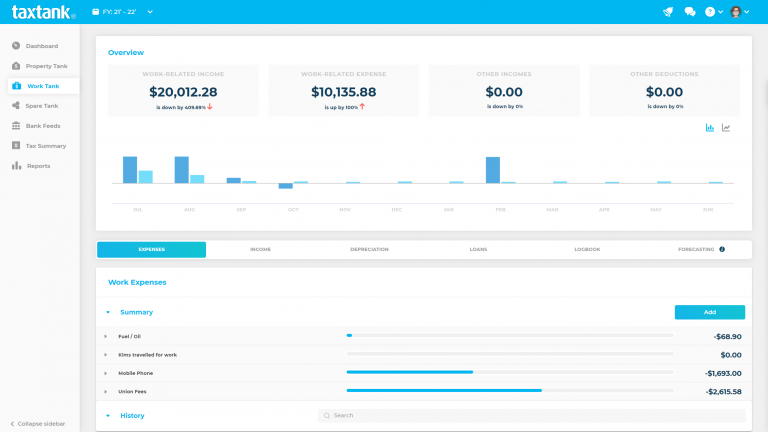

Tax software to effortlessly manage your work income and expenses

TaxTank empowers you with smart income tax management tools so you can take control of your finances. Now you can efficiently handle your work-related income and expenses, ensuring you make the most of every possible tax deduction.

Stay on top of your finances, maximise your tax deductions, access real-time insights, and make smarter investment decisions while keeping your work income and expenses in check.

Hassle free income tax preparation

Worried about minimising your income tax, even if numbers aren’t your forte? TaxTank simplifies the process so you can manage your work-related income, expenses, vehicle kilometers, logbooks, and loans all in one convenient hub.

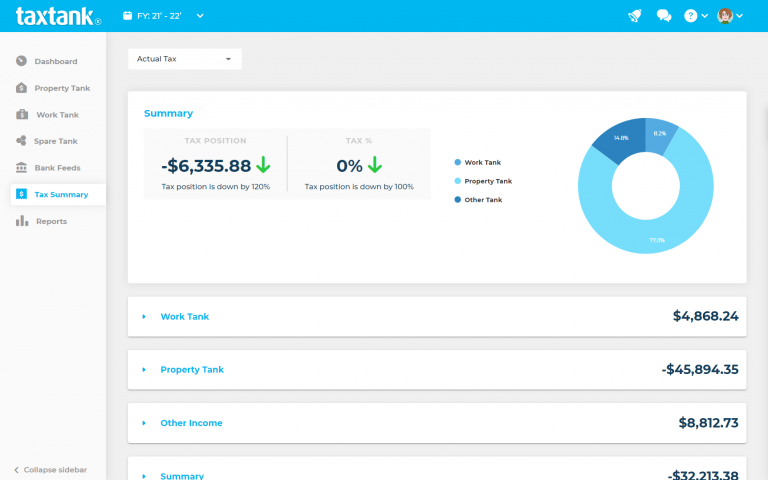

As you reconcile your income and expenses from your bank feeds, you can closely monitor your actual income tax position in real-time.

Our tax summary consolidates all your financial data, providing a clear view of how different income and expense types impact your income tax liability.

Super easy to use, and I love that it automatically tracks my deductions.

Janet Hermoso

Take control with powerful features

TaxTank is Australia’s only purpose-built software to help manage your income tax all year round. Track performance, monitor your real-time tax position every day of the year, and keep all your receipts and documents securely stored in one audit-ready platform. With powerful automation tools, TaxTank helps you claim every eligible deduction accurately and confidently, without the last-minute stress at tax time.

Financial Oversight

See your financial position all year round so you can make informed decisions about your money.

Live Bank Feeds

Ensure nothing is missed with automated live bank feeds using Open Banking.

Automated Tax Tools

Automatically allocate income and expenses using bank rules so you can set and forget.

