Tax Return Calculator

Brought to you by TaxTank – Australia’s first automated smart tax calculator software to ensure you claim everything you are entitled to without worrying that you’re making a mistake or missing out.

Tax Calculator 2023/24

Use our tax refund calculator to estimate* your tax refund based on your income. This income tax calculator computes the estimated tax for Australian residents for tax purposes.

*DISCLAIMER: This tax return calculator is provided for informational purposes only and should not be considered as financial or tax advice. The results generated by the calculator are estimates based on the information provided and the current tax rates. Tax laws and regulations are subject to change, and the actual amount you owe or receive may vary.

- Live Bank Feeds

- Automated Transaction Allocation

- No More Guessing

- Live Tax All Year Round

Important Tax Deadlines

For all incomes earned between 01 July 2023 – 30 June 2024.

Tax returns can be lodged from 01 July 2024. You can prepare early with TaxTank so you know exactly what’s going on ahead of time.

For all incomes earned between 01 July 2022 – 30 June 2023.

Tax returns are now OVERDUE.

You can use TaxTank to get up to date and lodge with our partner accountants.

Tax returns are OVERDUE.

You can use TaxTank to get up to date and lodge with our partner accountants.

Connect your banks through Open Banking to ensure you never miss a deduction.

Manage your work income and expenses.

Monitor your shares, cryptos and other assets.

Manage your sole trader income and expenses.

Secure document storage for receipts and important documents.

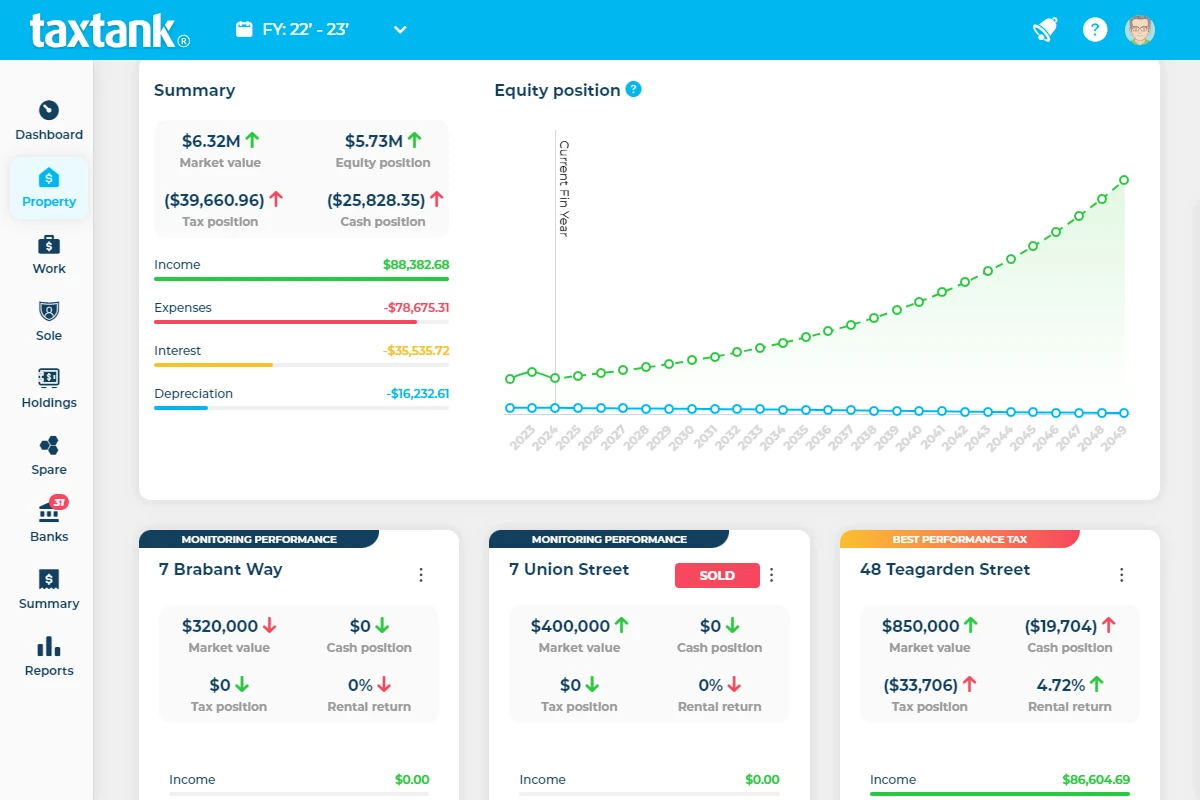

Manage your property portfolios to easily see each property’s debt, equity and cash position and more.

Invite your accountant, financial planner, broker or property group.

Invite your property co-owner to share live.

How TaxTank works

Built by Accountants, there are multiple Tanks that act like digital containers to organise your different incomes, expenses, properties and investments whilst securely storing receipts and documents year after year to protect against audit from the ATO.

When you allocate income and expense items from live bank feeds, you’re managing your tax and you can see your adjusting tax position in real time. A live tax calculator at your fingertips all year round!

- Property Tank - Manages your whole property portfolio

- Work Tank - Manages your work income and expenses

- Sole Tank - Manages your sole trader income and expenses

- Holdings Tank - Monitors your shares, crypto and other assets

- Spare Tank - Secures your important documents and receipts

Don't pay for more your tax return than you need to

Why pay over $100 just to lodge your tax return that you have to prepare yourself? With TaxTank you can pay as little as $95 for the whole year and get all this:

- Attach receipts to expenses for safe keeping

- Live Bank Feeds to maximise your deductions

- Live Tax, Cash & Equity Forecasts to see what refund you could be getting year round

- Monthly Budget Planner for visibility on where your money goes

- Permanent Document Storage for important documents

- Home office hours recorder to ensure no hours are missed

- Vehicle logbook to show you which claim method is most tax efficient

- Plus so much more!

What our customers are saying about us

The online support has been phenomenal, thank you Nicole. Everything was explained to me in an easy to understand manner.

It's a breeze to navigate and that's coming from someone who's genius zone is with people not on computers. I recommend them to everyone.

Frequently asked questions

TaxTank has been built as a modular system so you only pay for what you need. Starting from just $6 per month, you can start with any Tank that suits your needs and then add more as your financial situation requires.

It only takes a few minutes to get your bank feeds set up and to add in your details. There is a simple checklist to follow to help you get set up as quickly as possible too!

Not at all, that’s why we have come the rescue. Tax has always been so boring and convoluted, we have broken it down into cool software that is super easy to follow and understand. We also have a bunch of support videos and articles available should you need help with anything.

We partner with Basiq, one of Australia’s largest providers of Open Banking, so we now have access to over 180+ banks. As more come onboard with the Open Banking protocols, they will automatically get added to TaxTank.

Yes! The rules say expenses relating to preparing and lodging your tax return and activity statements include the costs of purchasing software to allow the completion and lodgement of your tax return. You must apportion the cost of the software if you also used it for other purposes.

If you’re talking about our built in smart tools, yes! If you’re talking about document retention, yes! If you’re talking about data integrity, yes! We take the rules and make them simple.

OMG no, the sooner the better! If you start later in the tax year you can easily import earlier bank account transaction to ensure nothing is missed.

You bet ya, we have an onboarding checklist to help you get started. Plus there are loads of video tutorials and support articles available directly in the help section. Don’t worry, we have thought of everything.

TaxTank officially starts from the 2020-21 financial year so you can most certainly go back and add data from those years if needed.

You can also add as many documents you want to from previous years to cover all bases.

The quick amswer is yes. You can read more about how they do this in our blog article ‘Can the ATO access your bank account’.