The Australian Taxation Office (ATO) has long maintained that property investors are serial offenders when it comes to tax mistakes, claiming that “9 out of 10 property investors get it wrong.” This alarming figure has fueled an aggressive compliance push, with data-matching, AI-driven audits, and tighter deadlines for taxpayers to prove their innocence.

But where did this statistic come from? And how reliable is it?

Despite the ATO using this claim to justify sweeping enforcement measures, the methodology behind it is alarmingly fragile, rooted in a tiny sample size, aged data, and a lack of transparency. In fact, the core data behind the claim is four years old, and the sample size is so small that it barely scratches the surface of Australia’s 2.2 million property investors.

Worse still, requests for transparency, including Freedom of Information (FOI) attempts, have been denied, leaving taxpayers with little choice but to comply with an AI-driven system that presumes guilt first and asks questions later.

So, what’s really going on? Let’s break it down.

Tiny sample over two years: The heart of the issue

At the core of the ATO’s infamous “9 out of 10 property investors” claim is the Random Enquiry Program (REP). Here’s how it works:

- 545 taxpayers audited per year – This includes all individual tax returns, not just those of property investors.

- Data bundled over two years – The ATO combines two consecutive years, creating a total of 1,090 audited returns.

- Limited focus on property investors – Of these 1,090 audits, only 464 relate to property investors, averaging just 232 per year.

From this small annual subset, the ATO extrapolates that 9 out of 10 property investors “get it wrong” and applies this statistic to 2.2 million investors nationwide. Despite a rapidly growing property market, the sample size and methodology remain unchanged, meaning compliance policies for millions are based on a tiny, outdated sample from four years ago.

This approach was critically examined in the Australian National Audit Office (ANAO) 2022–23 performance audit—a review that cost taxpayers a staggering $660 million. The ANAO raised serious concerns about the methodology, including whether the sample size was fit for purpose given the rise in property investors.

Data that’s 4 years old

If the tiny sample weren’t enough, the data used to formulate the “9 out of 10 property investors” claim isn’t current:

- Audits behind that figure date back four years, missing recent changes in tax law, improved record-keeping, and different market conditions.

- The ATO treats these outdated findings as if they reflect current investor behavior, driving modern compliance programs that are far more advanced and AI-driven.

It’s a bit like using 2019 financial data to make big decisions in 2023, the environment has changed, yet the numbers remain the same.

More enforcement, less margin for error

The ATO’s expanded compliance efforts aren’t just about catching errors, they fundamentally shift the burden onto taxpayers, increasing scrutiny and reducing safeguards.

✔ A System That Assumes You’re Wrong – Instead of verifying mistakes before taking action, the ATO automatically assumes an error and requires you to prove otherwise. The presumption of innocence? Gone. Now, you’re guilty until proven compliant.

✔ More Scrutiny, Less Flexibility – The Random Enquiry Program (REP) has been extended for two more years, with $90 million in additional taxpayer funding allocated to AI-driven audits, automated compliance letters, and expanded data-matching.

✔ Fast-Tracked Compliance Notices – AI scans rental income, bank deposits, insurance policies, and real estate agent records, flagging any inconsistencies. If something doesn’t match, a compliance letter can be automatically generated, no human review, no questions asked. Sound familiar? Just look at how Robodebt ended..

✔ A Tight Deadline with Costly Consequences – If flagged, you have just 28 days to provide documents, receipts, and explanations. Failing to respond fully within that timeframe can result in penalties, adjusted tax assessments, and further compliance action.

Is traditional record-keeping enough?

AI-driven audits, automated compliance flags, and real-time data matching have made tax an ongoing process, not a once-a-year task. While many rely on spreadsheets or business accounting software, these tools lack the features and functionality needed for investment properties, resulting in missed deductions, errors, and increased risk.

Meanwhile, the ATO is a decade ahead, using advanced technology to track every transaction and flag anomalies instantly. Taxpayers need to even the playing field with tools that provide the same level of oversight and accuracy.

