If you’re searching for Turbotax in Australia, you might be hoping for an easy, stress-free way to do your tax return. But here’s the reality: Turbotax is not available in Australia. The popular US-based tax software doesn’t support Australian tax laws or align with the ATO.

Many Aussies ask, “Is there a Turbotax equivalent in Australia?” The short answer is yes – but it’s not Turbotax. Instead, the best Turbotax alternative in Australia is TaxTank, a locally built tax platform designed specifically for Australian tax rules.

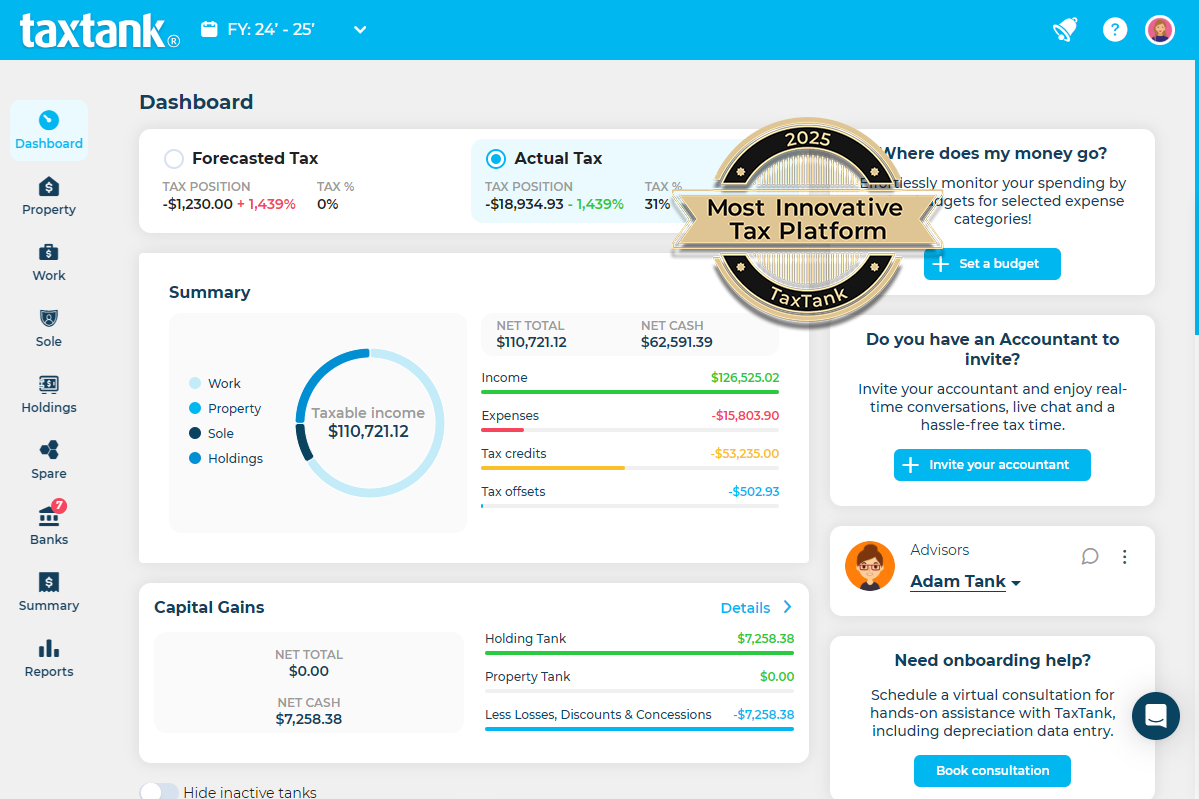

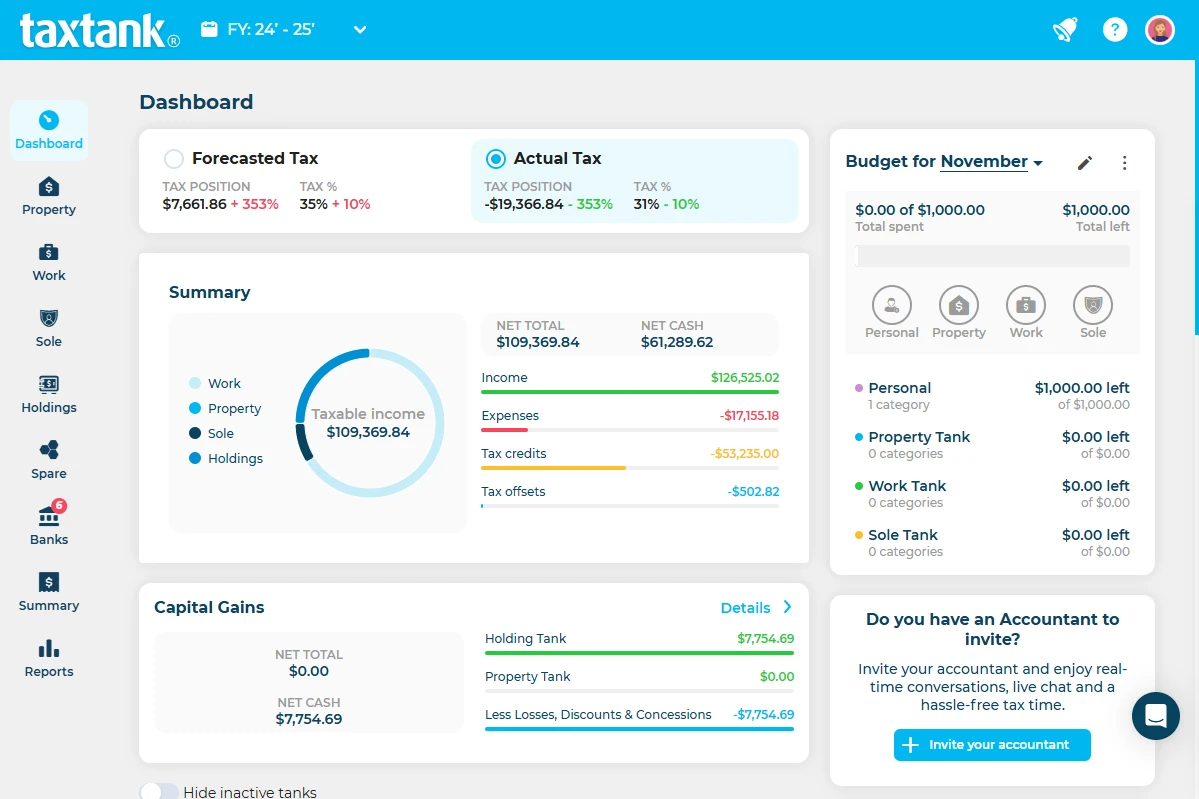

TaxTank gives you real-time visibility of your tax position throughout the year and handles everything from PAYG income and sole trader finances to property investment and capital gains on shares and crypto.

Stop wasting time looking for Turbotax Australia — choose a tool made for your tax system and get your tax done smarter and simpler with TaxTank.

Why Turbotax Isn’t Available in Australia

Turbotax was built for the United States tax system, which is completely different from the Australian Taxation Office (ATO) processes. The US relies heavily on self-preparation, federal and state filing, and itemised deductions. In Australia, we deal with:

- PAYG

- TFNs and ABNs

- Medicare levies

- Fringe benefits

- Rental property depreciation

- Capital gains tax (CGT) on shares, crypto and property

- Work-related deductions

- And much, much more

Turbotax simply isn’t programmed to understand any of this. You can’t connect it to your myGov account, it won’t calculate Medicare levies, and it definitely won’t handle things like negative gearing or franking credits. Even if you tried to force it, the software would be useless here and possibly lead to incorrect lodgements.

Stop Searching for Turbotax in Australia: Here’s What to Use Instead

If you’re looking for user-friendly, smart tax software that’s 100% designed for the Australian tax system, the solution is TaxTank.

