Repairs, Capital, and Initial Repairs: Understanding the ATO’s Depreciation Guidelines (Before They Do It for You)

The ATO depreciation guidelines are key to property investment, determining what you can and cannot claim. Success comes from choosing the right property, securing good tenants, and making the most of deductions. However, the ATO does not take a relaxed approach to tax claims.

That leaky roof might be a repair. A new kitchen is definitely an improvement. The oven that came with the property? That depends. Get it right and you can maximise deductions. Get it wrong and you could be spreading an expense over 40 years instead of claiming an immediate tax break.

Before a simple fix becomes a long-term tax deduction, let’s explore what you can claim, when, and why. This will keep your tax savings high, compliance in check, and the ATO uninterested in your return.

1. Repairs: The ATO’s Version of a Quick Fix

If something in your rental property breaks or deteriorates from wear and tear, and you restore it to its original condition without upgrading it, congratulations—you may have an actual, immediate deduction! Repairs are fully deductible in the same financial year you pay for them.

✔ Fixing a leaking pipe? ✅ Deductible

✔ Replacing a few missing roof tiles after a storm? ✅ Deductible

✔ Patching up a hole in the wall left by tenants who misunderstood the function of a door? ✅ Deductible

🚨 Warning: The ATO depreciation guidelines clearly define a repair as something that restores, not improves. If you decide to swap out that old sink for a shiny marble vanity because it “just made sense,” you’ve now entered capital improvement territory—and deductions get far less exciting (more on that below).

2. Capital Improvements: When the ATO Thinks You’re Getting Too Fancy

Capital improvements are upgrades that enhance the property beyond its original state. And because the ATO is a firm believer in delayed gratification, these costs must be depreciated over 40 years at 2.5% per year. Yes, you read that right. If you were hoping to claim the full amount in one go, you’re going to be disappointed.

🚫 Replacing a perfectly functional kitchen with a brand-new gourmet one? ❌ Capital

🚫 Tearing out an old bathroom to install modern fittings and heated floors? ❌ Capital

🚫 Adding a deck because ‘everyone loves an outdoor space’? ❌ Capital

Even if your upgrade is necessary, the ATO depreciation guidelines classify it under “capital works.” Their reasoning? Improvements increase the value of the property, and they believe you should share that benefit very slowly over the next four decades.

3. Initial Repairs: The ATO’s ‘Nice Try’ Clause

This is the one that trips up new investors. If you buy a property with existing damage and fix it up straight after purchase, the ATO calls that an initial repair, which means no immediate deduction for you. Instead, it’s lumped into your property’s cost base for capital gains tax (CGT) calculations when you sell.

🔍 How to spot an initial repair:

✔ If the issue was there when you bought the property, it’s not an immediate deduction.

✔ If the previous owner left you a property in “fixer-upper” condition and you renovate before renting it out, those costs must be capitalised.

🚫 Repairing a crumbling fence after purchase? ❌ No immediate deduction

🚫 Fixing a leaky roof that was dodgy from day one? ❌ No immediate deduction

🚫 Repainting a house that looked ‘charming’ in the listing but is actually flaking off in chunks? ❌ No immediate deduction

The ATO depreciation guidelines state that initial repairs are part of the property’s purchase price—not a rental expense. However, if you replace assets like ovens or dishwashers that were non-functional upon purchase, you can claim depreciation for their decline in value over their effective life.

How to Stay on the ATO’s Good Side

We live in a digital world, yet somehow, many property investors are still wading through shoeboxes of receipts and outdated spreadsheets. Meanwhile, the ATO is fully digital, and their data-matching systems are faster and sharper than ever. To avoid costly mistakes and maximise your deductions, it’s time to embrace technology and streamline your tax management.

With the right digital tools, particularly TaxTank, you can stay firmly in the ATO’s good graces while making sure you’re claiming everything you’re entitled to, without the hassle. Here’s how:

Live Bank Feeds & Smart Tax Tools

Manual tracking is a surefire way to miss deductions or misreport something the ATO already knows. TaxTank’s live bank feeds automatically import transactions, ensuring that nothing is ever lost, missed, or forgotten. Even better, its built-in smart tax tools and rules help categorise expenses correctly in real-time, so you always know your tax position.

🚀 The result? Fewer mistakes, faster deductions, and a clear, year-round view of your taxable income.

Permanent Document Storage

The ATO requires property investors to keep records for up to five years after selling a property. TaxTank’s permanent document storage helps you stay compliant.

✔ Upload and attach receipts, invoices, and contracts directly to transactions.

✔ No more paper clutter—everything is digitally stored and accessible anytime.

✔ Easily track CGT calculations when you eventually sell your property.

🚀 The result? ATO audit-proof documentation and no last-minute panics.