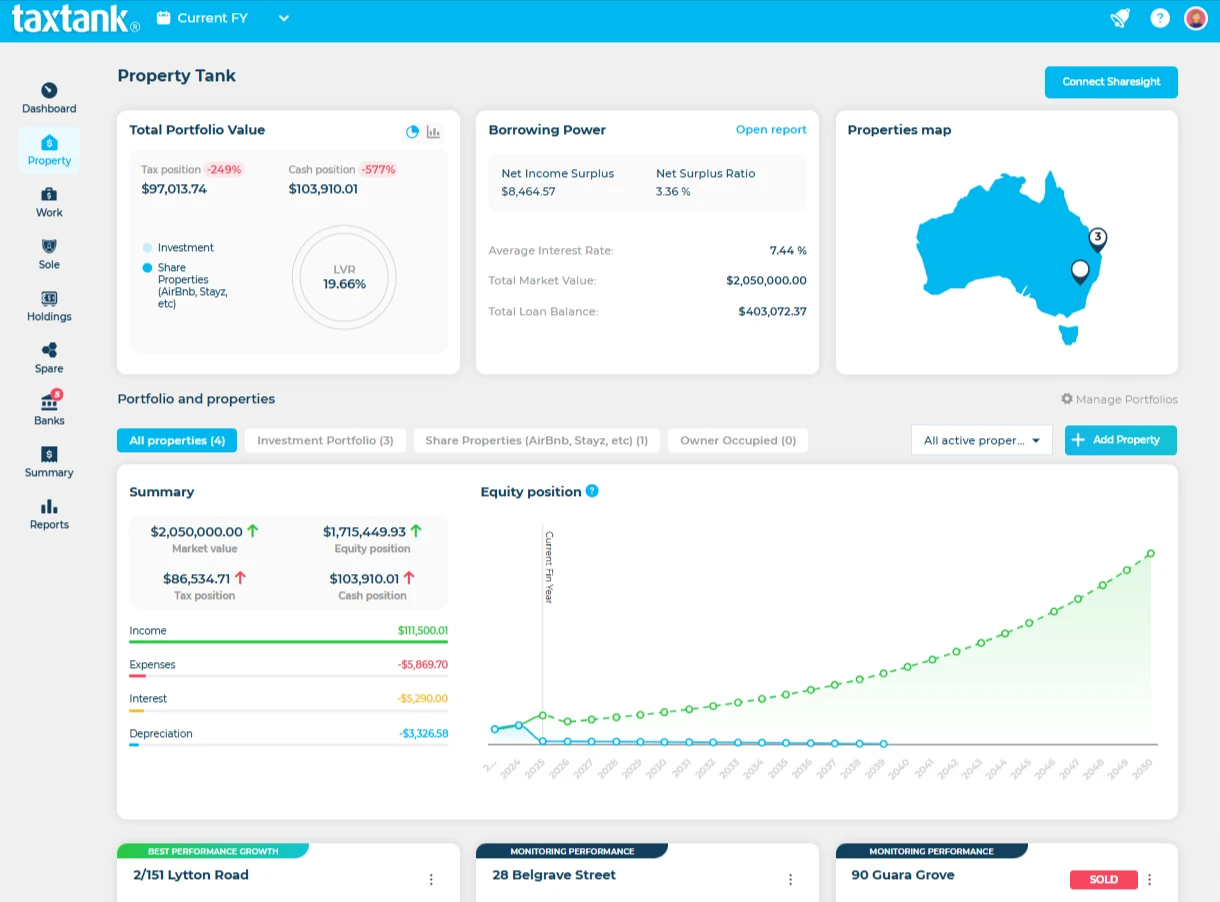

That’s where specialised property tax software like TaxTank comes in:

- Live Bank Feeds – Every transaction is captured immediately, loans can be apportioned, borrowing expenses automated and auto rules to eliminate error.

- Smart Tax Tools – Automated depreciation calculations, real-time property tracking, live reports and instant tax insights help you stay ahead of regulations.

- Future-Proof Compliance – As tax laws evolve and grandfathering provisions shift, TaxTank automatically captures and applies these changes, including capital costs, so you stay optimised and compliant year after year.

This isn’t just about software, it’s about certainty. The ATO won’t slow down, tax laws will keep shifting, and the burden of proof stays with you. Managing tax in real-time, all the time, is the surest way to stay compliant and ahead.

The Bottom Line

The ATO’s 9 out of 10 property investors statistic comes from just 232 property investor audits per year, using four-year-old data, yet it underpins the ATO’s increasingly AI-powered compliance approach. Bundling two years of minimal data to cover millions of taxpayers raises fundamental questions about the reliability of the claim, especially when today’s audits are so advanced and the margin for error is razor-thin.

Until the methodology and sample sizes are brought up to speed with modern realities, property investors must remain on high alert, because in this new compliance landscape, what the ATO perceives as an “error” can quickly become a costly ordeal.

Staying compliant with the ATO’s evolving tax requirements has never been more crucial. Don’t leave your tax to chance. TaxTank’s specialised property tax software offers real-time tracking, automated calculations, and future-proof compliance.

Make sure you’re ahead of the game and reduce the risk of costly errors. Start using TaxTank today to simplify your tax process and stay fully compliant with ease.