Selling a property is exciting, but the mention of Capital Gains Tax (CGT) can dampen the mood. This tax, which applies to the profit made from selling certain assets, can take a significant bite out of your earnings if you’re not careful. But don’t worry, there are smart ways to reduce Capital Gains Tax liability and keep more of your hard-earned cash. Let’s dive in and explore these strategies!

Understanding Capital Gains Tax on Property

What is Capital Gains Tax (CGT)?

Capital gains tax is essentially a tax on the profit (or “capital gain”) made when you sell an asset for more than its purchase price. In Australia, CGT applies to most properties unless specifically exempt.

How is CGT Calculated?

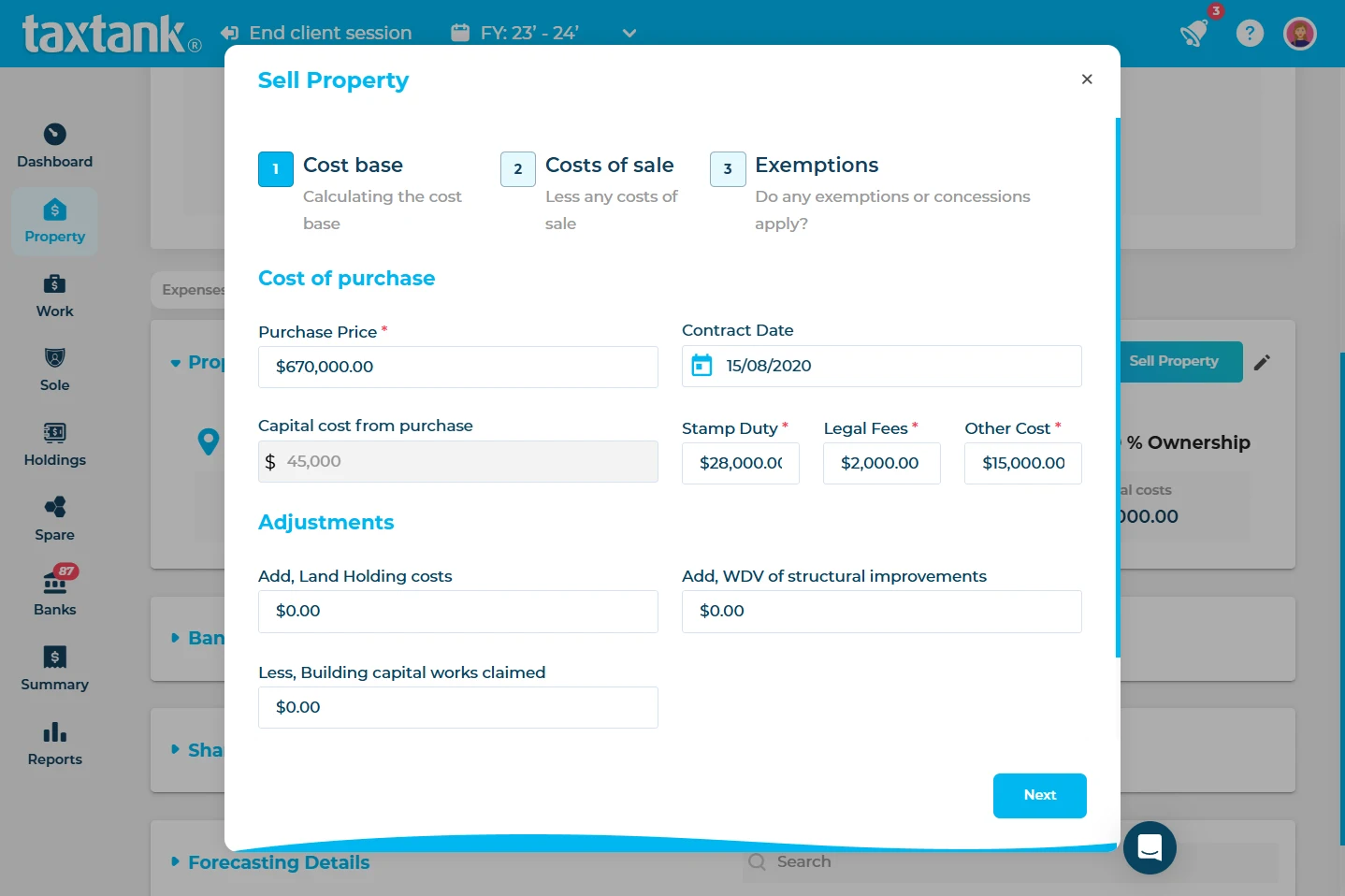

To calculate your capital gain, you’ll need to consider:

- The original purchase price of the property.

- Acquisition costs, such as stamp duty, buyer’s agent fees, and legal fees.

- The final sale price of the property.

- Depreciation adjustments, which may impact your cost base.

- Sale-related costs, such as agent commissions and legal fees.

