to CGT?

Not everything you sell will attract CGT. The ATO doesn’t care if you offload your old couch or finally say goodbye to that second-hand car from 2005. But if you’re cashing in on the following, CGT applies:

📌 Assets that attract CGT:

- ✅ Investment properties – If it’s not your main home, it’s fair game for CGT.

- ✅ Shares & ETFs – Whether you’re a long-term investor or a frequent trader, capital gains (or losses) apply.

- ✅ Cryptocurrency – Buying and holding crypto? No problem. But the moment you sell, swap, or even use it to buy something, CGT is triggered.

- ✅ Business assets – Selling a business or business property? You’ll likely face CGT, though small business concessions may apply.

- ✅ Collectibles over $500 – Art, rare coins, vintage cars—if they appreciate in value and you sell them, the taxman wants in.

📌 Assets that are CGT-exempt:

- 🚫 Your main residence (as long as you’ve lived in it the whole time). We’ll explain this one in more detail below.

- 🚫 Personal-use assets under $10,000 (e.g., your car, furniture, or that giant flat-screen TV).

- 🚫 Depreciating business assets (like computers and machinery).

CGT Exemptions and Discounts

The ATO isn’t completely heartless—there are several CGT exemptions and discounts to soften the blow:

- 50% CGT Discount – If you’ve held the asset for more than 12 months, individuals and trusts can slash their taxable gain by 50%. (Sorry, companies, you miss out on this one.)

- Main Residence Exemption – If the property you’re selling has been your primary home since day one, you won’t pay a cent in CGT. However, if you’ve rented it out or used it for business, you might only get a partial exemption.

- The Six-Year Rule (Even After Moving Out or Divorce) – If you move out of your main home and rent it out, you can still claim the main residence exemption for up to six years, as long as you don’t buy another “primary residence”.

- Relationship breakdown? If a property is transferred between spouses due to divorce or separation, CGT is usually deferred until the receiving party sells it meaning no immediate tax hit. However, if they later sell, the CGT calculation will consider the original purchase date and price, not the date of transfer.

- Small Business CGT Concessions – Own a small business? You might qualify for some serious tax breaks, including a 15-year CGT exemption or the ability to roll over your CGT liability into another investment.

✅ Pro tip: The best way to legally reduce CGT is through strategic timing and tax planning, which is why an automated capital gains tax calculator is a game-changer.

Why Use An Automated Capital Gains Tax Calculator?

Calculating CGT manually is about as fun as doing your own dental work. Every sale requires you to track costs, sale prices, holding periods, deductions, and offsets—and get one figure wrong? The ATO won’t be amused.

This is where automation makes life easier.

Benefits Of An Automated Capital Gains Tax Calculator

An automated capital gains tax calculator takes the hassle out of tax time by:

✅ Automating complex CGT calculations

✅ Factoring in real-time asset values and transaction data

✅ Saving time (no need to manually crunch numbers!)

✅ Providing accurate calculations before tax season hits

✅ Export ready reports saving your accountant time and you money

Common Mistakes When Calculating CGT Manually

Doing it yourself? Here are some pitfalls to avoid:

🚫 Forgetting to adjust for selling costs (ie, agent fees, holding costs etc..)

🚫 Miscalculating the 12-month CGT discount or other available concessions.

🚫 Not factoring in capital losses to offset gains

How To Use Australia’s First Automated Capital Gains Tax Calculator

Managing CGT manually across different asset classes is a logistical nightmare. Traditional capital gains tax calculators only focus on specific assets like shares or crypto, leaving property investors and business owners scrambling to track costs, exemptions, and tax offsets.

