Negative gearing is one of the most widely discussed investment strategies in Australia, especially among property investors. While it can offer significant tax advantages, many misconceptions surround its use and benefits.

At TaxTank, we believe in full tax transparency, so let’s bust some common negative gearing myths to help you take control of your investment property finances.

Negative Gearing Myth 1: Negative Gearing Is Only for the Wealthy

One of the biggest misconceptions about negative gearing is that it’s a tax loophole for the rich. In reality, it’s a strategy available to all Australian taxpayers, regardless of income level. In fact, ATO data shows that a large percentage of negatively geared property owners earn under $80,000 per year, proving that many middle-income Australians use negative gearing as a tool to build wealth.

Whether you own one investment property or multiple, TaxTank’s live tax position feature gives you real-time visibility into how rental losses offset other gains and impact your taxable income, helping you plan ahead with confidence.

Negative Gearing Myth 2: Negative Gearing Means You’re Losing Money

Many critics dismiss negative gearing as a bad investment strategy because it involves making a loss. But smart investors know it’s not about losing money, it’s about long-term capital growth and strategic tax benefits.

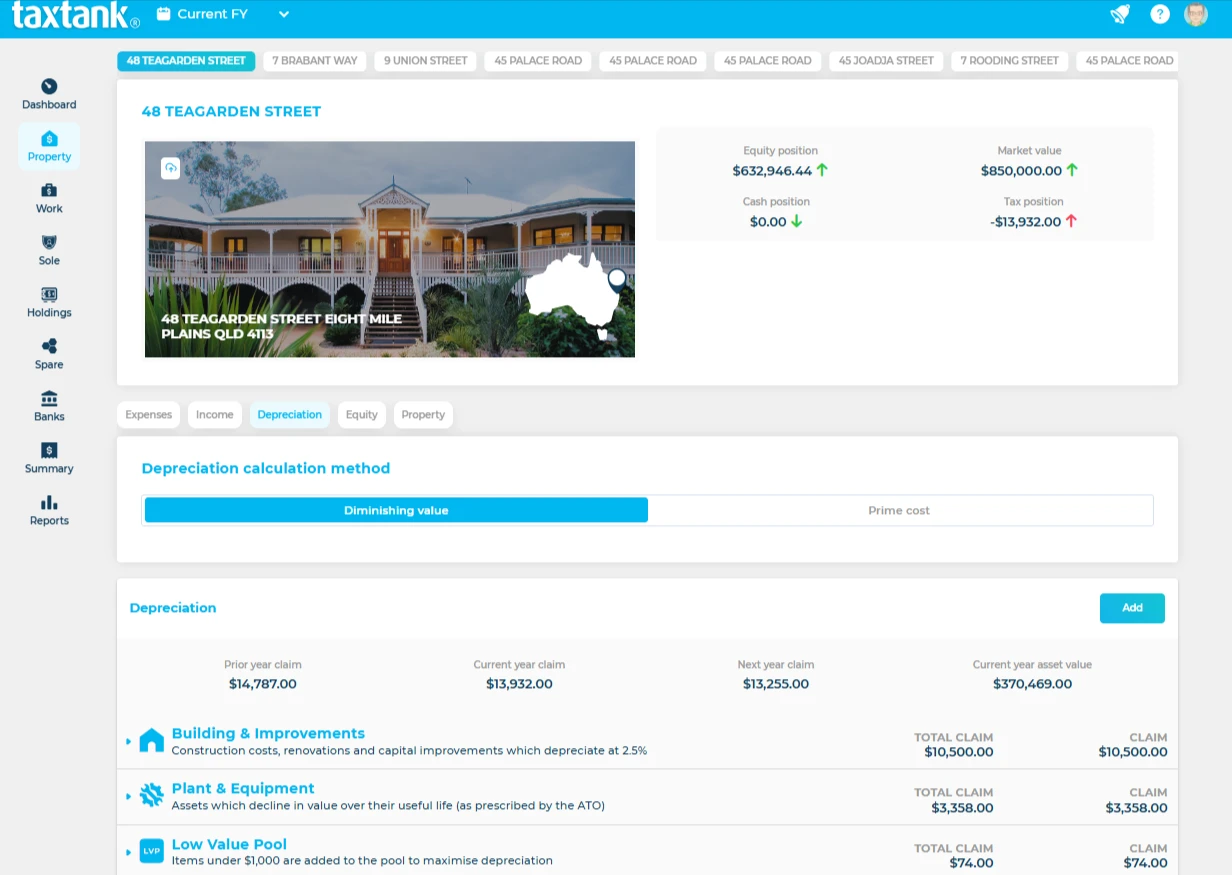

A key factor? Depreciation. New properties often come with significant depreciation deductions, helping offset rental losses and reduce taxable income, meaning you could still come out ahead while your property appreciates in value.

With TaxTank’s Property Tank, you get real-time tracking of rental income, expenses, and deductions, including automated depreciation calculations. No more spreadsheets, no more guesswork, just clear, live insights to make negative gearing work in your favour.

Negative Gearing Myth 3: Negative Gearing Always Leads to Positive Returns

Negative gearing is a tool, not a guarantee. Success depends on location, rental demand, and market trends. Buying in a weak market could leave you with an underperforming property.

That’s why TaxTank integrates with CoreLogic, giving you real-time property value estimates and market growth projections using 10 year rolling averages for houses and units by suburb. You can see exactly how your investment is performing and whether your negative gearing strategy is paying off.

Negative Gearing Myth 4: The Government Will Abolish Negative Gearing

Every few years, the debate flares up, will negative gearing be scrapped? While it makes for a great political headline, history tells a different story. When negative gearing was briefly restricted in 1985, rents surged, forcing the government to reverse the decision in 1987.

Rather than speculating, smart investors plan ahead. With TaxTank’s Property Tank, you can model different tax scenarios, forecast changes, and adapt your strategy in real-time, ensuring you’re prepared for whatever policies come next.

