Property tax software for effortless portfolio management

Ditch the property spreadsheets and manage your whole property portfolio in one place – including investment properties, your home and properties owned in trusts.

Now you can streamline your finances, maximise deductions, gain real-time insights for smarter investments and minimise your property tax.

The #1 investment property software for smart investors

Whether you’ve got a single investment property or an entire portfolio, TaxTank is the only tool you need to manage performance, stay compliant, and save tax – effortlessly.

Thousands of investors across Australia are already saving time, money, and stress with TaxTank.

We have used Xero for my properties but for specific property functionality TaxTank is better and the pricing far outweighs what we were paying. If I could give 10/10 I would. Thank you so much!!!

Bel Austin

Take control with powerful features

TaxTank is the only purpose-built software in Australia designed specifically for property investors to manage their property tax – all year round. Track performance, monitor your real-time tax position 365 days a year, and store every receipt and document in one secure, audit-ready place. With powerful automation tools built in, TaxTank ensures you claim every deduction you’re entitled to – accurately, confidently, and without the end-of-year scramble.

Financial Oversight

See your financial position all year round so you can make informed decisions about your money.

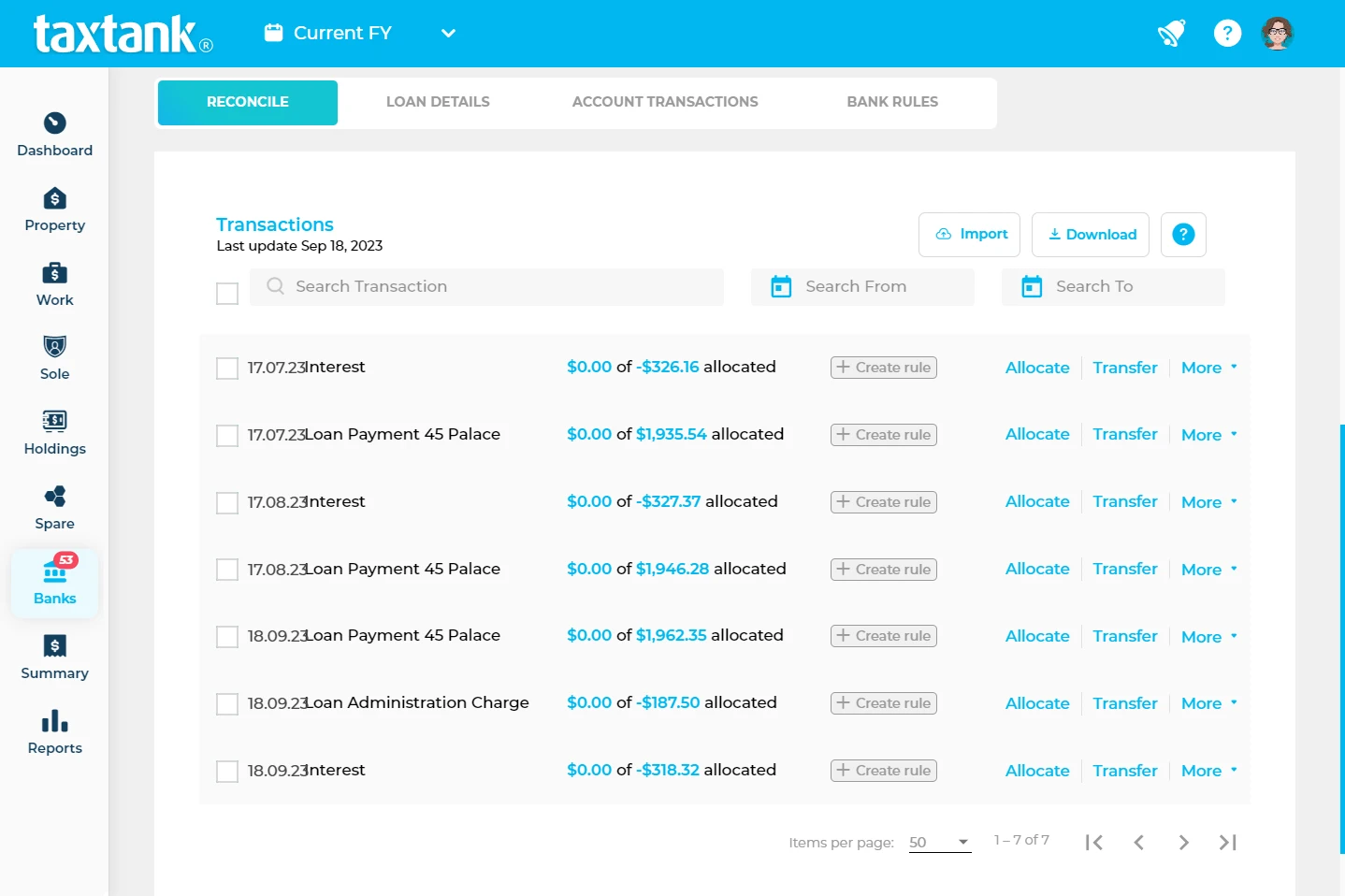

Live Bank Feeds

Ensure nothing is missed with automated live bank feeds using Open Banking.

