Owning an investment property can be financially rewarding, but to truly maximise your returns, it’s essential to understand the investment property tax deductions available to Australian property investors. Claiming the right investment property tax deductions can significantly reduce your taxable income and improve your cash flow.

Understanding and applying these deductions can make a huge difference in your bottom line, so let’s break down the most common tax-saving strategies available. This means fewer headaches come tax time and more time to focus on your investment strategy.

Understanding Investment Property Tax Deductions

Investment property tax deductions allow you to offset costs associated with owning and maintaining a rental property. These deductions apply to expenses incurred while the property is rented or genuinely available for rent. With solutions like TaxTank, you can easily manage your property’s tax profile, ensuring nothing is overlooked.

When it comes to maximising investment property tax deductions, understanding what can be claimed is crucial. Many property owners are unaware of the various expenses that qualify as investment property tax deductions, which can lead to missed opportunities to save.

Claimable Tax Deductions for Investment Properties

A common investment property tax deduction is the loan interest charged on loans taken out for the property.

Loan Interest and Borrowing Costs

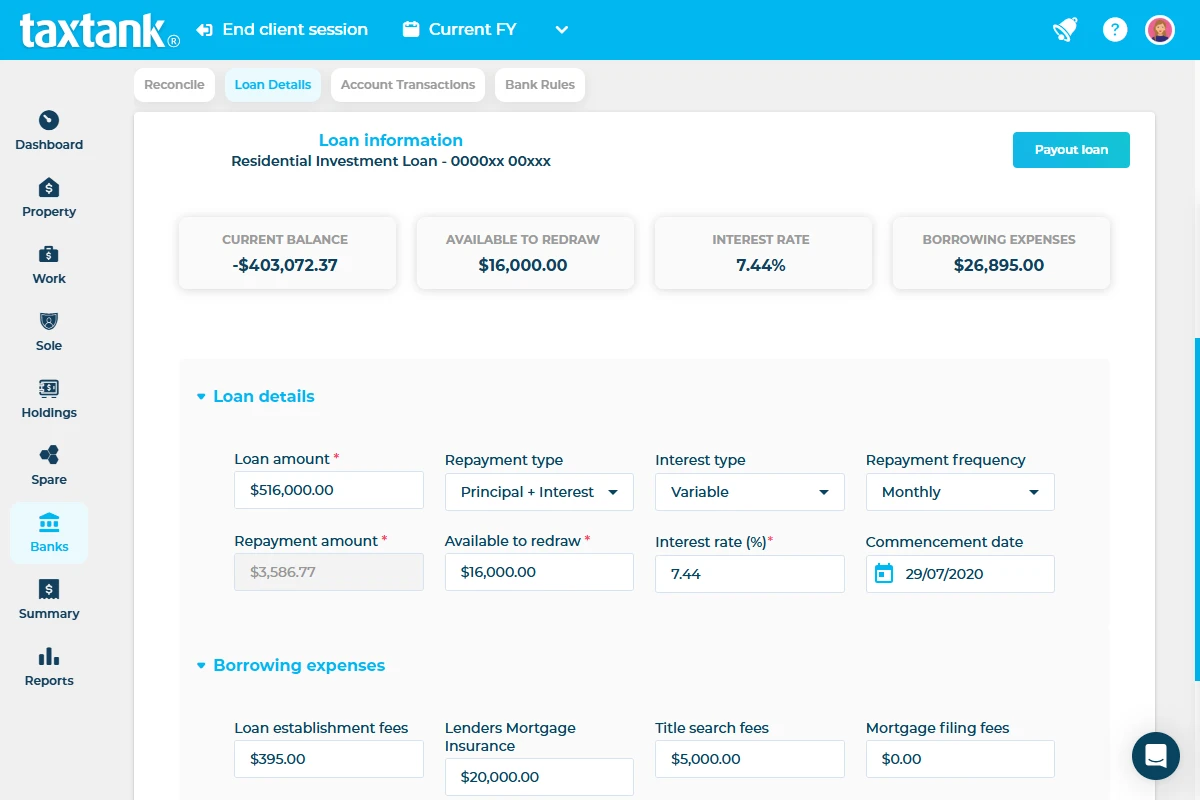

If you’ve taken out a loan for your investment property, the interest charged on that loan is tax-deductible. Additionally, you may claim borrowing costs such as:

- Loan establishment fees

- Mortgage broker fees

- Stamp duty on the mortgage

- Title search fees

- Costs for preparing and filing loan documents

Borrowing costs exceeding $100 are generally claimed over five years or the loan term, whichever is shorter. Platforms like TaxTank can track these costs for you, ensuring they’re correctly claimed.