Negative Gearing Myth 5: Negative Gearing Is Only for Property Investors

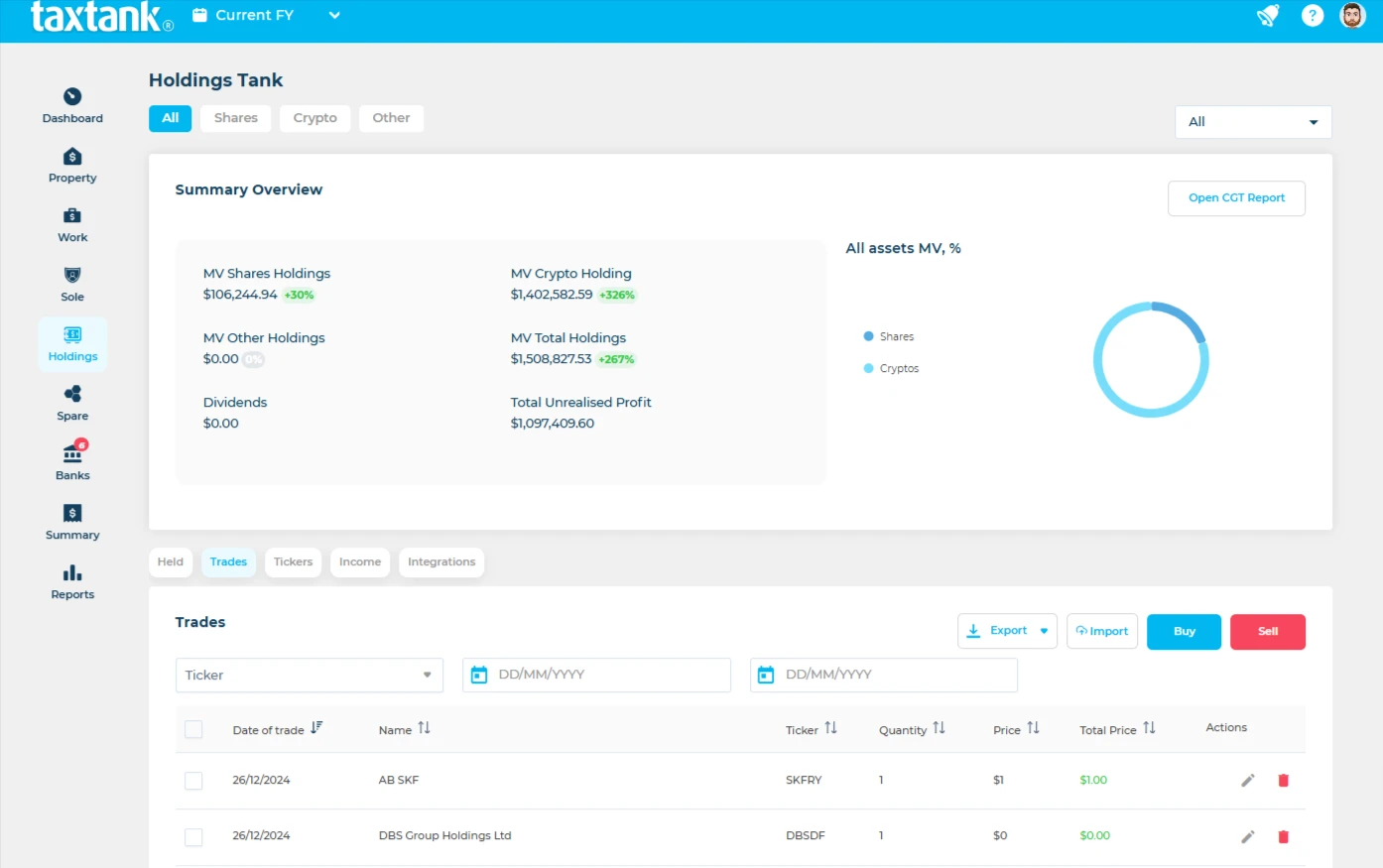

While mostly associated with investment properties, negative gearing applies to shares and managed funds too. If you borrow to invest in income-generating assets, you may be able to claim interest expenses as deductions.

TaxTank’s all-in-one tax management system allows you to track your investments across different asset classes, giving you a complete view of your finances, not just property.

Negative Gearing Myth 6: Negative Gearing Encourages Reckless Borrowing

Think negative gearing is just for property? Think again. While it’s commonly linked to real estate, negative gearing also applies to shares, managed funds, and other income-generating investments. If you borrow to invest, the interest on your loan may be tax-deductible, helping to offset your taxable income, just like with property.

With TaxTank’s all-in-one tax management system, you can track all your investments in one place, whether it’s property, shares, or other assets. Get a complete financial picture, maximise deductions, and make informed investment decisions, without the hassle of spreadsheets.

Negative Gearing Myth 7: Negative Gearing Makes Housing Unaffordable

Some argue that negative gearing makes housing unaffordable, but the reality is far more complex. Property prices are influenced by supply and demand, population growth, interest rates, and infrastructure investment, not just tax policy.

Rather than getting caught up in speculation, smart investors focus on the numbers. With TaxTank, you get data-driven insights to track cash flow, equity, and tax positions in real-time, helping you make informed decisions no matter what the market does.

Negative Gearing Myth 8: Negative Gearing Is the Only Way to Invest Successfully

Negative gearing is just one strategy, it’s not the only way to build wealth. Some investors prefer positive gearing, where rental income covers all expenses and generates a profit from day one. Others aim for an equally geared approach or a combination of both, creating a balanced portfolio that maximizes both cash flow and capital growth.

With TaxTank’s live tax tracking, you can compare negative, positive, and balanced gearing strategies in real time, helping you build a portfolio that aligns with your financial goals.

Take Control of Your Investment Strategy with TaxTank

Understanding the realities of negative gearing is key to smart investing. With TaxTank, you can:

- Track rental income and expenses in real time

- See the impact of negative gearing on your live tax position

- Monitor market trends and property values

- Model different scenarios to plan ahead

Don’t rely on guesswork! TaxTank gives you complete tax transparency, helping you optimise your investments with confidence.

Sign up today and take control of your property investments like never before!