Automated Tax Tools

Automatically allocate income and expenses using bank rules so you can set and forget.

Depreciation Calculators

Enjoy tax benefits without the hassle, using TaxTank’s simple and smart depreciation calculator.

Maximise Deductions

Automatic calculations of your estimated tax position to highlight ways to maximise deductions.

Easy Collaboration

Share with property co-owners, accountants and advisors so you can keep on top of everything year round.

Secure Document Storage

Attach receipts, document, statements and even warranties for a secure record that never fades.

Peace Of Mind

Avoid stress at the end of the financial year and know your tax position all year round.

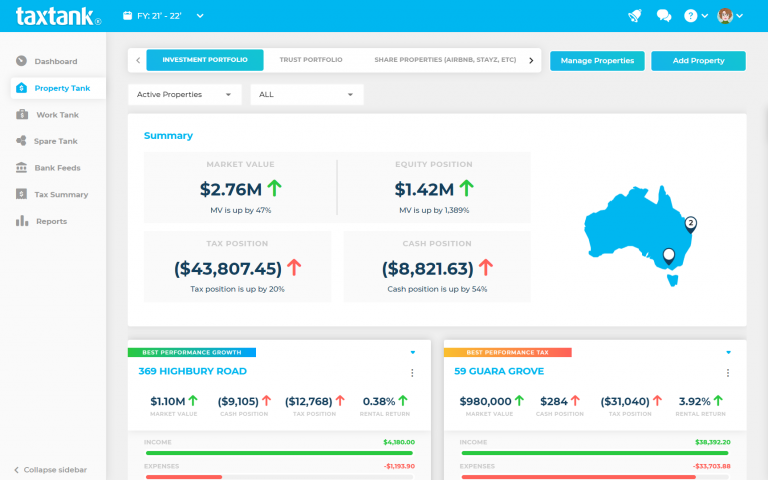

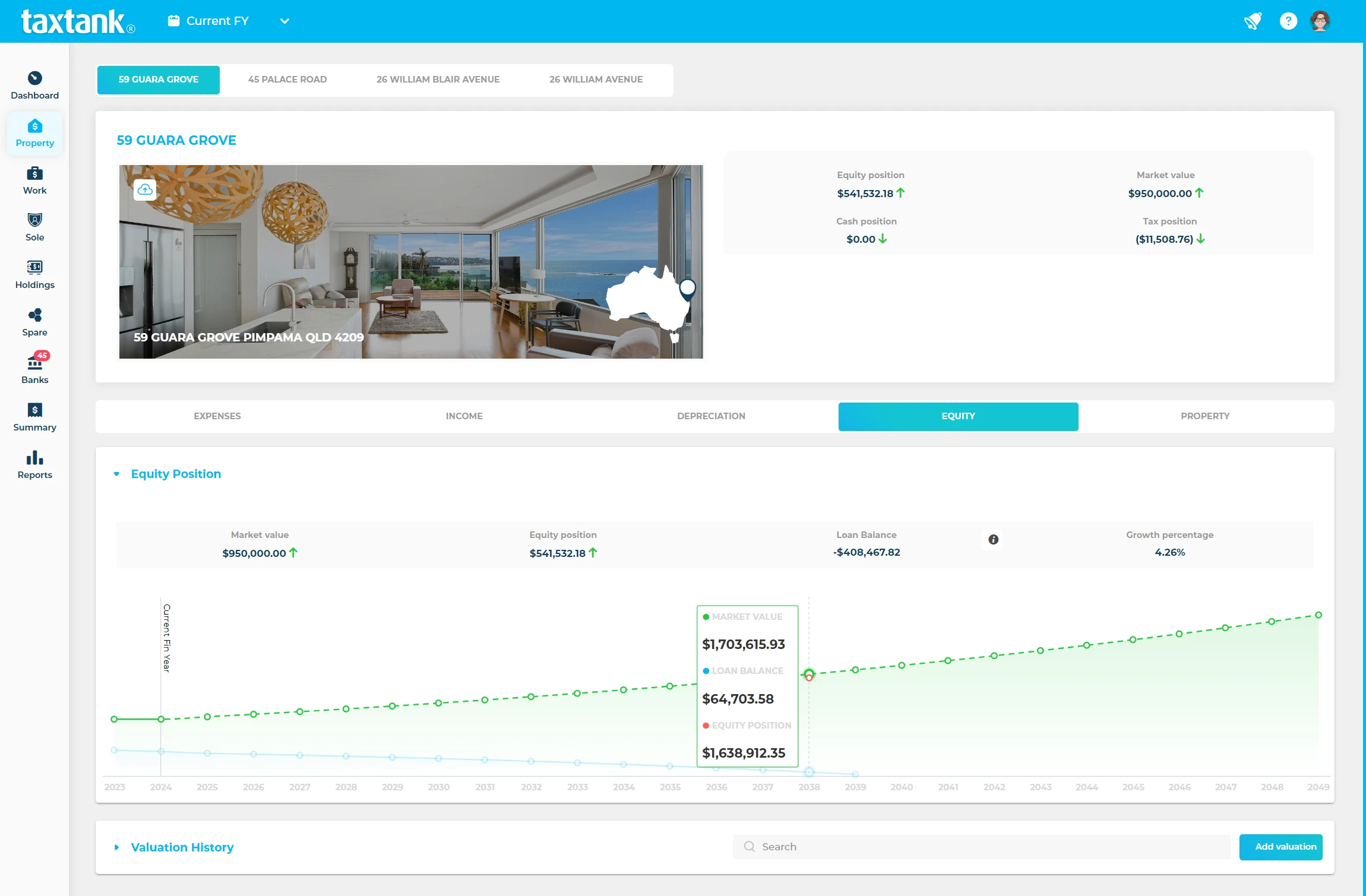

Real-time performance and property tax insights

TaxTank reports the tax and cash position of properties and portfolios live so you can see exactly what each property costs to hold (cash position) and the impact in your tax return (tax position) so you can make better decisions to proactively control how much tax you pay.

Better still, we’ve partnered with CoreLogic to forecast growth and equity over time for better planning. Having a clear picture of property performance and equity, coupled with rental returns and interactive reports, will ensure you’re always in control and armed with the right information when thinking about buying or selling.

Stay ATO compliant without the headache

9 out of 10 rental claims have errors – don’t let yours be one of them.

Using live bank feeds to capture every possible deduction, and built-in smart tools to calculate claims correctly, you can be confident you’re getting it right.

You’ll know exactly what’s happening with each property so you can make the best decisions and minimise your tax.

Manage your entire property portfolio in one place

TaxTank lets you group your properties in different portfolios to ensure you have complete management and oversight of equity, growth and property tax – no matter what your structure is. Even better, you can create customised portfolios to manage them in a way that works for you.

Investment Properties

Add investment properties as per your ownership for simple tax and compliance.

