Owning an investment property in Australia can be one of the most rewarding financial decisions you make. With the Australian real estate market often delivering consistent capital growth and rental income, it’s no wonder that property investment remains a popular choice. However, the administrative burden of managing multiple properties, keeping track of expenses, and staying on top of tax obligations can quickly become overwhelming. This is where a reliable Investment Property Tracker becomes indispensable.

The right Investment Property Tracker not only simplifies your property finances but also ensures you maximise your tax deductions, ultimately increasing your returns. Among the many options available, TaxTank stands out as the premier solution for Australian property investors. Tailored specifically for the Australian market, TaxTank offers unparalleled features that streamline property tracking and tax management, ensuring you stay compliant while optimising your financial outcomes.

The Challenges of Property Investment in Australia

Investing in property is not without its challenges. From fluctuating property values to the complexities of tax regulations, investors need to be vigilant. One of the biggest hurdles is keeping accurate records of all income and expenses related to the property. Australian tax law is stringent when it comes to claiming deductions on investment properties, and failing to maintain precise records can lead to missed opportunities and potential audits.

For instance, tracking rental income, maintenance costs, interest expenses, depreciation, and capital improvements can be a daunting task, particularly if you own multiple properties. Moreover, the ATO requires detailed documentation to substantiate any claims, which means that sloppy or incomplete records could result in denied deductions or, worse, penalties. Using a dedicated Investment Property Tracker like TaxTank ensures that every detail is recorded accurately, making the entire process more manageable.

Why TaxTank is the Best Investment Property Tracker in Australia

Comprehensive Property Management

TaxTank is designed to be a one-stop solution for all your property tracking needs. It allows you to track every aspect of your investment property from rental income, expenses, loan repayments, and depreciation schedules, ensuring that you have a complete overview of your property’s financial performance at all times. As the leading Investment Property Tracker in Australia, TaxTank offers real-time insights that are crucial for making informed decisions.

One of the standout features of TaxTank is its real-time reporting capabilities. TaxTank reports the tax and cash position of properties and portfolios so you can see exactly what each property costs to hold (cash position) and the impact on your tax return (tax position) so you can make better decisions to proactively control how much tax you pay.

Better still, they’ve partnered with CoreLogic to forecast growth and equity over time for better planning. Having a clear picture of property performance and equity, coupled with rental returns and interactive reports, will ensure you’re always in control and armed with the right information when thinking about buying or selling. TaxTank is more than just an Investment Property Tracker; it’s a complete solution for property investors.

