Tax News and Updates

Stay updated with the latest tax news, expert tips, and tricks to maximise your returns. Explore our blog for insights on tax strategies, property investment, and more.

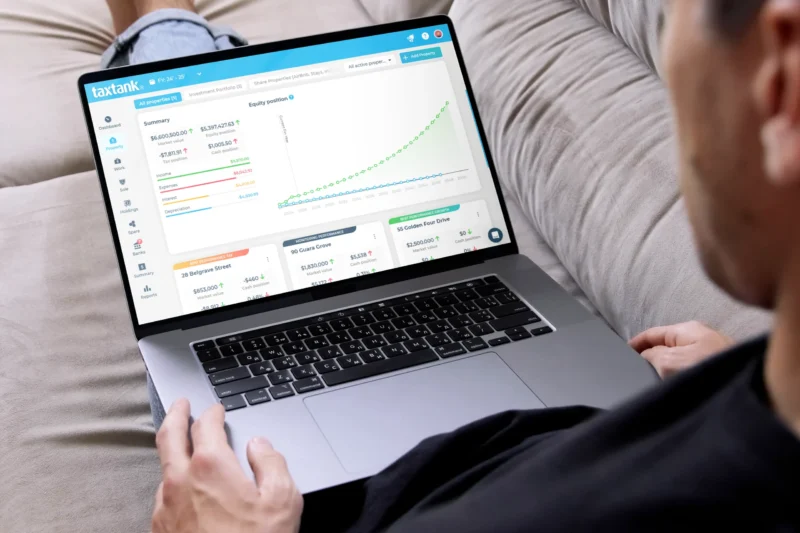

Why Tracking LVR and Equity Matters for Property Owners in 2026

The moment most property owners miss (And why tracking LVR and equity as goals matters in 2026) For most property owners, the biggest opportunities don’t announce themselves. They arrive quietly.

One login. Multiple lives. No more workarounds.

Most people don’t have a single financial identity. There’s the personal you.There’s you as a sole trader.There’s you with properties, but in a trust, SMSF or company.And sometimes there’s you,

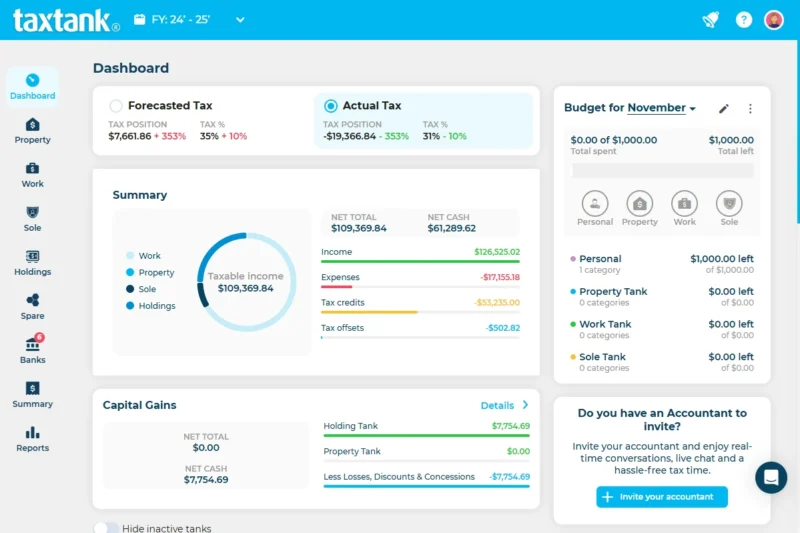

TaxTank – The Best Budget Planner in Australia

Managing your finances effectively is essential for achieving long-term financial stability. TaxTank is emerging as the premier budget planner in Australia, offering a comprehensive solution for individuals, families, and sole

Best App for Budgeting in Australia 2025: Compare TaxTank, Raiz, PocketSmith, YNAB & More

Finding the best app for budgeting in Australia in 2025 is essential for anyone wanting complete control over their finances. With rising living costs, investment options, and complex tax rules,

Budgeting Tips: How to Build a Budget That Actually Works

When it comes to budgeting tips, most people know they should have a plan, but few actually stick with it. Budgets can feel like boring spreadsheets, strict rules, or something

TaxTank: The Best App for Personal Money Management in Australia

Managing personal money management in Australia has never been more important. With rising living costs, shifting tax rules and increasingly complex financial lives, Australians need a tool that provides clarity,

When “Tax Just Happens”, It Probably Won’t Happen in Your Favour

The ATO’s 2030 vision is slick: a frictionless digital future where “tax just happens.” Lovely, except it rarely just happens in your favour. Australia is quietly aligning with global tax-tech

Banks vs Brokers: Who’s Really Winning the $400 Billion Tug-of-War?

