No two accounting firms are the same; they all have different business values, different goals, and different ideal clients. So how do you choose the accounting software that’s right for your firm? Fortunately, there are some must-have features that will boost business at any accounting firm regardless of size, clientele or budget.

Every accounting firm will benefit from software that can:

1. Streamline your day-to-day operations

If your current software doesn’t eliminate the need for paperwork and email chains, then it’s definitely time for a change! Automated tax tools can simplify your day-to-day operations, prevent important tasks from slipping through the cracks, and ensure you never miss a deadline again.

Software that provides live data feeds and automated tax calculations is an absolute must if you want to manage your workload easily and seamlessly. Streamlining your day-to-day operations is the first step towards increasing your firm’s profitability and scalability.

2. Provide secure online storage

It’s 2021; officially time to go cloud or go home. Cloud computing offers you and your clients a safe and secure online storage solution for invoices and receipts, eliminating the need to chase stressed-out clients for paper documents every time the EOFY comes around.

3. Report in real-time also now for individuals & property investors!

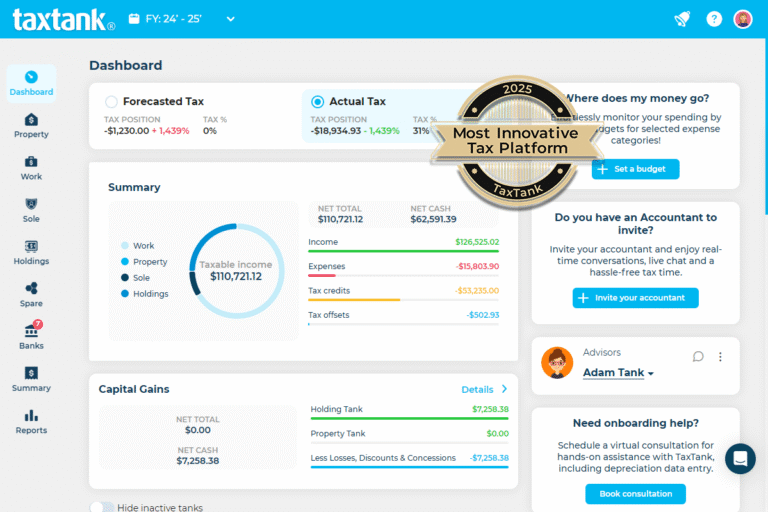

Cloud computing also enables you to deliver innovative service in real-time to your individual clients, especially property investors who definitely need more control. Your main job is to ensure your clients feel tax confident all year round, and real-time reporting on their individual tax position does just that. Choose software that helps you monitor your clients’ tax position in real-time, so that you can simply step in whenever you see a problem to solve or an opportunity to take advantage of.

Cloud based software like TaxTank, also provide real time access to client information which reduces WIP and increases productivity across the firm (nice).

4. Send and receive instant messages

Instant messaging is yet another benefit of moving to the cloud. Not only does it allow for clear communication, instant messaging also creates a culture of collaboration amongst your colleagues and clients. It’s the quickest and easiest way to share information and insights for a speedy turnaround and an absolute must in software solutions.

5. Connect with everything you need

Always look for accounting software that offers important integrations such as Xero. This will enable you to work even more efficiently, keeping your clients happy and your firm on track to greater profit and scalability.

6. Keep client data organised in one central place

Centralised data storage is a very attractive feature in accounting software because it saves you so much time. You’ll be able to quickly find historical data, ensure compliance, lower the risk of audits, avoid losing documents and instantly access critical insights to better serve your clients. This is ideal for you and your business, but your clients will also love the peace of mind.

7. Offer automated payment collection and invoicing

Getting paid is important, right? So why not look for accounting software that takes the headache out of invoicing and payment collection? Simplified time tracking and automated billing will save you and your colleagues from many hours of painful admin tasks.

8. Deliver more value to your clients

Your choice of software should add value to your services with an intelligent system your clients actually like. The software you choose should help make your services an ongoing source of valuable information, rather than stressful, once-a-year event that everyone dreads.

Imagine an accounting software that generates personalised tax tips that empower your clients to make better decisions and save more money? You’ll be please to know this software finally does exist, and it can genuinely help your individual clients pay less tax and gain more confidence.

There are just two more critical considerations when choosing the accounting software that’s right for your firm:

1. Is it designed by accountants, for accountants?

Who best understands what will make an accountant’s job easier and more rewarding? And who has the best insights on how to make an accounting firm more profitable and scalable?

That’s right – accountants do! It pays to do your research to make sure you’re using software that was designed by accountants, for accountants. Otherwise you could miss out on some of the essential tools for defining, organising and tracking your firm’s work.

2. Is it free for accountants and affordable for clients?

Unlike other accounting software, TaxTank is free for accountants. For your property investment clients, it’s only $15/month and $3 for each additional property, and the monthly fee for individual tax clients is just $9!