Share Accommodation

Calculate the percentage of claim accurately with smart tax tools and update any time.

Vacant Land

Automatically capitalise property expenses to ensure you minimise any Capital Gains Tax (CGT).

Trusts & Companies

Centrally manage properties held in other entities for complete portfolio oversight.

Principle Place of Residence (PPOR)

Manage your home expenses and simply move it to an investment portfolio if things change.

Ready to take control of your property tax? No more spreadsheets. No more stress. Just smarter property tax management – all in one place. Try TaxTank FREE today and discover how effortless property tax can be.

It's easy to get started

Getting started with TaxTank is simple and affordable. With pricing starting from just $15* per month, you can access all the specialised tools you need to manage your property tax effectively.

- Free Trial

- No Credit Card Required

- Cancel Anytime

PROPERTY TANK

Simply add Property Tank so you can monitor your whole property portfolio in one place. You can manage up to 5 properties for only $15* a month.

$15/month

Paid Annually

ADDITIONAL

PROPERTIES

Have more than 5 properties? No problem, you can add as many as you like with our property add-on.

$3/month

Paid Annually

Trusted by Property Investors across Australia

It's literally about 10 minutes a week to allocate transactions and I'm on top of my paperwork which means no more spreadsheets or tax time stress.”

Frequently asked questions

Absolutely it is worth adding your own house. You can keep a really accurate budget and look at updated market values and growth predictions. Plus if you change your main residence to an investment property in the future, you will have your records in the one place.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

Yes you can. The beauty of TaxTank is that you can record these changes accurately and when they happen so you can future proof yourself should the ATO have any questions.

Yes absolutely, you can use our Share Properties calculator and it will accurately work out the percentage required to allocate and report accurately to the ATO.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.