Working from home can come with valuable tax deductions — if you know what you’re entitled to claim. With the ATO tightening up rules around work from home deductions, getting it right is more important than ever. Here’s everything you need to know to claim work from home deductions properly, avoid red flags, and maximise your tax return using TaxTank, Australia’s smartest way to track and claim your home office.

What Counts as Working From Home?

To claim work from home deductions, you must be genuinely working from home to earn income. This includes:

- Full-time remote workers

- Hybrid employees with regular work-from-home days

- Sole traders and freelancers running a business from home

- Casuals or part-timers doing admin tasks or emails from home

Occasional tasks like checking emails or answering a few work calls don’t count. The ATO expects a regular, structured working pattern.

What Work from Home Deductions Can You Claim?

Depending on your situation, you may be able to claim:

1. Running Expenses

These relate to the cost of using your home for work. Deductible items include:

- Electricity and gas (heating, cooling, lighting)

- Internet usage

- Mobile and landline phone use for work

- Home office equipment depreciation (computers, desks, chairs, printers)

- Cleaning costs (specific to the work area)

2. Occupancy Expenses (For Sole Traders Only)

If your home is your principal place of business, you can also claim:

- Rent or mortgage interest

- Council rates

- Home insurance premiums

⚠️ Employees cannot claim occupancy expenses, even if you work full-time from home.

Choosing the Right Method to Claim: Actual Costs vs Fixed Rate

The ATO offers two main methods and the Occupancy method for Sole Traders only:

1. Fixed Rate Method (70c per hour)

From 1 July 2024, you can claim 70 cents per hour worked from home, covering:

- Electricity and gas

- Internet and phone

- Stationery and computer consumables

If you choose this method your cannot claim the above expenses as they are considered “included” in the hourly rate by the ATO and you must keep a detailed record of actual hours worked from home. Estimates won’t cut it.

Separate claims can be made for depreciating assets like laptops or chairs.

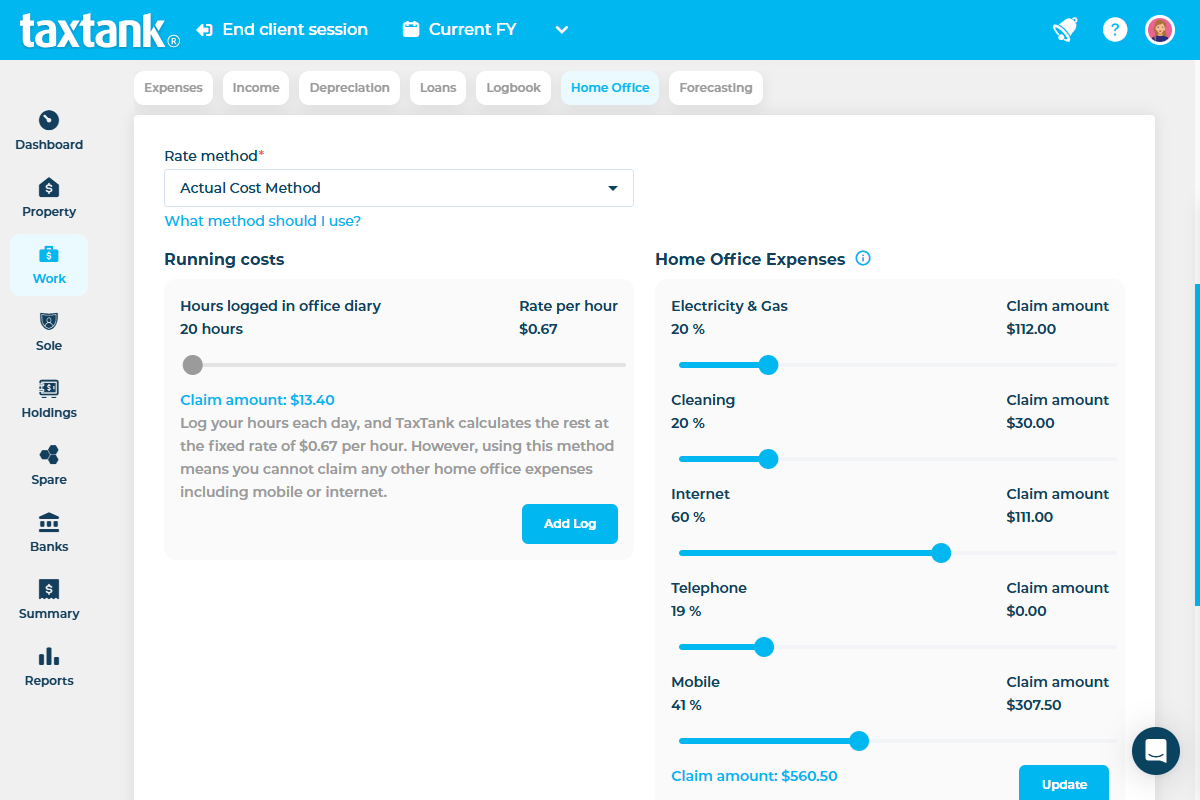

2. Actual Cost Method

With this method, you can claim a percentage of specific costs related to your home office, including:

- Electricity and gas for heating, cooling, and lighting

- Home and mobile internet or data expenses

- Mobile and home phone usage expenses

- Stationery and computer consumables, like printer ink and paper

- Cleaning costs for a dedicated home office space

This method usually yields higher work from home deductions but requires detailed records and receipts.

