Managing your financial records and receipts is an important aspect of running a business or personal finances. It is essential to have an organised record-keeping system to avoid any complications or a knock on the door from the ATO. In this article, we will guide you on how to organise your financial records and receipts so you can start the year off on the right foot and be ready well ahead of tax time this June.

Understand the record-keeping requirements

The Australian Taxation Office (ATO) has specific record-keeping requirements for businesses and individuals. It is essential to understand these requirements and ensure that you maintain accurate records. You must keep records of all your income, expenses, and transactions for a minimum of five years. Failure to maintain accurate records can result in adjusted tax returns, penalties and in more serious cases, legal action.

Set up a filing system

The first step towards organising your financial records is setting up a filing system. Create separate files for different types of financial documents such as receipts, invoices, bank statements, and tax returns. It is essential to label each file clearly and arrange them chronologically. This will help you locate the required documents easily when you need them.

Use digital tools

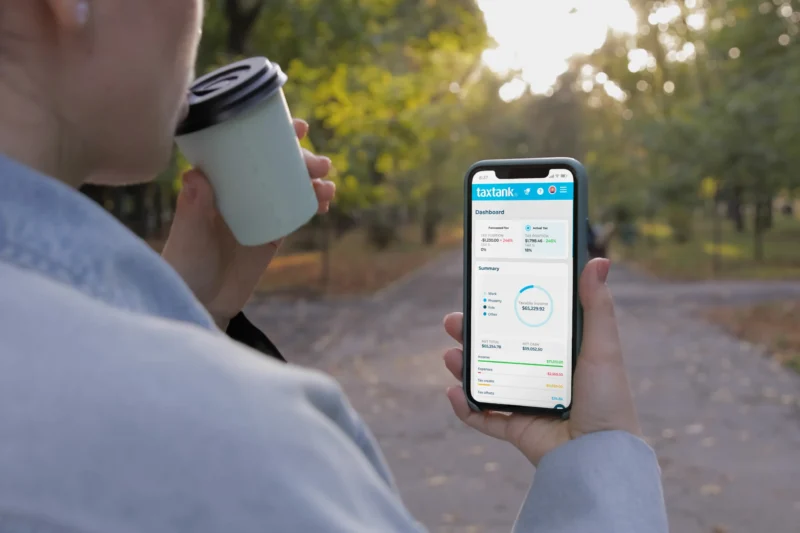

Manual record keeping can be time-consuming and prone to errors. Therefore, it is advisable to use digital tools to streamline the process. There are various accounting software available that can help you organise your financial records and receipts. You can scan and store your receipts digitally, making it easier to access them when required.

You could also choose a digital software like TaxTank that’s purposefully built for sole traders. Unlike other business softwares like Xero and Myob, TaxTank actually produces a business schedule, and better still calculates your tax position in real time all year round from just $9 per month.

Keep track of your expenses

To avoid missing out on any tax deductions, it is essential to keep track of your expenses throughout the year. Keep a log of all your business-related expenses, including travel expenses, office supplies, and equipment. You can use a spreadsheet or an accounting software to maintain a record of your expenses. This will help you claim all the eligible tax deductions and reduce your tax liability.

Organise your receipts

Organising your receipts is a crucial aspect of managing your financial records. It is essential to keep all your receipts organised and in one place. Use a separate file for receipts and arrange them chronologically. You can also categorise them by vendor or expense type to make it easier to locate them later. If you have digital receipts, make sure to store them in a secure cloud storage system.

Reconcile your accounts

Reconciling your accounts regularly is essential to ensure the accuracy of your financial records. Make sure to match your bank statements with your accounting software or spreadsheet. This will help you identify any discrepancies or errors and rectify them before tax time. Or better yet, choose a software application that uses live bank feeds to match all of your income and expenses throughout the year.

Final Thoughts

Organising your financial records and receipts for tax time in Australia is essential to avoid any legal complications. Understanding the record-keeping requirements, setting up a filing system, using digital tools, keeping track of expenses, organising receipts, and reconciling accounts are some of the steps you can take to streamline the process. With these tips, you can ensure accurate and efficient record keeping, reducing your stress levels during tax time. Why not start cultivating good habits by starting TaxTank free for 14 days.