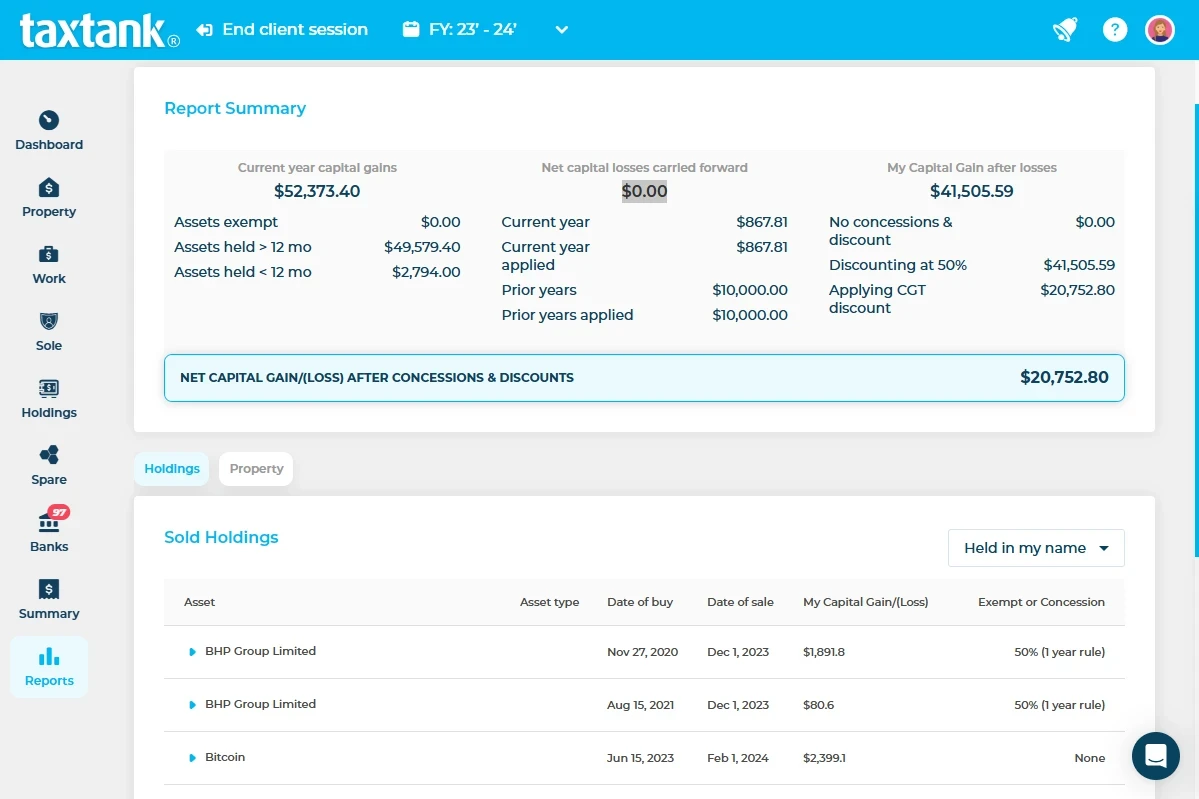

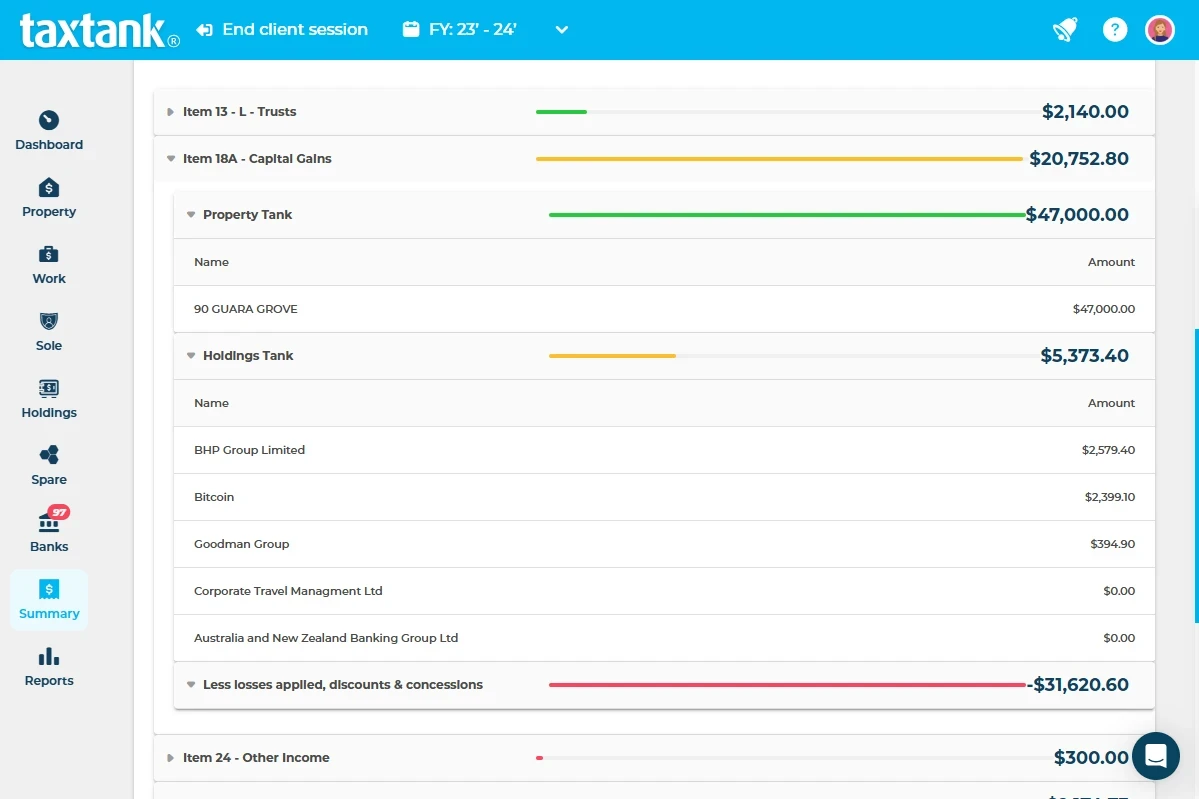

TaxTank is Australia’s first fully automated capital gains tax calculator solution, designed to seamlessly manage CGT across all investment types, including property, shares, crypto, and business assets. with real-time tracking, automated cost base calculations, and full compliance with grandfathering provisions year after year.