Depreciation Calculators

Enjoy tax benefits without the hassle, using TaxTank’s simple and smart depreciation calculator.

Maximise Deductions

Automatic calculations of your estimated tax position to highlight ways to maximise deductions.

Easy Collaboration

Share with accountants and advisors so you can keep on top of everything year round.

Secure Document Storage

Attach receipts, document, statements and even warranties for a secure record that never fades.

Peace Of Mind

Avoid stress at the end of the financial year and know your tax position all year round.

Maximise home office claims

Working from home? Make every hour count. Work Tank’s automated Home Office Diary takes the guesswork out of tax time by tracking your work-from-home hours and calculating the best method to claim – whether it’s fixed rate or actual costs.

It’s the easiest way to ensure you’re claiming every dollar you’re entitled to without triggering audit alarms. Just set it, forget it, and let Work Tank handle the rest.

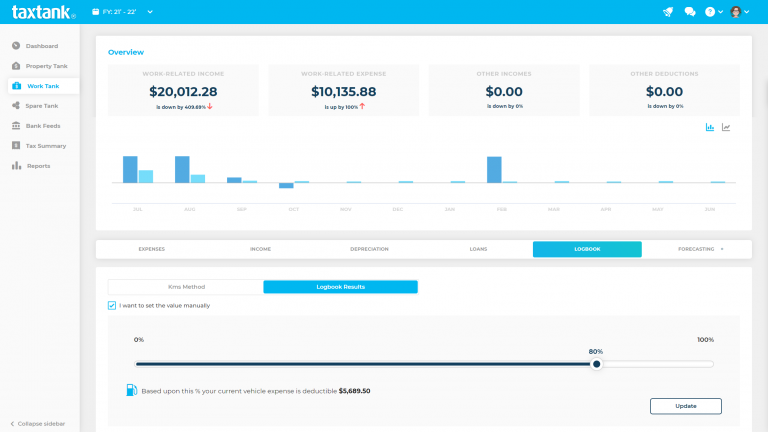

Simple vehicle expense claims

TaxTank makes it easy to manage your work vehicle expenses. Record travel in our vehicle logbook and let TaxTank update your expenses and claims automatically.

You can even switch between the claim methods to see which is most tax efficient for you based on your activity.

You can relax knowing you’re claiming the right way, that your records are safe and you’re complying with the ATO.

Stay ahead of income tax all year round

Don’t wait until tax time to find out what you owe. With TaxTank, you get real-time insights into your estimated tax position all year round, so you can plan ahead and stay in control.

You can even add your HECS balance, and TaxTank will automatically calculate your repayment and include it in your total tax summary. That way, you’ll always know where you stand and can make smarter decisions to reduce your tax bill.

Take control of your income tax today. Try TaxTank FREE and discover how effortless managing your tax can be!

It's easy to get started

Getting started with TaxTank is simple and affordable. With pricing starting from just $9 per month, you can access all the specialised tools you need to manage your work income and expenses effectively.

- Free Trial

- No Credit Card Required

- Cancel Anytime

WORK TANK

Simply add Work Tank so you can manage your income tax in one simple platform.

$9/month

Paid Annually

Paid Annually

Trusted by 10,000+ Aussies

Frequently asked questions

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgment of your tax return.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

Yes, you can claim deductions for home office expenses if you meet certain criteria. You can either claim your actual expenses by allocating from live banks feeds or you can use the revised fixed-rate method and keep a logbook of your hours in TaxTank.

Yes, you can claim deductions for your work vehicle using our built in Vehicle Logbook.

You can’t directly lodge with TaxTank, however, you can either export the myTax report and lodge directly yourself or you can use our virtual accountant’s to review and lodge your tax return on your behalf.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

It only takes a few minutes to get your bank feeds set up. It may take a few minutes extra to add in your forecasted incomes, however we have tried to make it as easy as possible with simple to follow checklist.