Financial software for Australian property investors.

"The TaxTank software has been a game changer for us in providing a cost effective, integrated, real-time system that simplifies the process of managing investment property financial transactions and information. Using TaxTank has ensured we have reduced costs and effort at the end of financial year, minimised tax paid as we can now track all expenses and income in one single system and peace of mind knowing we can find everything in one secure place.."

Our pricing starts from as little as $15 per month and is customisable so you only pay for the Tanks that suit your individual needs. TaxTank is also 100% tax deductible so it’s a win, win.

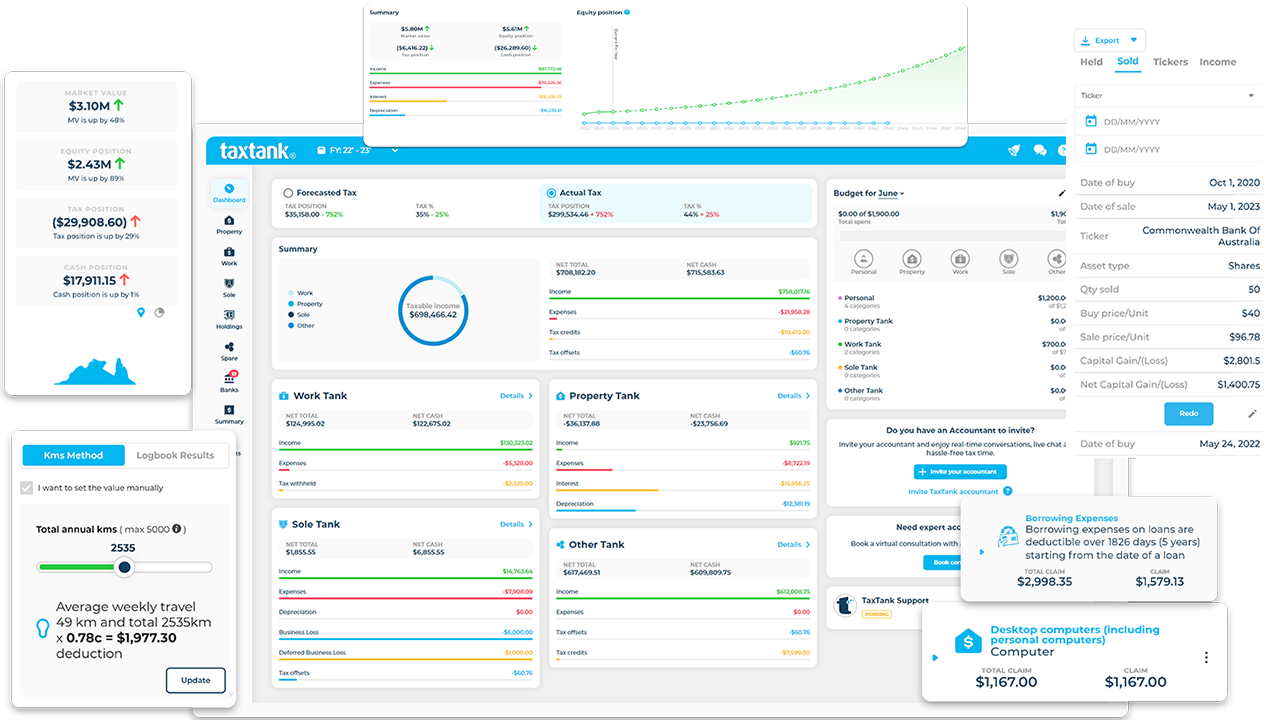

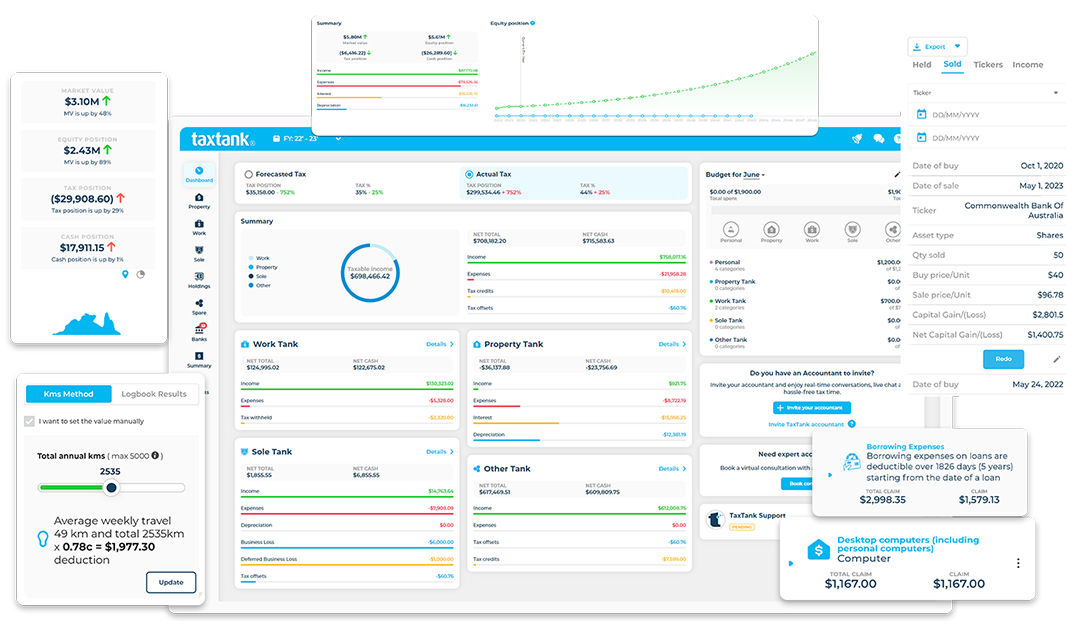

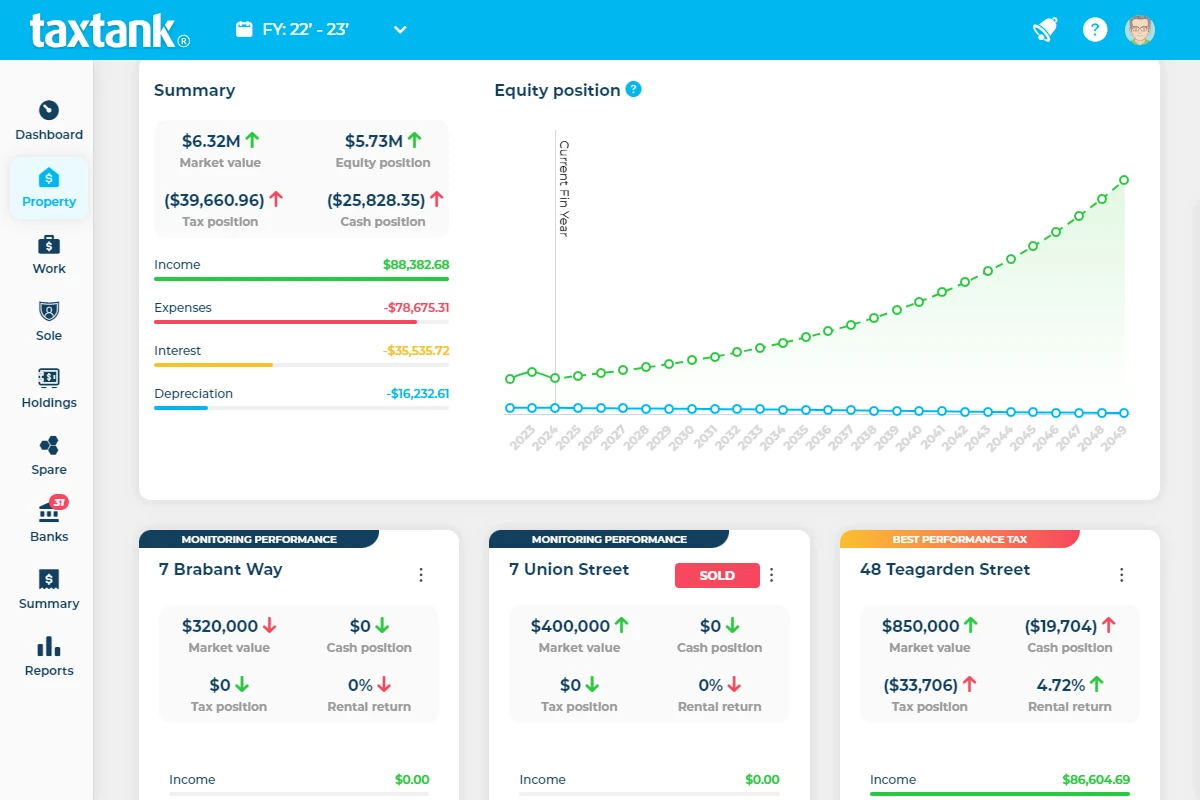

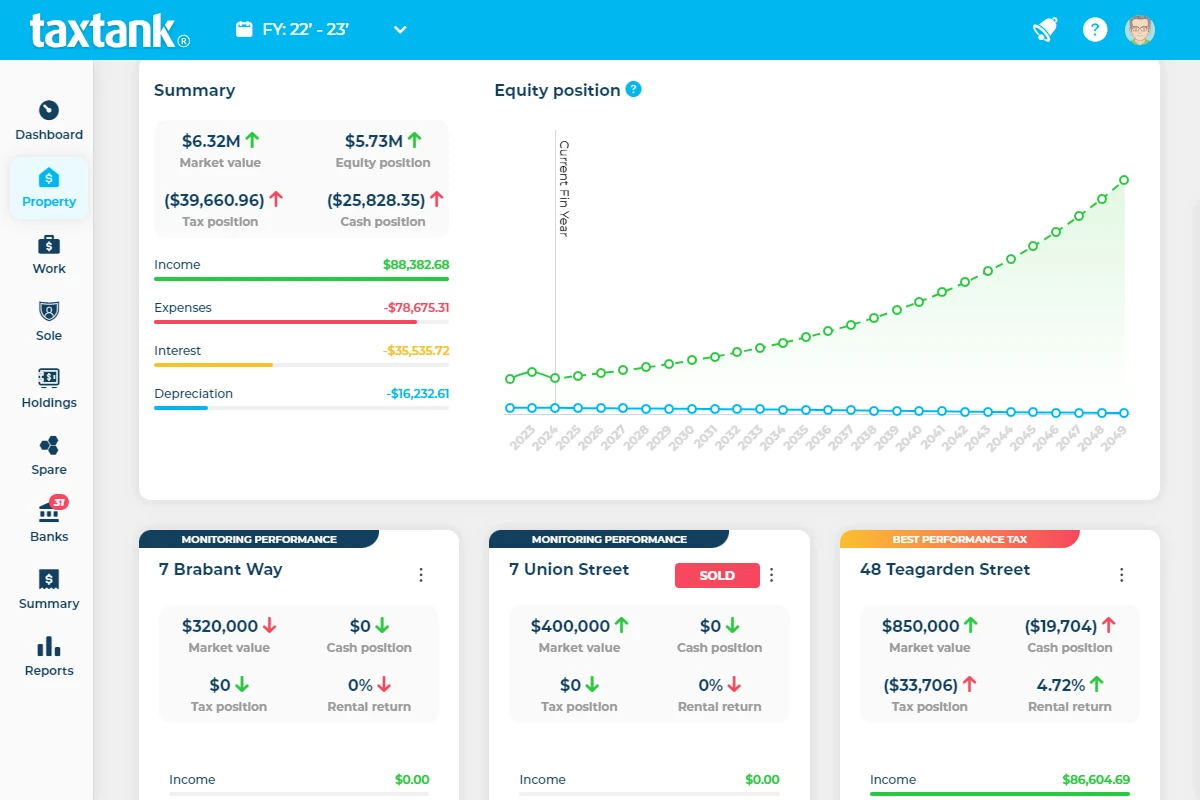

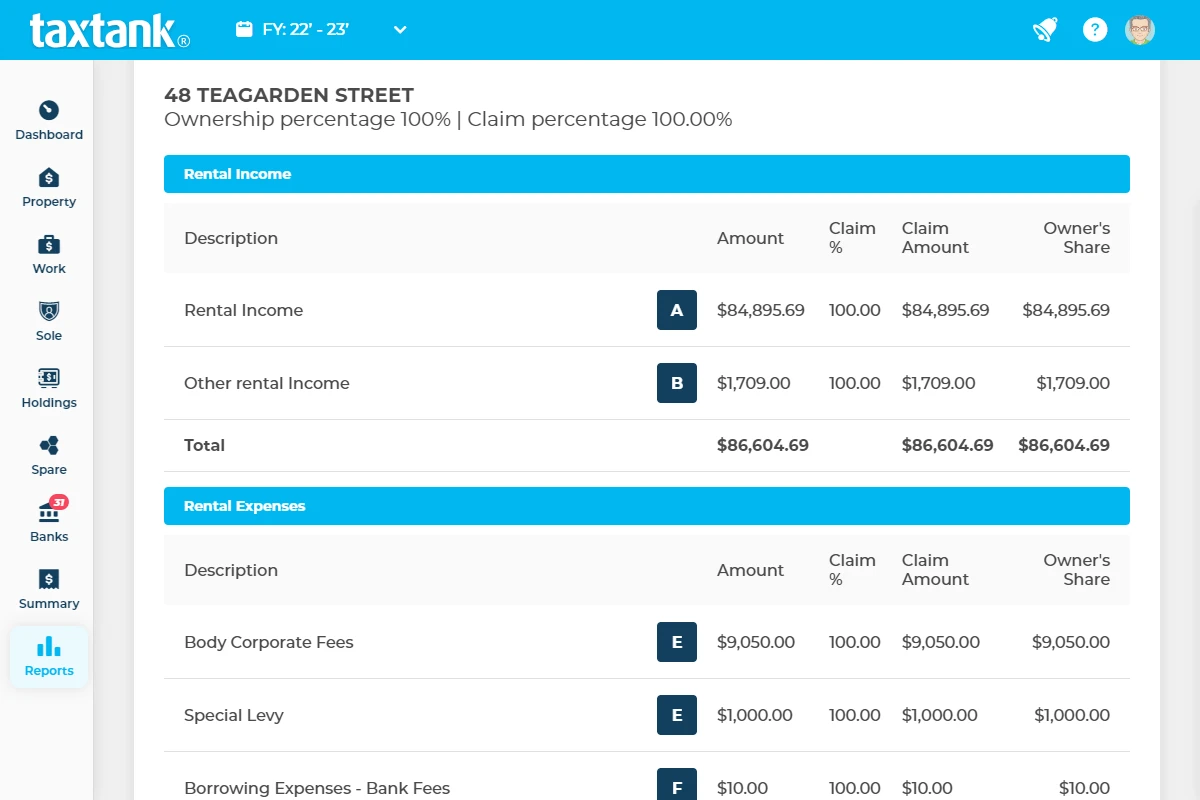

With TaxTank you can see the tax and cash position of your properties and portfolios in real time. Get visibility on what each property costs to hold (cash position) and the impact in your tax return (tax position) so you can make better decisions to proactively control how much tax you pay.

Better still, through our partnership with CoreLogic you can forecast growth and equity over time. With more data at your fingertips, you’re always in control and armed with the right information when you need it.

