Navigating your tax return in Australia can be a daunting process, but it doesn’t have to be. Whether you’re a first-time taxpayer or a seasoned lodger, understanding how to calculate your tax return can help ensure you claim the correct deductions and maximise your refund. Here, we break down the key steps and provide detailed information to make the process simpler.

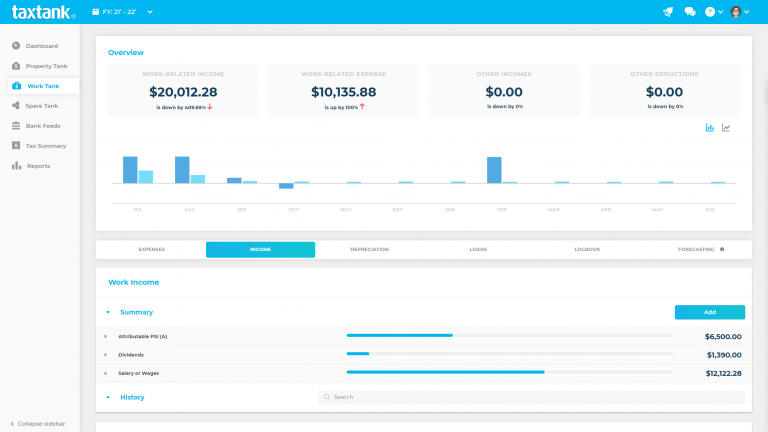

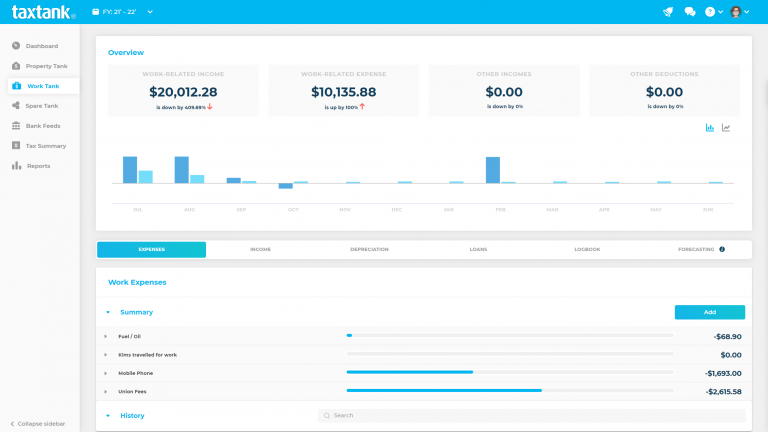

For those looking to eliminate the stress of last-minute tax calculations, platforms like TaxTank offer a unique solution by calculating your tax live throughout the year, removing any surprises at the end of the financial year.

Understanding the Australian Tax System

Before diving into the specifics of how to calculate your tax return, it’s essential to have a basic understanding of the Australian tax system. The Australian Taxation Office (ATO) operates on a progressive tax scale, meaning the more you earn, the higher percentage of your income you’ll pay in tax. The financial year in Australia runs from 1 July to 30 June, and your tax return must be lodged by 31 October if you’re lodging yourself or later if using a registered tax agent.

Taxable Income

Your taxable income is the foundation of your tax return. This is the income you’ve earned during the financial year minus any deductions. To calculate your tax return, you need to consider all income sources and allowable deductions. Taxable income includes wages, investment income (such as dividends and interest), Sole Trader business income, Partnership or Trust distributions, and other earnings like government payments.

💡One of the biggest challenges is keeping track of your income and expenses throughout the year. This is where TaxTank shines. It provides a live year-round tax calculation that tracks all your earnings, expenses, and deductions in real time, ensuring there are no nasty surprises when you lodge your return.

Formula to calculate taxable income: Taxable Income = Total Income – Deductions

Let’s break down what falls under these categories:

Income Sources

Salary and wages: The income you earn from your employer, including bonuses and allowances.

Investment income: This includes dividends from shares, rental income from property, and interest earned on bank accounts.

Sole Trader business income: If you’re self-employed, your business’s net profit (after expenses) is included in your taxable income, minus any prior year losses.

Partnership or Trust distributions: This refers to the profits you receive from a partnership or trust, sharing in the earnings from business activities or other income-generating assets.

Government payments: Some government benefits, like the JobSeeker Payment, are taxable and should be included.

💡By using TaxTank, all of your income sources are automatically tracked, and you can see exactly how much tax you owe in real time, making tax planning easier.

Allowable Deductions

Deductions reduce your taxable income and can significantly affect the size of your tax refund. It’s important to be aware of what expenses are deductible.

Work-related expenses: If you incur expenses related to your job, such as uniforms, tools, or travel expenses, they may be tax-deductible. Also things like income protection insurance, union fees and industry specific registration and licences.

Home office expenses: As more Australians work from home, you can often claim a portion of your household expenses, like internet, electricity, and phone bills. Alternatively, you have the option to claim a flat hourly rate to cover all your home office costs.

