At TaxTank, we are committed to providing the most up-to-date and accurate tax information to help individuals, property investors and sole traders make informed decisions about their tax. The ATO announced yesterday a number of key areas that they will be focusing on this tax time, including rental income, capital gains tax and work-related expenses.

It’s important for Australian taxpayers to be aware of these areas and ensure that they are meeting their tax obligations so let’s take a closer look at each of these areas and what you need to know to stay compliant and protected from unnecessary and costly audit adjustments.

Rental Income

If you own a rental property, you need to be aware of the tax implications that come with this. Rental income of all kinds is considered taxable income, and you need to declare it accurately on your tax return. You can also claim deductions for expenses related to your rental property, such as repairs and maintenance, insurance, property management fees and interest on loans apportioned to the let areas and duration.

The ATO has flagged that they are paying particular attention to ensuring that property investors are correctly apportioning loan interest expenses correctly. If you have any part of your loan that was used for private purposes, you must ensure you don’t claim this portion in your tax return. This includes amounts drawn from investment property loans for non-investment use.

The ATO will be forcing banks to hand over the data of 1.7 million property investors and using their data-matching program to ensure compliance in this area so to avoid any issues, we recommend you keep accurate records of all of your rental income and expenses.

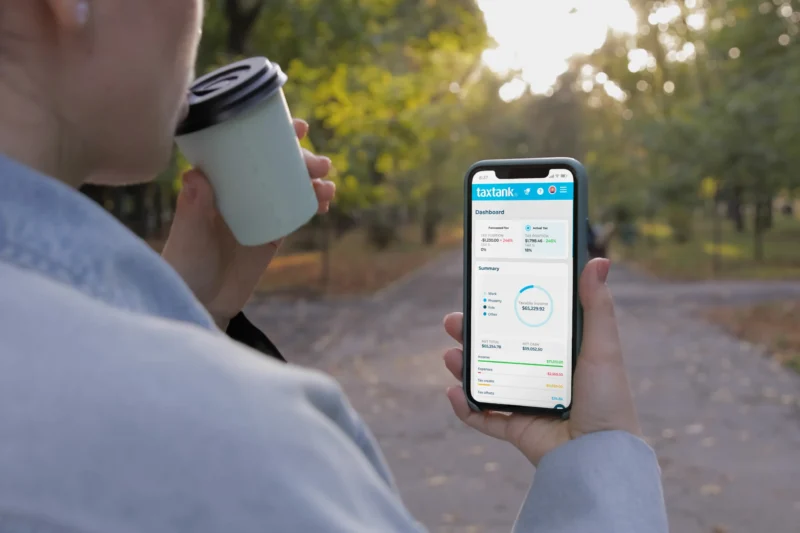

Using a software like TaxTank allows you to use your live bank feeds to ensure you claim not only your rental income, but also the loan interest related to each rental property accurately. There is even a portfolio for share properties so you can accurately calculate your expenses for properties let through Airbnb, Stayz and similar platforms.

By answering a few simple questions TaxTank will calculate the correct percentage of claim which makes tax time simple and accurate to keep the ATO away. If your situation changes simply update your answers to update your percentage of claim for that year.

Capital Gains Tax

Your main residence or PPOR is generally exempt from capital gains tax (CGT), but if you have used it to generate income – such as by renting it out at any time through sharing economy platforms like Airbnb or Stayz, or by running a business from home – CGT may apply.

To calculate your capital gain, it is important to keep records of the income-producing period and the portion of the property used to generate income. Whether you had long-term tenants or a series of short-term guests through Airbnb, the same property investor tax rules will apply. You must declare all assessable income in your tax return, so that you can claim deductions for your operating costs and losses.

TaxTank enables investors to seamlessly manage income from Airbnb along with the rest of your property portfolio across the years, which means your short-term tenants will no longer leave you with a long-term tax headache!

Work-Related Expenses

One of the biggest areas for the ATO this year is work-related expenses. While it is perfectly legal to claim deductions for expenses that are directly related to your job, the ATO recently changed how taxpayers can claim their WFH deductions.

The revised fixed-rate method is effective from 1 July 2022 and under this method, you can claim a rate of 67 cents per hour which includes all expenses such as electricity, mobile and internet costs. However, there are now more record-keeping requirements, namely you must keep a record of all home office hours across the year.

The other ‘actual’ method remains the same and involves claiming the actual expenses to calculate all deductions. However to avoid getting caught out by the ATO, it is important to keep detailed records of all of your work-related expenses. This includes receipts, invoices, and any other documentation that shows that the expense was directly related to your job.

TaxTank lets you not only allocate all of your expenses, but lets you track the hours you work from home to accurately calculate your fixed rate method if you choose to use it.

Final Thoughts

In conclusion, staying on top of tax obligations is essential for any property investor or individual taxpayer in Australia. By following the tips outlined in this article, you can ensure that you are meeting their tax obligations and avoiding any potential penalties or charges. Remember to keep accurate records, and be mindful of new rules and ATO expectations. By doing so, you’ll be well on your way to a stress-free tax season.

Why not try TaxTank for a free 14-day trial and start feeling more confident about the upcoming tax season. It’ll transform the way you think about and manage tax so you don’t have to stress about ATO crackdowns!