3. Occupancy Method (Sole Traders Only)

If you have a dedicated home office, workshop or storage area for your sole trader business, the Occupancy Method allows you to claim a portion of both occupancy and running costs.

You can calculate and apportion the real costs of:

- Mortgage interest or rent

- Council rates

- Land taxes

- House insurance

Plus the actual costs (running expenses)

- Electricity and gas for heating, cooling, and lighting

- Home and mobile internet or data expenses

- Mobile and home phone usage expenses

- Stationery and computer consumables, like printer ink and paper

- Cleaning costs for a dedicated home office space

What Records You Must Keep

No matter which method you use to claim work from home deductions, accurate records are crucial. You need:

- A log of hours worked at home (not just a sample)

- Receipts or invoices for purchases

- Proof of how you apportioned work-related usage (e.g. phone bills)

Use TaxTank’s Home Office Diary

TaxTank includes a purpose-built Home Office Diary that automatically:

- Tracks your work-from-home hours

- Accurately calculates and apportions work from home deductions for work-related usage

- Record expenses directly from bank feeds and attached receipts.

- Lets you switch between methods to determine the best claim method for your situation

- Stores receipts and purchase details

- Keeps everything ATO-compliant and audit-ready

Case Study: Claiming the Right Way with TaxTank

Emma, a hybrid marketing consultant, works from home 3 days a week. Using TaxTank:

- She logs her work-from-home hours weekly via the Home Office Diary.

- She allocates her energy bills and internet costs directly from Bank Feeds and they are apportioned according to her claim percentage.

- TaxTank calculates her total claim using both methods and she can switch between the methods to see which method gives her the most tax-effective option.

Come tax time, she’s ready to lodge with confidence — no spreadsheets, no guesswork.

What You Can’t Claim

The ATO is strict on incorrect claims. These are not deductible:

- Coffee, tea, or snacks

- Childcare while working

- Rent if you’re an employee

- Any portion of expenses without valid documentation

Avoid These Common Mistakes

- Relying on the old 80c/hour COVID shortcut — it’s no longer valid

- Estimating hours or guessing bills

- Claiming personal expenses as business-related

- Using spreadsheets instead of proper records

Streamline Your Home Office Deductions with TaxTank

TaxTank is purpose-built for Australian taxpayers who work from home. Whether you’re a full-time employee, a freelancer, or running a side hustle, TaxTank:

- Tracks hours automatically via the Home Office Diary

- Stores all receipts in one secure place

- Applies ATO-compliant rules in real time

- Maximises your deduction using bank feeds and smart logic

- Prepares your tax summary, ready for lodgement

No more spreadsheets. No more guesswork. Just clean, clear tax tracking — all year round.

Final Word

Claiming your work from home deductions correctly can put serious dollars back in your pocket — but only if you’re keeping accurate records and applying the right method. Using TaxTank gives you total confidence, total compliance, and total clarity.

Start using TaxTank today and make your tax return work as hard as you do.

FAQs

Who can claim work from home deductions in Australia?

You can claim work from home deductions if you’re genuinely working from home to earn income. This includes full-time remote workers, hybrid employees, sole traders, freelancers, and part-time or casual staff regularly performing work-related tasks from home.

What expenses can I claim when working from home?

You can claim running expenses like electricity, internet, phone usage, and depreciation on home office equipment. If you’re a sole trader using your home as your main place of business, you may also claim occupancy expenses such as rent, mortgage interest, and rates.

Can employees claim rent or mortgage costs?

No. If you’re an employee, even if you work from home full-time, you can’t claim rent or mortgage interest. Occupancy costs are only deductible for sole traders whose home is their principal place of business.

What are the methods for claiming work from home deductions?

There are two methods:

Fixed Rate Method (70c/hour) – from 1 July 2024, this covers electricity, internet, phone, and consumables.

Actual Cost Method – you calculate and apportion the real costs of your expenses based on work-related use.

What records do I need to keep?

From the 2023 financial year onwards, the ATO requires:

* A log of actual hours worked from home

* Receipts or invoices for expenses

* Evidence of how you apportioned usage for work purposes

Can I estimate my hours or use the old COVID shortcut?

No. The 80c per hour COVID shortcut method ended in 2022. You must now keep actual records of the hours you worked from home — estimates and samples aren’t accepted.

What can’t I claim as a home office expense?

You can’t claim personal expenses like coffee, snacks, childcare, or any portion of costs without valid documentation. Rent is also not deductible for employees.

How does TaxTank help with work from home deductions?

TaxTank includes a Home Office Diary to track your hours, store receipts, and apply ATO-compliant rules. It compares both methods and lets you choose the one that gives you the best deduction — no spreadsheets, no guesswork.

Is it better to use the fixed rate or actual cost method?

It depends on your situation. The actual cost method can result in a higher deduction, but it requires more detailed records. TaxTank automatically compares both methods and suggests the most tax-effective option.

What happens if I don’t keep proper records?

You risk having your deduction denied by the ATO or flagged for an audit. Keeping accurate, real-time records ensures you’re compliant and helps maximise your refund.