Mortgage brokers have quietly seized control of Australia’s lending landscape. They now handle 76.8% of all new home loans, a record-breaking $400+ billion in annual settlements. The big banks? They’re

TaxTank – The Best Personal Accounting Software in Australia

Managing your personal finances has never been more important. Whether you’re a sole trader, property investor, crypto trader, or simply an employee looking to stay on top of your tax

The Real Cost of Working From Home: When 70¢ an Hour Erases Your Deductions

As the debate ramps up over who should, shouldn’t, will and won’t work from home, with headlines swinging between productivity wins, burnout risks, and office culture nostalgia, one thing rarely

Top 5 Property Accounting Software in Australia (2025 Update)

Managing your investment property finances is no small task. Between tracking rental income, mortgage interest, depreciation, maintenance, and tax implications, it’s easy to lose clarity without the right property accounting

Refinancing: The Forgotten Tax Deduction That Could Save You Thousands

Refinancing is booming. According to the Australian Bureau of Statistics, more than $21 billion in investor home loans were refinanced in a single month this year, as Australians scramble to

Sole Trader? Here’s Why You Need to Think about a Separate Business Bank Account

Picture this: it’s June. You’re at the kitchen table, laptop open, drowning in a sea of bank statements. Somewhere between your Bunnings runs, client payments, transfers to other personal accounts,

How Smarter Property Management Can Help Maximise Rental Returns and Minimise Risk

As a landlord in today’s dynamic market, you’re constantly balancing the books. Your goal is to maximise returns on your investment while navigating an increasingly complex landscape of tax compliance,

Life Insurance for Property Investors: Protecting Your Bricks, Mortar & Peace of Mind

Property investment is a great way to build long-term wealth in Australia, but even the smartest portfolio can come unstuck without a solid safety net. Whether you’ve got one rental

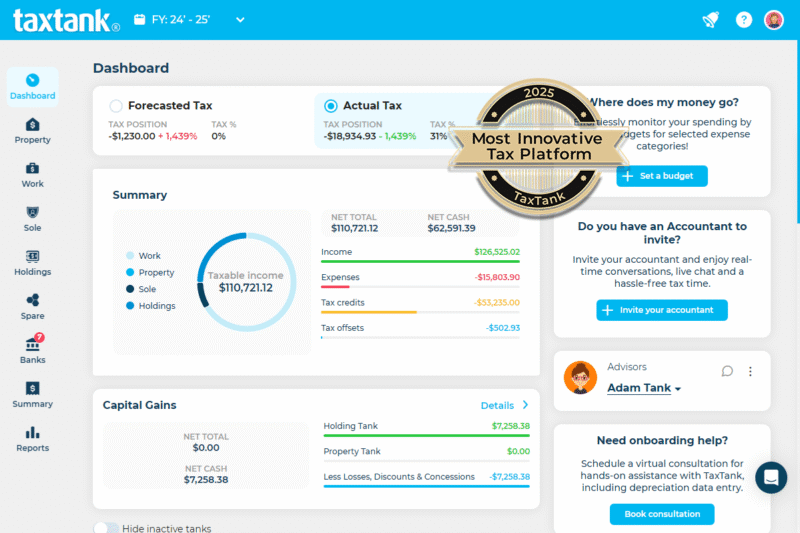

TaxTank Wins WeMoney’s Most Innovative Tax Platform 2025

We’re excited to announce that TaxTank has been named The Most Innovative Tax Platform 2025 by WeMoney. It’s recognition we’re proud of because it confirms what our customers already know:

The No. 1 Rental Property Accounting Software in Australia

Managing a rental property portfolio can be financially rewarding, but without the right tools it can quickly become a bookkeeping headache. Tracking rent, expenses, depreciation, capital gains, and tax deductions