Key Features of TaxTank’s CGT Automation

📌 Permanent Document Storage for Longevity

✅ Secure, permanent document storage ensures all asset-related records are available whenever needed.

✅ Year-over-year grandfathering provisions are automatically applied, ensuring compliance with changing tax laws.

📌 Cost Base Automation with Add-Backs for Property

✅ Automatic cost base tracking includes purchase price, stamp duty, legal fees, agent fees, and renovations.

✅ Smart add-backs adjust for capital improvements, depreciation, and non-deductible expenses, ensuring the most tax-efficient CGT outcome.

✅ Live portfolio tracking means property owners always have an up-to-date CGT position, avoiding last-minute surprises at tax time.

📌 Optimised CGT Calculation Across All Asset Classes

CGT isn’t just about individual assets—it’s about the big picture. TaxTank ensures:

✅ Gains and losses across all asset classes (property, shares, crypto, and business assets) are automatically offset for a favourable CGT calculation.

✅ Real-time tax impact projections help investors plan CGT outcomes before selling.

✅ CGT discounts and exemptions (including the 50% CGT discount for assets held over 12 months) are auto-applied, ensuring tax savings.

Tips to Reduce Your Capital Gains Tax

No one likes handing over more tax than necessary. Here are proven strategies to minimize your CGT bill:

1. Hold Assets for 12+ Months

Selling too soon? You’ll miss out on the 50% CGT discount. If possible, hold onto assets for at least a year to halve your tax bill.

2. Offset Gains with Losses

If you’ve had a bad investment year, don’t despair—use capital losses to offset capital gains and reduce your tax liability.

3. Time Your Sale in a Low-Income Year

CGT is added to your taxable income, so if you’re expecting a lower-income year (e.g., career break, maternity leave, or retirement), selling then could push you into a lower tax bracket.

4. Contribute to Superannuation

Did you know you can use super contributions to offset CGT? If you’re under the concessional cap ($27,500 per year), making a pre-tax contribution can reduce your taxable income and lower your CGT bill.

5. Use the Bring-Forward Rule

Did you know you can carry forward unused concessional super contributions for up to five years if you’ve contributed less than the annual caps? This allows you to make a larger tax-deductible contribution, reducing both your taxable income and CGT liability, as long as your super balance is under $500,000.

6. Automate CGT Calculations with TaxTank

Tracking CGT across property, shares, crypto, and business assets can be overwhelming. TaxTank automates everything, cost base tracking, loss offsets, and CGT discounts, ensuring you never overpay. It also applies grandfathering provisions, securely stores all records, and generates ATO-compliant reports, saving you time, stress, and tax dollars.

FAQs About Automated Capital Gains Tax Calculators

What is the best automated Capital Gains Tax Calculator in Australia?

TaxTank is the leading automated Capital Gains Tax Calculator in Australia. It uses live data and complies with Australian tax laws and regulations to ensure your CGT calculations are accurate and up to date.

Can I test different scenarios for my investment property to calculate potential CGT?

Yes, TaxTank allows you to use the ‘Sell Property’ feature to simulate potential CGT. If you decide not to sell, you can simply undo the sale to compare different scenarios before making a final decision.

Are automated capital gains tax calculators 100% accurate?

While automated calculators provide real-time calculations, accuracy depends on the data entered. Errors can occur if numbers are input incorrectly by the user. However, TaxTank reduces the risk of errors by integrating with Open Banking, Sharesight, and other platforms for seamless data entry.

Does TaxTank’s Capital Gains Tax Calculator support crypto?

Absolutely! TaxTank integrates with Sharesight and is expanding to support more crypto platforms, ensuring that your crypto transactions are accurately reflected in your CGT calculations.

Do I need an accountant for crypto CGT calculations?

Not necessarily. TaxTank simplifies crypto CGT calculations, doing the heavy lifting for you. If you have other assets subject to CGT, TaxTank makes it easy to manage all your investments in one place—no accountant required!

Conclusion

Capital Gains Tax doesn’t have to be stressful. With TaxTank, you can manage your CGT, tax obligations, and financial oversight all in one place. By tracking property, shares, crypto, and business assets in real time, automating cost bases, and applying offsets, TaxTank optimises your tax position while giving you complete control over your finances.

Take the guesswork out of tax time and make smarter financial decisions to actually control how much tax (and that includes CGT) you actually pay!!!