Vehicle and travel expenses: You can claim travel costs that are directly related to your job or study, but keep in mind that commuting to and from work isn’t eligible for reimbursement. You have two methods for claiming: you can either track your actual expenses or use a flat rate per kilometer traveled for work-related trips.

Donations: Contributions to registered charities may be deductible.

Self-education expenses: If you’ve taken courses or training to enhance your skills for your current job, you may be eligible for a tax deduction. Plus, you no longer have to worry about losing the first $250, making it easier to claim the full amount of your eligible expenses.

Investment property expenses: You can claim a range of costs related to managing your investment property, including repairs, insurance, loan interest, and depreciation on the building and other assets in some circumstances. Additionally, borrowing expenses can be spread over five years.

Superannuation contributions: If you’ve made extra concessional contributions to your super fund, these may be tax-deductible, provided they fall within the allowable caps.

💡With TaxTank, deductions are automatically allocated to the right categories, so you don’t have to worry about missing out on claiming what’s rightfully yours.

How to Calculate Tax Payable

Once you have your taxable income, the next step is to apply the Australian tax rates to determine your tax payable. The ATO publishes updated tax rates each year, and for most individuals, the tax brackets for the 2024–2025 financial year are as follows:

- $0 – $18,200: No tax payable

- $18,201 – $45,000: 19c for each $1 over $18,200

- $45,001 – $120,000: $5,092 plus 30c for each $1 over $45,000

- $120,001 – $200,000: $25,000 plus 37c for each $1 over $120,000

- $200,001 and above: $54,600 plus 45c for each $1 over $200,000

Example Calculation

Let’s say your taxable income for the year is $85,000. Here’s how you would calculate your tax return:

- The first $18,200 is tax-free due to the tax-free threshold, so no tax is paid on this portion of your income.

- For the next $26,800 (the portion between $18,201 and $45,000), the tax rate is 19c for every dollar. This results in:

$26,800 x 0.19 = $5,092 - For the remaining $40,000 (the portion of your income between $45,001 and $85,000), the tax rate is 30c per dollar, which results in:

$40,000 x 0.30 = $12,000

Now, adding these together:

- $0 (for the first $18,200)

- $5,092 (for the portion between $18,201 and $45,000)

- $12,000 (for the portion between $45,001 and $85,000)

Total: $17,092

So, your total tax payable on a taxable income of $85,000 is $17,092.

💡With TaxTank, you don’t have to manually crunch these numbers. The platform will automatically calculate your tax payable throughout the year, giving you up-to-date insights and helping you avoid any unexpected tax bills at year’s end.

Medicare Levy

In addition to income tax, most Australians are required to pay the Medicare levy, which remains 2% of your taxable income. If your income is below a certain threshold, you may be exempt from paying the levy, or you may qualify for a reduction.

Using the previous example, if your taxable income is $85,000, you would calculate the Medicare levy as follows:

Medicare Levy = $85,000 x 2% = $1,700

So, in this case, your total tax payable is:

$17,092 (income tax) + $1,700 (Medicare levy) = $18,792

Medicare Levy Surcharge

If your income exceeds the threshold and you don’t have private health insurance, you may be required to pay the Medicare Levy Surcharge (MLS) — essentially, a second Medicare-related tax. For the 2024/25 financial year, the MLS adds an extra 1% to 1.5% tax on your taxable income, depending on how much you earn. This surcharge is intended to encourage higher-income earners to take out private hospital cover, reducing the strain on the public health system.

For the 2024/25 financial year, the income thresholds are as follows:

- Individuals earning $93,000 or more and families earning $186,000 or more are subject to the MLS.

- The surcharge rates apply as follows:

- 1% for individuals earning $93,000–$108,000 (families earning $186,000–$216,000)

- 1.25% for individuals earning $108,001–$144,000 (families earning $216,001–$288,000)

- 1.5% for individuals earning $144,001 or more (families earning over $288,001)

💡TaxTank factors in the Medicare levy and any surcharge you may incur, so your ongoing tax calculations are accurate and up-to-date.

Calculating Your Tax Refund

Your tax refund depends on how much tax you’ve already paid throughout the year across all income sources, as well as any tax offsets you may be eligible for. While many Australians rely on Pay As You Go (PAYG) withholding, which automatically deducts tax from wages, income can also come from other sources, such as investments, rental properties, business income, or foreign earnings.

In addition to the tax paid, tax offsets, such as the Low and Middle Income Tax Offset (LMITO) or Senior Australian Tax Offset, can reduce your overall tax liability, potentially increasing your refund. Understanding how tax and offsets apply across these multiple income streams is crucial for accurately calculating your refund or potential tax payable.

Pay As You Go (PAYG) Withholding

For most Australian employees, tax is automatically deducted from their wages or salary through the Pay As You Go (PAYG) system. Your employer calculates the appropriate amount of tax to withhold based on your earnings and any adjustments for things like tax offsets, then sends it directly to the ATO on your behalf. This withheld tax is reported on your income statement (formerly known as a group certificate) at the end of the financial year.

