Working from home? Running your business from your living room? You might be missing out on valuable deductions! But not anymore. We’re excited to introduce Australia’s first digital Home Office Diary that automates your claims, keeps you compliant, and maximises your tax deductions – all in one.

As the Australian Taxation Office (ATO) continues to tighten its rules on home office claims, it’s more important than ever to track every detail accurately. But with TaxTank, keeping your records in perfect shape has never been easier. Our upgraded Digital Home Office Diary is designed to make your life easier while ensuring you get the maximum deductions you deserve.

What’s new?

TaxTank’s digital Home Office Diary is now even better – and here’s why:

1. First digital Home Office Diary on the market

TaxTank is proud to offer the first digital Home Office Diary in Australia, designed specifically to simplify your tax time. Say goodbye to messy spreadsheets and handwritten logs! With TaxTank’s digital home office diary, you can track every hour worked from home with ease, and we’ll take care of the rest. It’s a modern solution to ensure you’re always compliant with the latest ATO requirements.

2. Effortless hour tracking

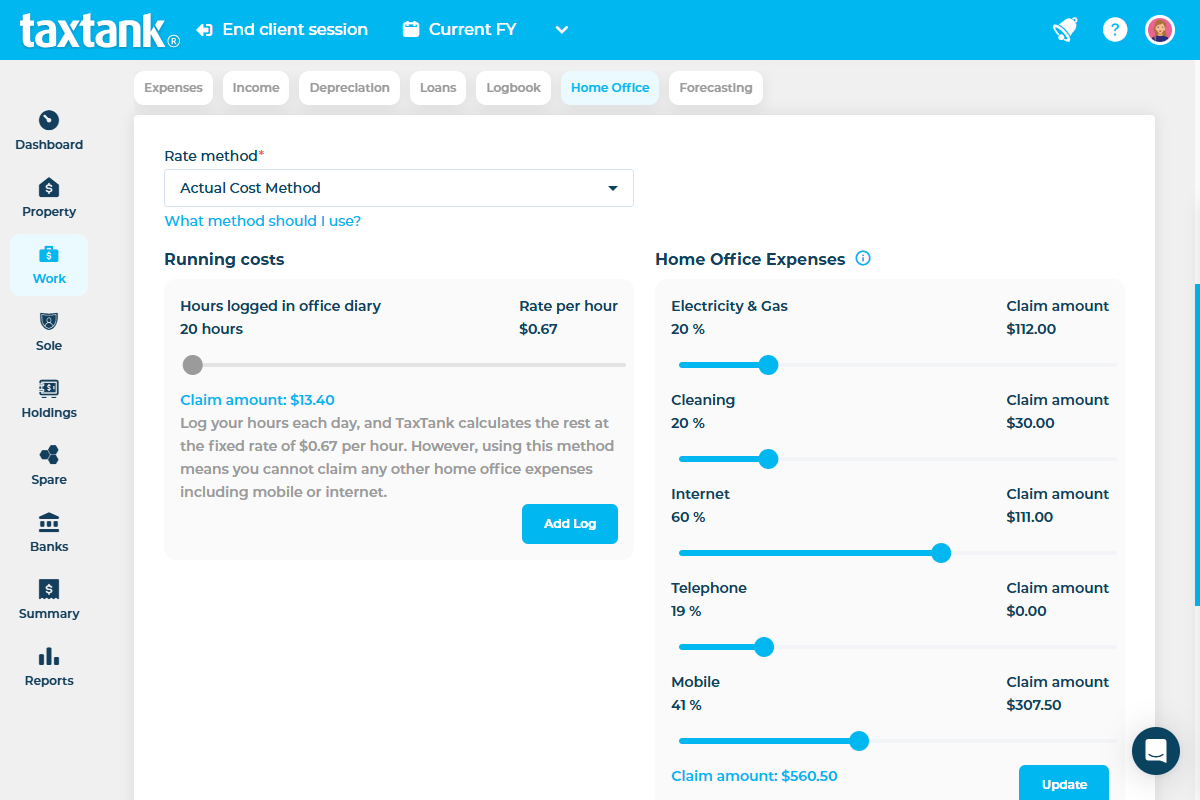

Recording hours worked from home can be tedious. But with TaxTank, we’ve streamlined the process. Simply log your hours worked each day, and we’ll automatically calculate the deductions for you. No more guesswork or keeping manual records – our system handles it seamlessly so you can focus on what matters most.

3. Maximise your work from home deductions with flexibility

Whether you’re claiming the fixed rate, actual expenses, or the occupancy method (perfect for sole traders), TaxTank’s digital Home Office Diary lets you switch between methods effortlessly. Unsure which will give you the biggest return? No problem! With a click, you can switch methods to instantly see which one gives you the best tax benefit. If your situation changes mid-year, simply adjust your entries, and we’ll automatically update all your records for the financial year.

4. Built for Sole Traders

For sole traders, we’ve included a handy m² calculator to help you claim the occupancy option accurately. This allows you to calculate your home office space usage with precision, ensuring you’re claiming the maximum deduction for your home-based business.

5. Stay audit-ready with ease

The ATO is more focused on work from home deductions than ever, which means accurate record-keeping is crucial. TaxTank’s digital Home Office Diary ensure your logs are always ready for an audit. With live bank feeds syncing directly to your diary, every expense is automatically recorded and linked to your home office usage – guaranteeing accuracy down to the last cent.

Included with TaxTank products

We believe in making tax time easier for everyone. That’s why TaxTank’s digital Home Office Diary is included in both our Work Tank and Sole Tank products. Whether you’re a freelancer, small business owner, or just working from home, this feature is designed to save you time and money.

Why you need the digital Home Office Diary

The ATO has recently tightened the rules on claiming home office deductions. Here’s a quick look at what’s changed:

- Detailed hour-by-hour records: The ATO now requires specific documentation for each day you work from home.

- Full expense documentation: If you’re claiming the fixed rate (67 cents per hour), you’ll need detailed records of expenses like electricity, internet, and phone bills – no receipts, no deduction.

- Increased scrutiny: With the ATO’s new compliance checks, only fully documented claims will be allowed.

TaxTank’s Home Office Diary is designed to help you meet these new requirements effortlessly. Our automated system takes the stress out of tracking and reporting, ensuring you’re fully compliant and maximising your deductions without the hassle.

Ready to start claiming?

Don’t miss out on the deductions you’re entitled to. TaxTank’s digital Home Office Diary is here to help you claim every cent you deserve. Stay compliant, maximise your deductions, and enjoy the ease of digital record-keeping.

Get started today and experience the TaxTank advantage – it’s tax time made easy.