What Is TaxTank?

TaxTank is an Australian-built, cloud-based tax platform made for individuals, sole traders, investors and everyday taxpayers who want to take control of their tax position. It links directly to bank feeds, tracks deductions, logs real-time tax estimates, and even handles capital gains on property, shares and crypto.

TaxTank doesn’t just help with your tax return – it helps you manage your tax position all year round, so there are no nasty surprises at EOFY. No more trying to pull together receipts at the last minute. No more guessing what you’ll owe.

How TaxTank Compares to Turbotax (If Turbotax Actually Worked Here)

| Feature | Turbotax (USA) | TaxTank (Australia) |

| Local tax system support | ❌ US only | ✅ 100% Aussie |

| Open banking with live bank feeds | ❌ No | ✅ Yes |

| Tracks tax in real-time | ❌ No | ✅ Yes |

| Handles PAYG | ❌ No | ✅ Yes |

| Capital gains for property, shares & crypto | ❌ US stocks only | ✅ Yes |

| Property investor tools, including deprecation | ❌ Limited | ✅ Full property tools |

| Built in vehicle logbook | ❌ No | ✅ Yes |

| Built-in home office diary | ❌ No | ✅ Yes |

| Suits Aussie sole traders | ❌ No | ✅ Yes |

| Affordable pricing | ❌ N/A | ✅ From $6/month |

Why TaxTank Is the Best Tax Software for Australians

1. Built for Australian Tax Rules

TaxTank doesn’t just bolt on some Aussie features — it was built from the ground up to handle the unique complexity of the Australian tax system. Whether you’re a PAYG employee, property investor, side hustler or sole trader, the software automatically calculates your tax position and deductions based on ATO rules and real-time data.

2. Real-Time Tax Position Tracking

Unlike other platforms that show your tax outcome at the end of the year, TaxTank gives you a live view of what you’ll owe (or get back) at any point in time. As transactions flow through your bank feed and deductions are added, your estimate updates automatically. No more nasty surprises in July.