When you lodge your tax return, the total PAYG tax withheld is compared to your actual tax liability, which takes into account all income sources (such as investments, rental properties, or business income) and any eligible tax offsets. If too much tax was withheld, you’ll receive a refund. If too little was withheld, you’ll need to pay the difference.

Why the ATO’s Data Matching Matters for Managing Your Tax

The Australian Taxation Office (ATO) has significantly ramped up its use of data matching technology to track income and ensure tax compliance. Using sophisticated algorithms, the ATO collects data from a wide range of sources, including banks, employers, investment platforms, and property agencies. This means that all your income—whether from wages, dividends, rental properties, or foreign sources—is visible to the ATO, even if you don’t report it yourself.

Here’s why this matters:

- Investment income: The ATO can match dividends and interest reported by banks and companies to the figures in your tax return.

- Rental income: Data from property managers and rental platforms is cross-checked with the income you declare from investment properties.

- Sole trader or business income: Business transactions, including online sales, are increasingly reported to the ATO, making it harder to under-report earnings.

- Foreign income: International financial institutions report foreign earnings, which are then matched to your Australian tax obligations.

With data matching in full swing, even small errors or omissions when you calculate your tax return can trigger audits or penalties. As the ATO becomes more advanced, it’s crucial to manage your tax efficiently and ensure every income stream is accurately reported.

TaxTank simplifies this process by helping you manage your income streams in one place, automatically tracking and categorising your income while giving you a real-time tax position throughout the year. With TaxTank, you can stay one step ahead of the ATO’s data matching, ensuring compliance and maximising your tax outcomes.

Calculate Your Tax Return Step-by-Step

- Determine your total income: Start by adding up all your income sources, including wages (PAYG), investment income (like dividends and interest), rental income, sole trader or business profits, foreign income, and any capital gains from selling assets. Be thorough, as the ATO’s data matching technology can cross-check these figures against third-party reports to ensure nothing is missed.

- Subtract allowable deductions: Claim all eligible deductions to reduce your taxable income. These can include work-related expenses, property-related costs (such as repairs, depreciation, and property management fees), and investment-related expenses, like interest on loans. Remember, accurate record-keeping is essential here to avoid ATO scrutiny.

- Calculate tax payable: Apply the correct tax rates using the ATO’s tax brackets for the relevant financial year. Keep in mind that for income without automatic tax withholding—like rent, dividends, or foreign earnings—you’ll need to calculate the tax manually. If you qualify for any tax offsets (like the Low and Middle Income Tax Offset), ensure they are included in this step, as they can significantly reduce your overall tax liability.

- Compare tax payable to tax paid: Review how much tax has already been paid through PAYG withholding, or any tax instalments you’ve made throughout the year. Compare this to your total tax payable. If you’ve overpaid, you’ll receive a refund. If not enough tax was withheld, you’ll owe the ATO the difference.

💡Managing all of this can get complicated, especially with multiple income streams, deductions, and tax offsets. TaxTank simplifies the process by keeping track of your income, deductions, and tax payable in real-time, ensuring you stay on top of your tax obligations and maximise your refund potential.

Or use our tax refund calculator to calculate your tax refund estimate* based on your income.

Common Mistakes to Avoid

When lodging your tax return, certain mistakes can delay your refund or even result in additional tax to pay. Given the ATO’s advanced data matching technology, it’s more crucial than ever to avoid these pitfalls and ensure your return is accurate and fully substantiated:

- Failing to report all income: With the ATO’s ability to match data from banks, employers, and other financial institutions, leaving out income—whether from investments, rental properties, foreign sources, or business profits—will likely trigger a review or audit. Make sure every dollar you’ve earned is accounted for.

- Incorrect or overstated deductions: Claiming deductions you’re not entitled to, or failing to properly substantiate your claims, can raise red flags. The ATO uses data matching to cross-check expenses, so ensure your deductions (e.g., work-related expenses, property costs, and investment-related fees) are accurate and backed by receipts or relevant documentation. Going digital with your records can help streamline this process and avoid mistakes.

- Missing deadlines: Failing to lodge your tax return by the due date can lead to penalties and interest charges. The ATO doesn’t miss deadlines, and neither should you. Make use of digital platforms to set reminders and submit on time.

- Not updating your details: Ensure your contact information and bank details are up-to-date with the ATO. Incorrect details can delay your refund or cause important ATO notices to be missed.

Conclusion

In today’s era of data-driven compliance, staying organised and maintaining accurate digital records is more important than ever. The ATO’s sophisticated data-matching systems leave little room for error, so having real-time insight into your tax position is essential. TaxTank simplifies this process by providing real-time tracking of your income, deductions, and tax position, helping you avoid common mistakes and stay a step ahead of the ATO.

To calculate your tax return in Australia doesn’t have to be overwhelming. With a clear understanding of the tax system and the support of tools like TaxTank, you can easily manage your tax obligations, track your income and deductions year-round, and avoid any unexpected surprises at tax time. Take control of your tax situation and start your 14 day free trial with TaxTank today!