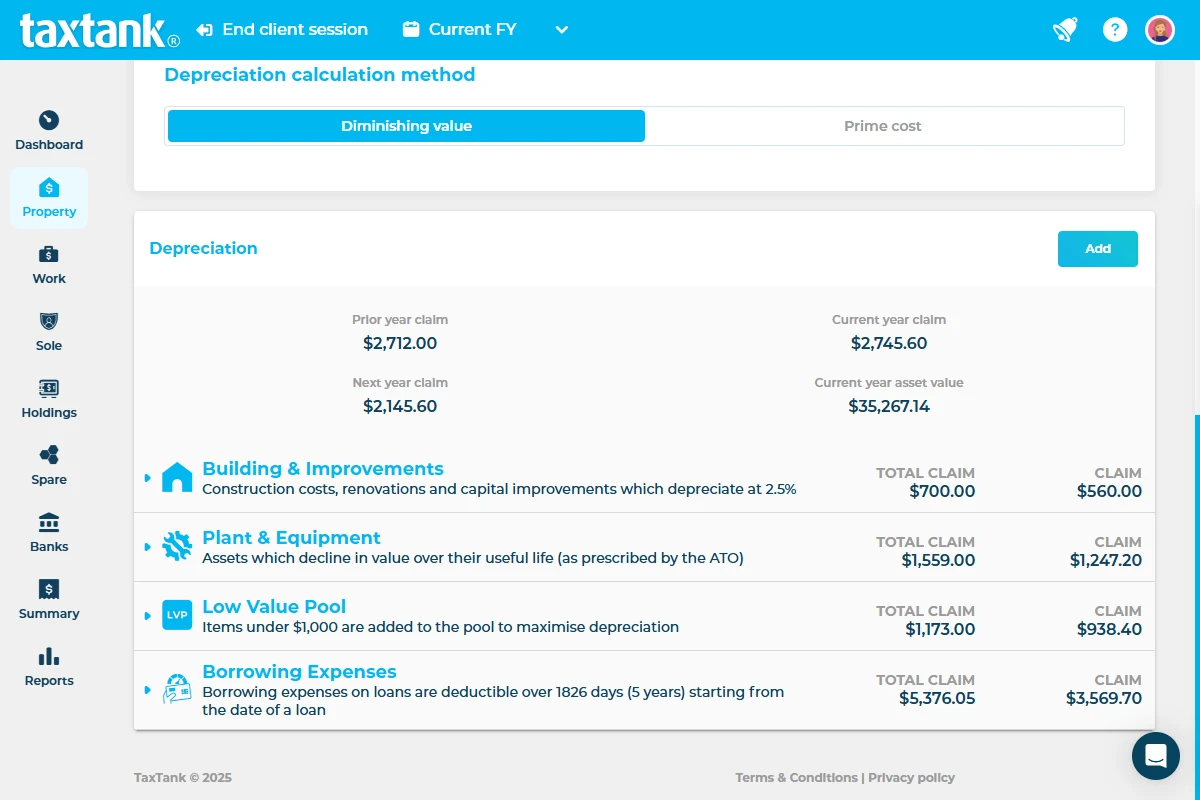

Depreciation, DIY Projects & Borrowing Costs

Depreciation schedules, initial repairs, and loan interest deductions can be a tax minefield. Misclassify something, and you could lose out on thousands in deductions—or worse, end up on the ATO’s radar.

✔ ATO Depreciation Guidelines: TaxTank automates depreciation tracking, ensuring you claim the right amounts each year.

✔ DIY Projects & Initial Repairs: Know the difference between repairs (immediate deduction) and capital improvements (40-year wait).

✔ Borrowing Costs: TaxTank tracks loan fees, ensuring you amortise deductions correctly and claim every dollar allowed.

🚀 The result? Maximised deductions, fewer ATO disputes, and more tax savings.

Why Risk It? Go Digital with TaxTank

The ATO expects precision, and TaxTank delivers it. With automated tracking, smart tax tools, and secure record-keeping, you can claim confidently, stay compliant, and never leave money on the table.

📢 Smart investors go digital. The rest take their chances. Which one are you?

Final Thoughts: Play Smart, Claim Smart

The ATO’s depreciation guidelines can be complex, but once you understand the rules, you can claim every dollar you’re entitled to—without setting off any alarms. Before you pick up that toolbox, ask yourself:

“Am I simply restoring what was already there?” → Repairs. Instant deduction.

“Am I upgrading or improving something?” → Capital works. 2.5% over 40 years.

“Did this problem exist before I bought the place?” → Initial repair. 2.5% over 40 years.

Got it? Good. Now go forth, claim wisely, and let TaxTank do the heavy lifting. 🚀

Start your TaxTank free trial today!