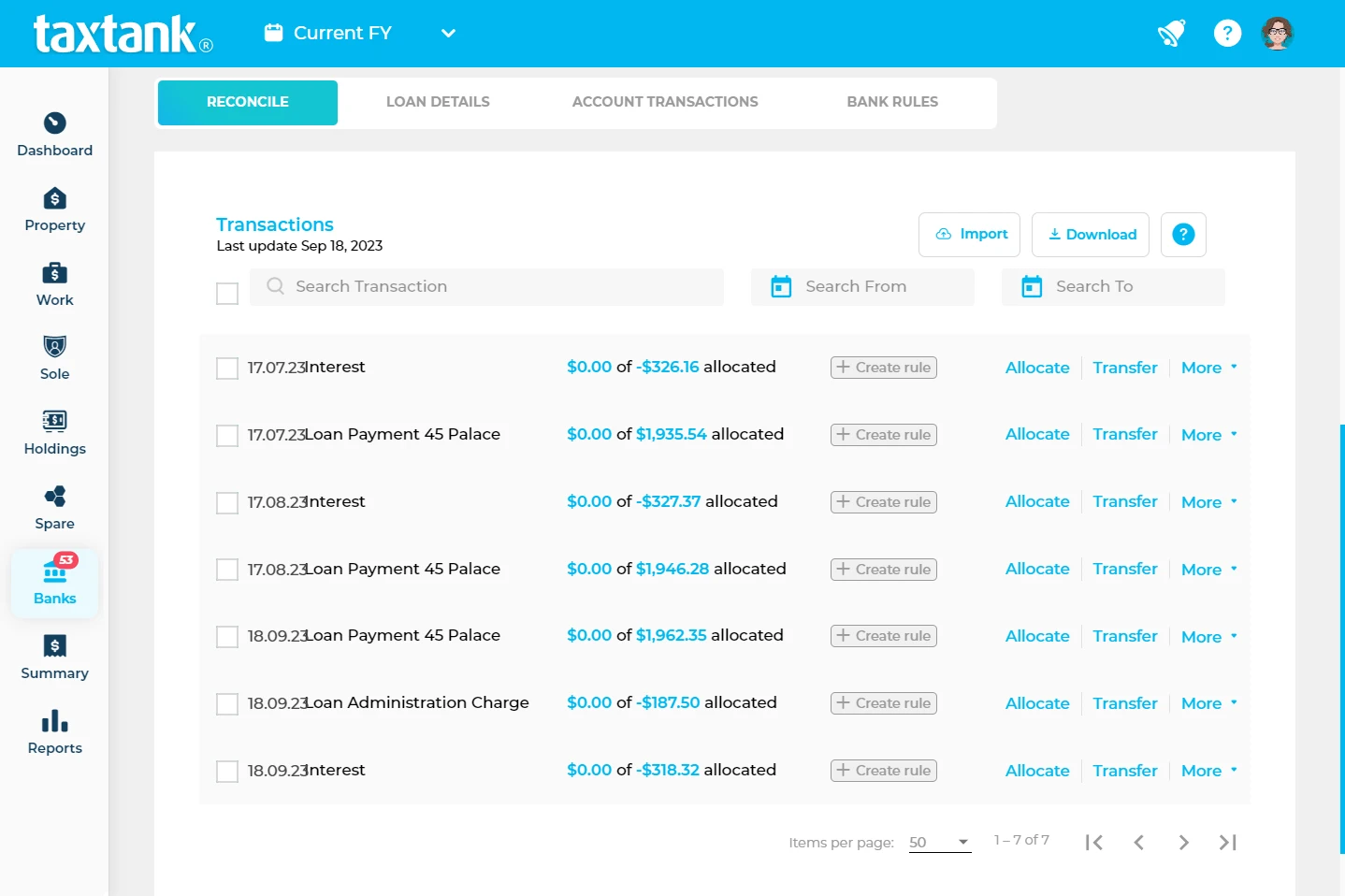

Live Bank Feeds with Open Banking

A significant innovation that sets TaxTank apart as an Investment Property Tracker is its integration with live bank feeds through Open Banking. This feature allows you to seamlessly link your bank accounts, enabling automatic and secure updates of all your financial transactions. With live bank feeds, every income, expense, and loan repayment related to your investment properties is captured in real-time, reducing manual entry and the risk of errors. This ensures your financial data is always up-to-date, making your tax calculations more accurate and hassle-free. Open Banking not only enhances convenience but also adds a layer of security and efficiency to your property management, giving you more time to focus on growing your investment portfolio.

Optimised Tax Management

When it comes to tax time, many property investors dread the task of collating receipts, calculating deductions, and ensuring that they’ve claimed everything they’re entitled to. TaxTank, as an advanced Investment Property Tracker, takes the stress out of tax management by automatically calculating your tax obligations and potential refunds based on the data you’ve entered throughout the year.

The platform is fully compliant with Australian tax laws, and it’s regularly updated to reflect any changes in regulations. This means you can rest assured that you’re always claiming the maximum deductions legally allowed, without the risk of non-compliance. The precision and ease that TaxTank brings make it the ultimate Investment Property Tracker for tax management.

Tailored for Australian Property Investors

Unlike generic property management tools, TaxTank is specifically designed for the Australian market. This means it takes into account the unique aspects of Australian property investment, such as negative gearing, capital gains tax (CGT) discounts, and the intricacies of depreciation schedules for Australian properties. As an Investment Property Tracker built for Australians, it ensures all these local factors are seamlessly integrated.

For example, TaxTank includes built-in tools for calculating depreciation using the latest rates and methods approved by the ATO. Adding existing depreciation schedules, new builds, and renovation projects for a property is relatively fast and painless in TaxTank. The better news is that once added, the schedules automatically allocate to future years to ensure nothing is missed year after year. This level of customisation is what makes TaxTank the preferred Investment Property Tracker for Australian investors.

Ease of Use and Accessibility

Despite its comprehensive features, TaxTank is incredibly user-friendly. The platform is designed with simplicity in mind, making it accessible even to those with limited financial or technological expertise. The intuitive onboarding checklist guides you through each step of the process, from setting up your property profile to adding your banks and property portfolios.

Additionally, TaxTank is available as a web-based platform that is responsive on all devices, giving you the flexibility to manage your property portfolio on the go. Whether you’re at home, in the office, or inspecting a property, you can easily access your account and update your records in real-time. This accessibility further enhances TaxTank’s reputation as the top Investment Property Tracker.

How TaxTank Stacks Up Against the Competition

There are several property management tools available in Australia, but none offer the same level of detail and customisation as TaxTank. While some platforms focus solely on tracking rental income and expenses, TaxTank provides a holistic view of your property investment, integrating tax management, compliance, and financial analysis into a single platform. This integration is what sets TaxTank apart as a superior Investment Property Tracker.

Other tools may offer basic reporting features, but they often lack the depth of data required to make truly informed decisions. TaxTank, on the other hand, allows you to drill down into the specifics of your property’s performance, providing detailed insights that can help you optimise your investment strategy.

Moreover, many competing platforms are not tailored to the Australian market, meaning they may not account for local tax laws or financial practices. This can lead to inaccurate calculations and missed opportunities for tax savings. TaxTank’s Australian focus ensures that every feature is designed with the local investor in mind, making it the most reliable and effective Investment Property Tracker for managing your investment properties in Australia.

The Future of Property Investment with TaxTank

As the Australian property market continues to evolve, the need for sophisticated management tools will only increase. With its commitment to innovation and user-centric design, TaxTank is poised to remain at the forefront of the industry, offering investors the tools they need to navigate the complexities of property investment. As the most advanced Investment Property Tracker, TaxTank is ready to meet these challenges head-on.

Whether you’re a seasoned investor with a large portfolio or a first-time buyer looking to make your first purchase, TaxTank provides the comprehensive support you need to succeed. By simplifying the management of your investment properties and optimising your tax outcomes, TaxTank ensures that you can focus on what really matters: growing your wealth and securing your financial future. With TaxTank as your Investment Property Tracker, you’re well-equipped to achieve your financial goals.

Conclusion: Choose TaxTank for Unmatched Property Tracking

In the competitive world of property investment, having the right tools at your disposal can make all the difference. TaxTank stands out as the best Investment Property Tracker for Australian investors, offering a unique combination of comprehensive property management, optimised tax handling, and ease of use.

By choosing TaxTank, you’re not just investing in a tool; you’re investing in the future of your property portfolio. With its powerful features, user-friendly interface, and commitment to the Australian market, TaxTank is the clear choice for investors looking to take their property management to the next level. TaxTank truly is the ultimate Investment Property Tracker for anyone serious about maximising their returns and minimising their tax burden.

Don’t leave your property’s financial performance to chance. Make the switch to TaxTank today and experience the peace of mind that comes with knowing your investments are in the best possible hands.