Work-Related Deductions: How to Beat the ATO Benchmark Without Triggering an Audit

If you claim work-related deductions in Australia, the Australian Taxation Office (ATO) has you on its radar, even if you don’t realise it. One of their favourite tools is the

Best Tax Software in Australia 2025: Why TaxTank Leads for Individuals

When you’re choosing tax software in Australia, the right platform can mean the difference between a smooth, stress-free return and a last-minute scramble. In 2025, TaxTank proudly takes the crown

How to Avoid the Tax Mistakes 90% of Property Investors Make

In 2017 the ATO announced 9 out of 10 property investors make mistakes. Years later, the error rate hasn’t budged, says the ATO, but their AI’s appetite for your data

The Number 1 Alternative to Turbotax in Australia

If you’re searching for Turbotax in Australia, you might be hoping for an easy, stress-free way to do your tax return. But here’s the reality: Turbotax is not available in

Health Cover That Saves You from the ATO (and Your Wallet)

Let’s face it: the Medicare Levy Surcharge may not be Australia’s most inequitable tax… but it’s definitely in the top five. To break it down, you already pay 2% of your income via the Medicare

How Sole Traders and Side Hustlers Can Outsmart the ATO’s Compliance Bots

The ATO’s cranking up compliance for micro-hustlers, expecting you to run your business like a seasoned CEO, even though 40% of the 1.6 million sole traders are already juggling full-time

NobleOak + TaxTank: Cutting the Crap, Keeping the Cover

Life insurance is one of those things you know you should have… but it’s often buried in the too-hard basket – tangled in red tape, hidden brokerage fees, and outdated policies sitting

Choosing the Best Tax App for Your Situation

When it comes to doing your taxes, the right tax app can save you hours of time and help you claim every deduction you’re entitled to. But with so many

NobleOak + TaxTank: The Backup Plan Your Income Deserves

Picture this. You’ve got a solid income, a mortgage or two, maybe some shares, a growing super fund, and a pretty good handle on your tax (especially if you’re a

The Cost of Being Unprepared: Why Income Protection is More Important Than Ever

You’ve spent years building financial security, investing, planning, and making smart moves. Then, bam! Life throws a curveball, like that time you thought you could still do a backflip at

The Life Insurance Trap: Are You Overpaying Without Even Realising It?

For years, getting life insurance meant long forms, complicated medical exams, endless waiting, and hidden costs buried in fine print. It was one of those ‘set and forget’ things, something

TaxTank’s Latest Features & Smarter Tax Tools in 2025

EOFY might be nearly over, but we’re just getting started. At TaxTank, we’ve spent the last few months fine-tuning, integrating, and launching features designed to give you more control, more

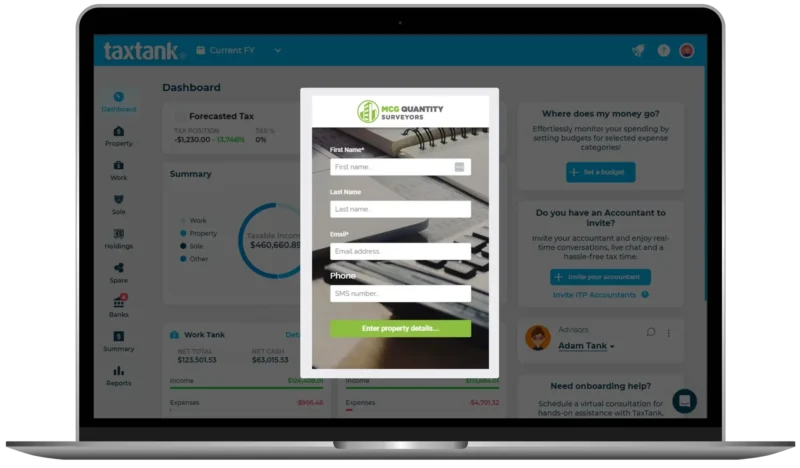

TaxTank Teams Up with MCG Quantity Surveyors: A Perfect Partnership for Savvy Property Investors

TaxTank is thrilled to announce our new partnership with MCG Quantity Surveyors, one of Australia’s leading quantity surveying firms. As a property investor, you already understand the importance of maximising