Are you ready to play the tax game and come out on top? The ATO has its eyes set on a few key areas this financial year, but with a little savvy, you can navigate the scrutiny and maximise your tax return. Here’s how to stay one step ahead of the ATO and ensure you’re not overpaying a cent.

1. Nail Work-Related Expenses

The ATO is laser-focused on work-related expenses, especially those related to working from home. They’re keeping an eagle eye on claims to ensure they’re legitimate and accurately documented. To avoid a dreaded “please explain” call from the tax office, keep detailed records. Whether you’re using the actual cost or the fixed rate method, make sure you have all receipts and a log of your working hours from home.

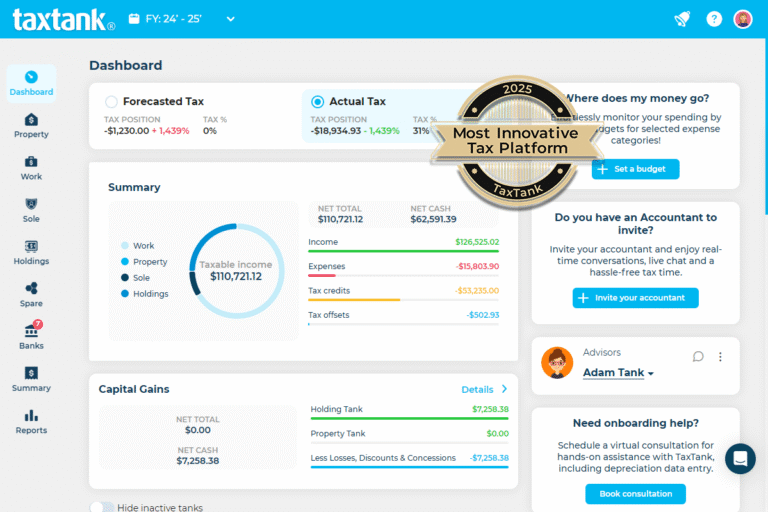

Key Features of TaxTank:

- Live Bank Feeds: Create rules to auto allocate and track your work-related expenses, including vehicle claims and depreciation.

- Time Log: Helps you keep an accurate log of your working hours from home.

- Receipt Storage: Secure digital storage for all your receipts and documentation.

2. Get Real with Rental Property Claims

Rental property deductions are another hot spot. The ATO has found that 9 out of 10 rental property owners are making mistakes, often inflating claims to offset increased rental income. Remember, general repairs like replacing a broken window can be claimed immediately, but major improvements like a new kitchen can only be deducted over time. Keep meticulous records and categorise expenses correctly to avoid falling into this common trap.

Apportionment of Loans: When it comes to rental properties, one of the key areas the ATO scrutinises is the correct apportionment of loan interest. If you’ve refinanced your property or taken out additional loans, ensure that only the portion related to income production is claimed.

Key Features of TaxTank:

- Loan Apportionment Tools: Set the claim percentage per property, and even personal, to accurately calculate and apportion loan interest for rental properties.

- Accurate Income and Expenses: Tracks all income and expenses related to your rental properties from live banks feeds, including depreciation.

- Capital vs. Repair Deductions: Assists in categorising expenses correctly to maximise deductions, plus additional tools for DIY projects.

3. Include All Your Income

It might seem obvious, but failing to declare all income on your tax return is a big no-no. The ATO is on the lookout for undeclared income from sources such as bank interest, dividends, and payments from other agencies. Ensure you wait until all your income is pre-filled in your tax return before lodging. This way, you’ll avoid mistakes and reduce the risk of your return being flagged for review.

Key Features of TaxTank:

- Live Bank Feeds: Open banking complaint to enable live feeds for most banks and financial institutes to track income in real time.

- Mapped to the Tax Return: Categories to allocate incomes and tax withholding across all reportable income types.

4. Perfect Your Record Keeping

Good record-keeping is your best defense against the ATO’s scrutiny. Whether it’s receipts for work-related expenses, proof of rental income and deductions, or documentation of any other claims, having everything in order will help you substantiate your claims and avoid penalties on your tax return.

Key Features of TaxTank:

- Digital Receipt Storage: Securely stores all your receipts and financial documents in one place.

- Comprehensive Reporting: Generates detailed reports and worksheets to support your claims.

- Audit Defence: Stores and collates capital expenses over time to ensure your capital gains tax (CGT) calculations are accurate in future years.

5. Master Capital Gains Tax (CGT) for Property and Crypto

Speaking of capital gains tax (CGT), this is another area where the ATO is focusing its attention. Whether you’re selling property or dealing in cryptocurrency, accurate reporting is essential. The ATO is particularly interested in ensuring that all capital gains from crypto transactions are declared and that any applicable CGT discounts or exemptions are correctly applied.

Key Features of TaxTank:

- CGT Calculator: Accurately calculates capital gains for property, shares and cryptocurrency year round, ensuring the optimal tax position.

- Asset Tracker: Helps you track purchase and sale dates, as well as any associated costs, to ensure accurate CGT reporting.

- Live Market Position: Reports on the closing market value for shares and other asset classes to monitor portfolio performances.

6. Borrowing Expenses

Borrowing expenses, such as loan establishment fees, stamp duty on mortgages, and title search fees, are another area of focus. These expenses must be apportioned over the life of the loan or five years, whichever is shorter. Ensure you’re accurately apportioning these expenses to avoid any issues with the ATO.

Key Features of TaxTank:

- Borrowing Expense Calculator: Add in your borrowing expenses and we’ll automatically calculate them over 5 years to ensure an accurate claim.

- Auto Loan Payout: If you refinance a loan, any residual borrowing expense claim will be automatically written off in the relevant financial year ensuring nothing is ever missed.

Bonus Tip 💡: Go Digital with TaxTank

Looking for a way to streamline your tax management and get ahead of the game when it comes to doing your tax return? Subscribe to TaxTank for a year. Not only will you benefit from cutting-edge digital tools to manage your taxes, but the subscription fee is fully tax-deductible so it’s a win-win!

By following these tips and keeping abreast of the ATO’s focus areas, you can navigate the tax season with confidence and potentially save a significant amount on your tax return. Happy filing!