Understanding Property Investment Tax in Australia

Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is

Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is

Are you ready to play the tax game and come out on top? The ATO has its eyes set on a few key areas this financial year, but with a

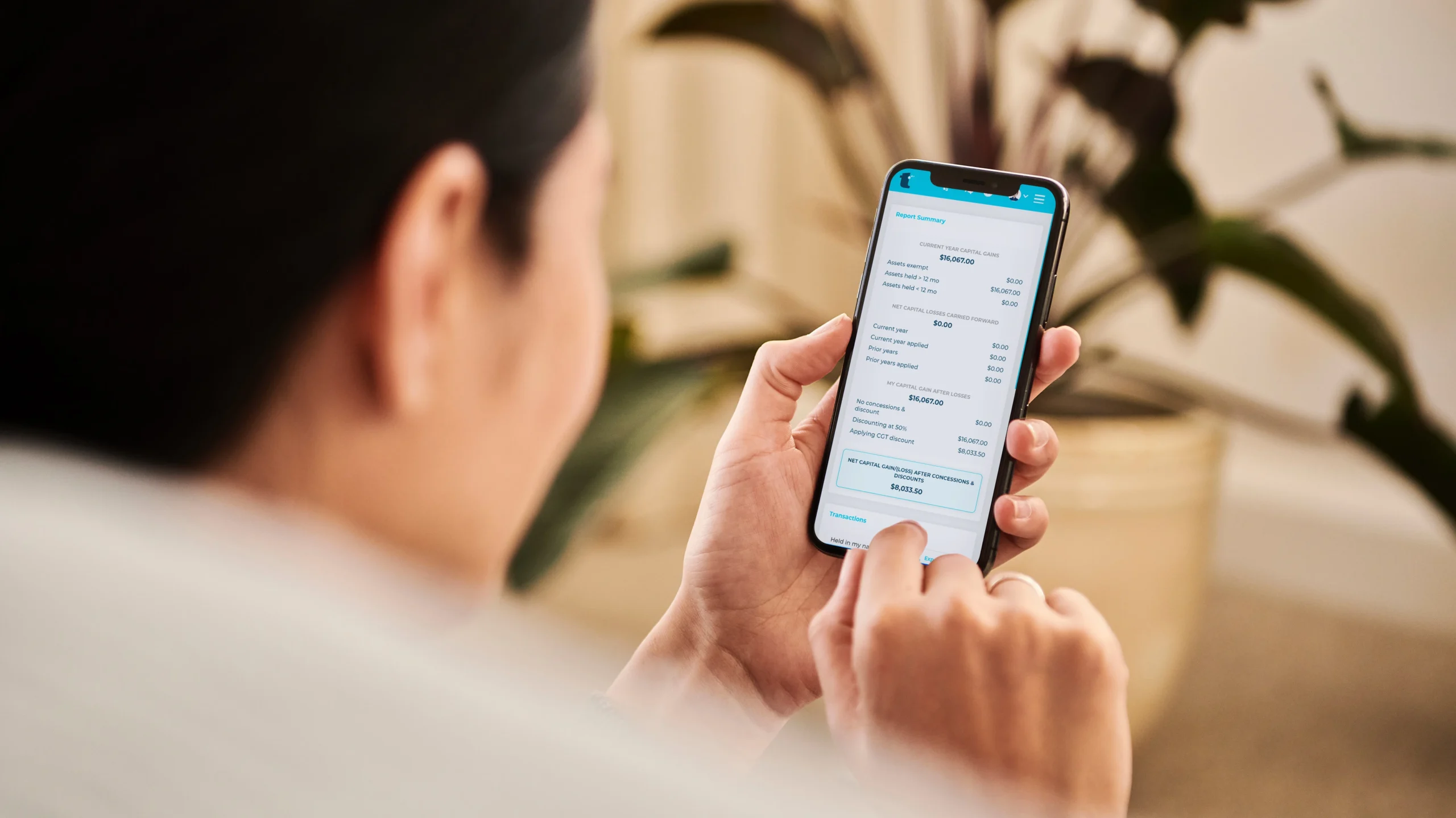

Every end of financial year, Australians eagerly await a potential tax refund, yet billions of dollars in unclaimed expenses remain on the table. A tax app could be the key to ensuring you claim the right amount and maximise your refund.

Gone are the days of drowning in paperwork and battling confusing tax forms. With the magical powers of the tax app, managing your finances becomes a breeze. Picture this: no more late-night stress sessions, no more headache-inducing calculations, just pure, unadulterated financial joy!

Are you one of the many people who have missed the tax deadline and are now facing overdue tax returns? Don’t worry, you’re not alone. Many individuals fail to lodge

Learn how to avoid common tax mistakes during tax time in Australia. Expert advice to ensure a smooth process during tax season.

As the end of the financial year (EOFY) approaches, it’s crucial to embark on early preparations to ensure a seamless and stress-free process. Many individuals in Australia tend to leave their tax return until the last minute, resulting in a rush and unnecessary stress. In this article, we will delve into the top ways you can prepare early for the end of the financial year.

Tax time is stressful for a lot of people. But if you’re a property investor, it can be even more so. Not only do you have to worry about your own tax return, but you also have to think about the investment property and how it will affect your taxes.

Are you already thinking about the extra money you could be receiving at tax time? Tax time is approaching and for millions of Australians this year could deliver a nice bonus thanks to the boost of a tax offset announced in the recent federal budget.

If just the thought of tax time makes your stress levels rise, you are not alone according to new research conducted by cloud-based tax software, TaxTank.

The recent survey of 1000 Australian taxpayers revealed more than half (56%) find tax time stressful with missed deductions the leading cause of stress ahead of not knowing if they will receive a tax refund or bill and making a mistake.

When it comes to tax time, many people feel like they are at a loss. They don’t understand the tax system and feel like they’re not in control with little power to do anything to actually control how much tax they pay.

Support

Resources

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation.

Copyright © 2024 TaxTank | All Rights Reserved.