Tax season can be a stressful time for many Australians, especially when it comes to keeping track of receipts, expenses, and income. Fortunately, there are apps available that make this process easier. Two of the most prominent tax management tools in Australia are the ATO app and TaxTank. In this comprehensive guide, we’ll compare these two apps to help you decide which one is best suited for your needs.

ATO App: The Government’s Solution for Tax Management

The ATO app is a free tool provided by the Australian Taxation Office (ATO) to help individuals and sole traders manage their tax records. A key feature of the ATO app is the myDeductions tool, which allows users to store and manage records of their expenses and income.

Key Features of the ATO App

The myDeductions tool within the ATO app offers a range of features designed to simplify tax record-keeping:

- Expense Tracking: The myDeductions tool enables you to keep records of your work-related expenses, such as travel, work-from-home costs, and other general expenses, including the cost of managing your tax affairs or making charitable donations.

- Income Recording: Sole traders can use the app to record their business income and expenses, making it easier to compile these records at tax time.

- Car Expense Logbook: The app allows users to maintain a logbook for car expenses, which is crucial for claiming deductions related to business or work-related car travel.

- Photo Capture: The app lets you take photos of receipts and invoices, ensuring that all your records are stored in one place.

Limitations of the ATO App

While the ATO app is a useful tool, it does have some limitations:

- Local Data Storage: One major drawback is that all data is stored locally on your device. This means that if you lose your phone or it gets damaged, you risk losing all your records.

- Device Restrictions: You can only record information on a single device throughout the year. If you switch devices, you won’t be able to consolidate records, which can be a significant inconvenience.

- No Accountant or Advisor Collaboration: The ATO app doesn’t allow you to invite your accountant or advisor to view your data, meaning all communication and data sharing must be done manually.