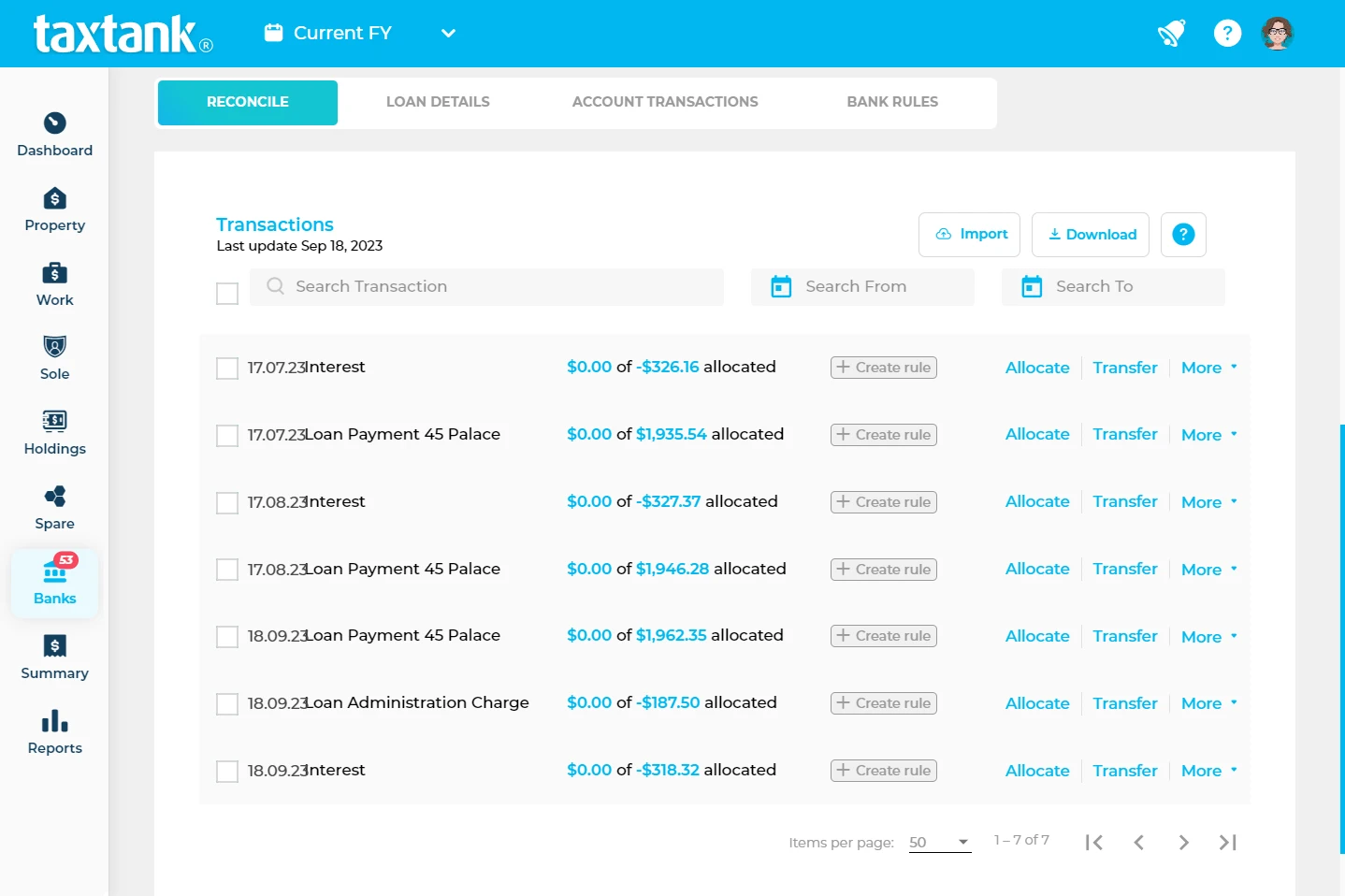

Beat the ATO at their own game with TaxTank. Using live bank feeds to capture every possible deduction, and built-in smart tools to calculate claims correctly, you can be confident you’re getting it right and minimising your tax.

Ditch the time consuming property spreadsheets and automate it all with TaxTank. Plus with rental property schedules, depreciation schedules and transaction reports available all year round, save money on accounting fees.

Sign up now and unlock the benefits of managing your property portfolio in one place.

Absolutely it is worth adding your own house. You can keep a really accurate budget and look at updated market values and growth predictions. Plus if you change your main residence to an investment property in the future, you will have your records in the one place.

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

Yes you can. The beauty of TaxTank is that you can record these changes accurately and when they happen so you can future proof yourself should the ATO have any questions.

Yes absolutely, you can use our Share Properties calculator and it will accurately work out the percentage required to allocate and report accurately to the ATO.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

It only takes a few minutes to get your bank feeds set up and adding in your property details. It may take a few minutes extra to add in your depreciation schedules, however we have tried to make it as easy as possible. If you have your last tax return handy, you can add in all of the details quickly, plus you can edit details if you make a mistake.

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation.

Copyright © 2025 TaxTank | All Rights Reserved.