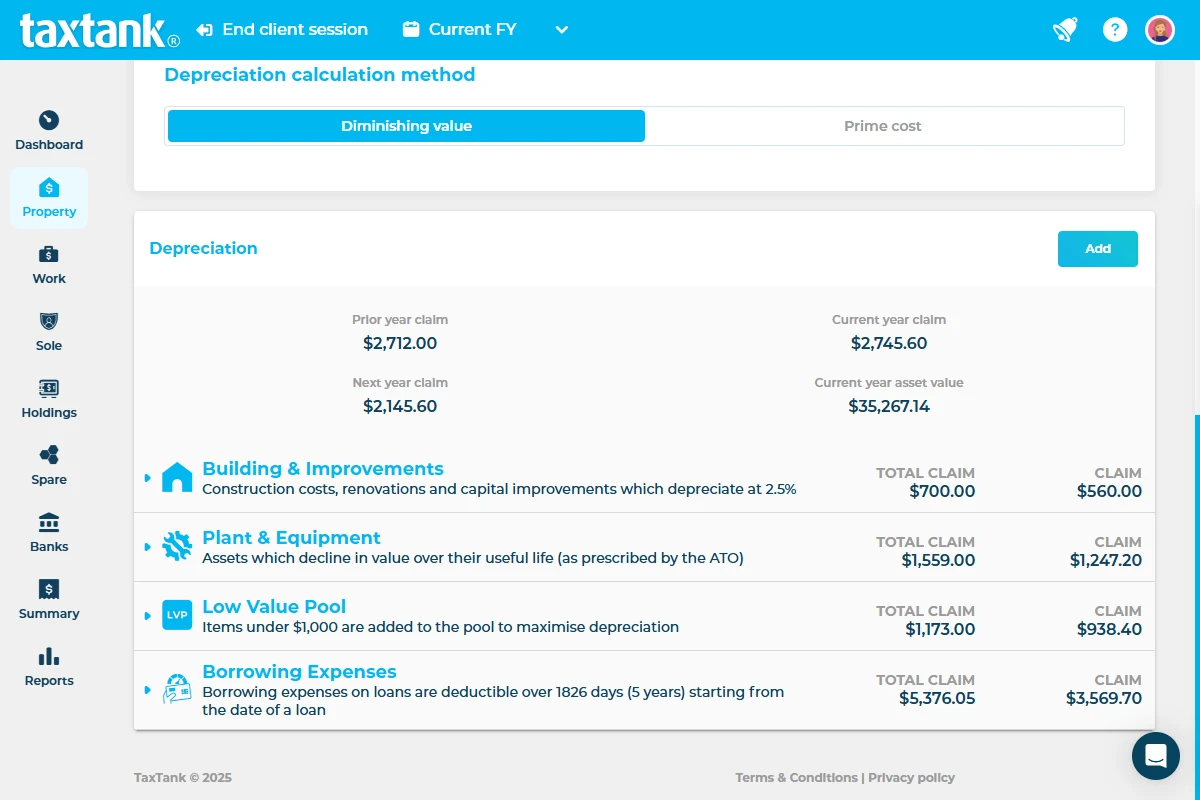

Depreciation on Assets and Building Structure

Depreciation allows you to claim deductions for the building structure and its fixtures, reducing your taxable income.

- Capital works deduction:

- Covers structural elements like walls, floors, and roofs.

- Typically deductible at 2.5% per year over 40 years for buildings constructed after 16 September 1987.

- Plant and equipment depreciation:

- Applies to items such as air conditioners, carpets, and kitchen appliances.

- Only assets purchased new or installed after 9 May 2017 are eligible.

With TaxTank’s depreciation tracking tools, you can automate calculations and stay on top of eligible claims, ensuring you don’t miss out on valuable deductions year after year.

Repairs and Maintenance

Deductions for repairs and maintenance address wear and tear or damage from renting out the property. Examples include:

- Fixing leaks

- Repainting walls

- Replacing broken appliances

Tracking investment property tax deductions related to property management can often be overlooked.

It’s important to note that repairs provide immediate deductions, while improvements are claimed as depreciation over time. TaxTank helps you categorise these expenses correctly, so you never miss a deduction.

Property Management Costs

Expenses related to property management are deductible, such as:

Even utilities and insurance are part of the investment property tax deductions you can take advantage of.

- Leasing fees

- Advertising costs for finding tenants

- Ongoing property management fees

By using TaxTank, you can track all your property management expenses in one place, giving you full visibility when it’s time to lodge your tax return. This eliminates the guesswork and ensures you’re claiming everything you’re entitled to.

Utilities and Insurance

You can claim utilities like water and electricity if you cover these costs for your tenants. Insurance policies related to the property—landlord, building, and contents insurance—are also deductible. TaxTank simplifies tracking and consolidating these expenses for maximum accuracy.

Minimising Capital Gains Tax (CGT)

Capital gains tax applies when you sell an investment property for a profit, but there are ways to minimise your liability:

- Hold the property for more than 12 months to qualify for the 50% CGT discount.

- Offset capital gains with losses from other investments.

- Maintain detailed records of all property-related expenses to reduce your capital gain.

Using TaxTank, you can store detailed records of purchase costs, improvement expenses, and sale details, making CGT calculations a breeze. This will also help you ensure that you don’t miss any important tax-saving opportunities when it comes time to sell.

Record-Keeping Tips for Accurate Claims

Meticulous record-keeping is crucial for maximising deductions and ensuring compliance. Keep records of:

- Receipts for expenses

- Loan documents and statements

- Depreciation schedules from a qualified quantity surveyor

- Tenancy agreements and rental income

TaxTank’s intuitive platform does the heavy lifting by securely storing your records and making them accessible whenever you need them. By utilising tools like TaxTank, you can ensure all your investment property tax deductions are well documented and ensures that you’re always audit-ready with perfect financial records for tax time.

Maximise Returns with Professional Guidance

Tax laws can be complex and ever-changing. Consulting a qualified tax specialist or accountant ensures you claim all eligible deductions while staying compliant. Tools like TaxTank work seamlessly with professionals to provide real-time data, streamlining the process and enhancing your financial outcomes.

Stay Ahead of Tax Changes

The Australian tax landscape evolves regularly. Stay informed on legislative updates to avoid missing opportunities to maximise savings. Partnering with industry experts and leveraging technology like TaxTank can simplify your property tax management, ensuring you’re always ahead of the game. Regular updates and features built into TaxTank keep you informed about any changes that could affect your investment property deductions, so you don’t have to worry about the latest tax laws.

With the right tools and professional advice, your investment property journey can be both profitable and efficient. By using the strategies outlined here and adopting tools like TaxTank, you can maximise your investment property tax deductions, save time, and achieve better financial outcomes by ensuring every investment property tax deduction is claimed. It’s easy to get started with a 14 day free trial, start today.