3. Full Capital Gains Tracking for Property, Crypto and Shares

Whether you’re a casual investor or a serious trader, TaxTank takes the stress out of capital gains tax (CGT). It calculates CGT across all asset classes live so you can see exactly how it impacts your tax throughout the year.

4. Property Investors Rejoice

TaxTank’s Property Tank is a game-changer for investors. It:

- Manages all properties across different ownership structures in one place

- Tracks rental income, expenses, cash flow, and tax in real time

- Monitors performance indicators like capital growth, LVR, and yields

- Automates depreciation and manage DIY renovation projects

- Automates borrowing expenses for loans and refinancing

- Calculates claim percentages for shared properties, including Airbnb and room rentals

- Tracks expenses for properties not yet rented in a dedicated land portfolio

- Uses a real-time CGT calculator to see the tax impact of sales

- Updates property values and growth percentages live with CoreLogic integration

- Creates instant property tax reports for accountants

- Syncs live data with Sharesight

- Securely stores all property documents in the Spare Tank

5. Integrated Bank Feeds with Open Banking

No more manual entry. With live bank feeds powered by Basiq, TaxTank syncs your income and expenses daily, and then auto-categorises them using smart rules. You can review, reclassify, and match transactions in just a few clicks. It’s simple, accurate and fast.

6. Smart Tools for Sole Traders and Side Hustlers

Sole traders love the Sole Tank, which acts like a digital business tool for tracking income, expenses, car logbooks, and work-from-home diaries. It keeps business and personal separate, so your tax is spot on, every time.

Plus, TaxTank autocalculates your tax position live so you always know how much tax to pay. It’s everything you need to ditch the spreadsheet and stay on top of your business finances year-round.

Simple, Affordable Pricing That Suits Every Taxpayer

TaxTank offers flexible pricing based on the tools you need. Whether you’re managing one rental property, running a freelance gig, or investing in crypto and shares, you only pay for what you use. Plans start from just $6/month, giving you full access to advanced tools, tax estimates, and real-time tracking.

There are no lock-in contracts, no hidden fees, and no paying for features you don’t need. Just smart tax software that makes sense. and pays for itself come tax time.

What About Lodgement?

When you’re ready to lodge your return, TaxTank provides you with a fully prepared interactive Tax Reports including the myTax Report. You can:

- Give it to your accountant, or better yet, invite them share in TaxTank for free

- Use it to lodge through myTax yourself

- Or hand it off to a registered tax agent

It’s flexible, accurate and lets you stay in control. You’re not locked into a specific workflow, and you’re not paying extra just to submit a form. You choose what works best for you.

Conclusion: Turbotax isn’t available in Australia, But TaxTank is, and it’s Australian owned

There’s no point wasting time looking for Turbotax in Australia as it simply doesn’t exist here. What does exist is something better: TaxTank, a locally developed platform that actually understands our tax system and makes managing it a breeze.

Whether you’re chasing deductions, calculating CGT, tracking rental income, or running a side hustle, TaxTank puts you in control. With affordable pricing, smart tools, and real-time insights, you’ll know exactly where you stand with the ATO – not just at tax time, but every day of the year.Get started with TaxTank today from just $6/month.

Because tax in Australia doesn’t need to be complicated – it just needs the right tools. Ready to take control of your tax? Visit TaxTank today and see why more Australians use this alternative to Turbotax.

FAQs: Turbotax in Australia

Can I use Turbotax for my Australian tax return?

No. Turbotax does not support Australian tax returns. It’s built for the US system and can’t handle Australian tax law.

Is Turbotax available in Australia?

Turbotax is only available for US taxpayers. There’s no official Turbotax Australia version, and using the US product for your Australian tax could lead to incorrect lodgements. The best tax software in Australia is TaxTank.

Why doesn’t Turbotax work in Australia?

The Australian tax system is completely different to the US. Turbotax is designed for US federal and state returns, not for Australia’s complicated tax legislation.

What is the best Turbotax alternative in Australia?

The best Turbotax alternative for Australians is TaxTank – locally built tax software that works seamlessly with ATO rules. It tracks your tax position in real time, handles PAYG, sole traders, property investors, and capital gains on Aussie shares and crypto.

Is there a Turbotax equivalent for Australia?

Yes. TaxTank offers the same ease of use as Turbotax but is designed for the Australian tax system. It integrates with ATO services, supports bank feeds, and automatically calculates your tax position throughout the year.

How much does a Turbotax equivalent cost in Australia?

TaxTank plans start from just $6 per month, with no lock-in contracts. You only pay for the tools you need, whether that’s for PAYG, sole trader, property investor or share/crypto CGT tools.

Is TaxTank safe to use?

Yes. TaxTank uses bank-grade encryption, complies with Open Banking security standards, and never shares your data without your consent. You can also add MFA for an additional layer of security.