For example, if you bought an investment property for $500,000 and sold it for $700,000, your $200,000 profit, adjusted for depreciation claims and eligible costs like stamp duty, agent fees, and legal expenses, would be subject to Capital Gains Tax (CGT).

Types of Property Subject to CGT

Not all properties are treated equally under CGT laws. While your primary residence is typically exempt, investment properties, holiday homes, and other secondary properties fall under CGT rules.

Top Strategies to Reduce Capital Gains Tax

1. Leverage the Main Residence Exemption

If the property you’re selling has been your primary residence, you may qualify for a full CGT exemption. To maximise this benefit, ensure the property consistently met the criteria for being your main residence, and maintain accurate records to support your claim.

2. Use the 50% CGT Discount

Individuals and trusts can reduce capital gains tax by 50% if they have held the asset for more than 12 months before selling. This discount effectively halves the taxable portion of your gain, significantly lowering your CGT liability.

3. Apply the Six Year Rule

Enhance your property’s cost base by including eligible expenses such as stamp duty, legal fees, and costs of structural improvements. A higher cost base reduces your capital gain, thereby decreasing your CGT liability.

4. Claim Eligible Property Expenses & Improvements

When you sell matters. For instance, if you sell just after the end of the financial year, you’ll have more time to plan your tax strategy and potentially spread the gain across multiple tax years.

5. Time the Sale Strategically

Consider the timing of your asset sale to align with a financial year when your taxable income is lower. Since CGT is added to your assessable income, selling during a low-income year can place you in a lower tax bracket, reducing the overall tax payable.

6. Make Concessional Superannuation Contributions (and Leverage the Bring-Forward Rule)

Contributing a portion of your capital gain into your superannuation as a concessional (pre-tax) contribution can reduce your taxable income. These contributions are taxed at a concessional rate of 15% within the super fund, which is often lower than your marginal tax rate, resulting in significant tax savings.

Additionally, if you’re eligible, you can use the superannuation bring-forward rule, allowing you to contribute up to three times the annual non-concessional cap in a single financial year (currently up to $330,000 as of 2024). This can be particularly useful for offsetting a large capital gain while maximising your retirement savings. Be sure to check the eligibility criteria, including age and total super balance limits, to ensure compliance.

Practical Tools and Resources

Tax Calculators and Software

Online CGT calculators, like the ones on the Australian Taxation Office (ATO) website, can help estimate your liability. Alternatively, tax software such as TaxTank streamlines this process, ensuring you claim all eligible deductions.

Key Government Resources

The ATO is your go-to source for official guidelines on CGT. Check out their CGT essentials page for comprehensive information.

When to Seek Professional Advice

If your situation feels overwhelming, a tax advisor can provide tailored strategies to minimise CGT and help you navigate complex rules.

Top 3 Mistakes to Avoid with Capital Gains Tax (CGT)

Keeping Accurate Records

Poor record-keeping is one of the most common mistakes in managing CGT. To correctly calculate your cost base and maximise deductions, it’s essential to maintain detailed records of purchase prices, associated costs, improvements, and sale details. Using a platform like TaxTank simplifies this process, ensuring all your property-related data is securely tracked and accessible in one place.

Understanding the 12-Month Rule

The 50% CGT discount applies only if you’ve held the property for at least 12 months, calculated from the contract date of purchase to the contract date of sale, not the settlement dates. Misunderstanding this can disqualify you from significant tax savings. Planning your transactions carefully with this in mind can help you take full advantage of the discount.

Tracking Changes Between Home and Investment Property

If your property transitions between being your main residence and an investment property, it’s crucial to keep accurate records of market values and dates of use. This ensures you correctly apply the main residence exemption or calculate CGT. With TaxTank, you can seamlessly switch properties between home and investment portfolios, keeping your records organised and ensuring compliance with ease.

Frequently Asked Questions About CGT

What happens if you don’t report CGT correctly?

The ATO uses advanced data-matching technology to identify discrepancies in property sales, share trading, and other asset disposals. If you fail to report CGT correctly, the ATO can impose hefty penalties and interest. Always double-check your calculations and maintain accurate documentation to ensure compliance.

Are non-residents eligible for CGT exemptions?

Non-residents typically don’t qualify for the main residence exemption and may face higher CGT rates. For example, non-residents are excluded from the 50% CGT discount on capital gains accrued after May 8, 2012.

Can you completely avoid paying CGT?

While it’s difficult to completely avoid CGT, exemptions like the main residence exemption and strategies like timing asset sales or utilising carried-forward losses can significantly reduce your liability. Proper planning and tools like TaxTank can help you navigate these strategies effectively.

Conclusion

Selling a property doesn’t have to mean losing a big chunk of your profits to capital gains tax. By understanding the rules, leveraging exemptions, and planning ahead, you can reduce capital gains tax and maximise your returns.

If you’re looking for an easy way to manage CGT and other tax obligations, try TaxTank. With tools designed to simplify property-related tax, it’s your ultimate tax sidekick.

Ready to take the stress out of property tax? Sign up with TaxTank today and discover smarter ways to handle your finances.