TaxTank: A Superior Alternative for Comprehensive Tax Management

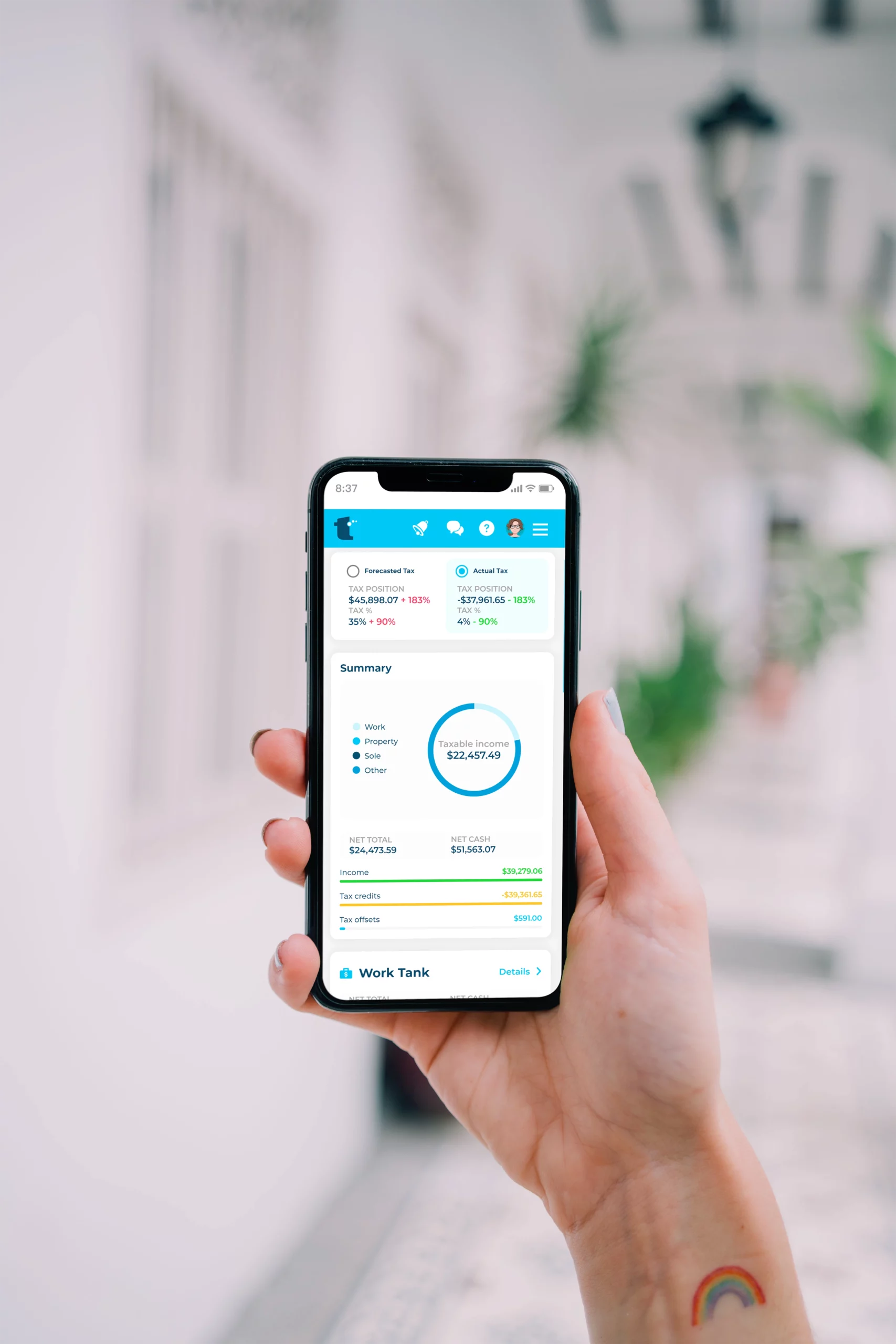

TaxTank is a cloud-based tax management platform designed to cater to the needs of individual taxpayers, sole traders, and investors in Australia. Unlike the ATO app, TaxTank offers a robust set of features that extend beyond basic record-keeping, making it a more powerful tool for managing your tax and finances throughout the year.

Why TaxTank Outshines the ATO App

Cloud-Based Data Storage: One of the standout features of TaxTank is its cloud-based storage. Unlike the ATO app, which stores data locally, TaxTank ensures that your records are securely stored in the cloud. This means you can access your data from any device, and you never have to worry about losing your information if your device is lost or damaged.

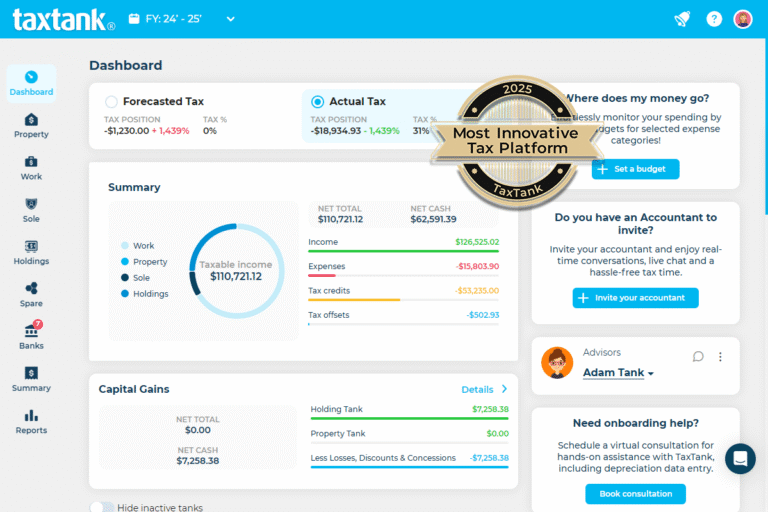

Auto-Calculation of Tax: TaxTank offers live tax calculations throughout the year. This feature is particularly useful for avoiding any surprises at tax time, as you can see how much tax you owe in real-time, making budgeting and planning much easier.

Depreciation and Capital Gains Tax Calculations: For those with investment properties or other assets, TaxTank automatically calculates depreciation and Capital Gains Tax (CGT). This feature is invaluable for ensuring that all deductions are accurately recorded and that you’re not overpaying your taxes.

Income and Expense Totals: TaxTank aggregates all your income and expenses, giving you a clear picture of your financial situation at any point during the year. This feature is especially useful for sole traders and investors who need to keep track of multiple income streams and expenses.

Accountant and Advisor Collaboration: TaxTank allows you to invite your accountant or advisor directly to the platform. This collaborative feature streamlines the process of preparing your tax return, as your accountant can access all your records in real-time, reducing the need for back-and-forth communication. Plus your advisor can see your live financial position to collaborate and make informed financial decisions.

TaxTank’s Key Features

- Real-Time Tax Tracking: TaxTank’s auto-calculation of tax liabilities means you can track how much tax you owe in real-time, helping you stay on top of your obligations.

- Comprehensive Financial Management: The platform goes beyond tax management, offering tools to manage your personal finances, including budgeting, expense and investment tracking.

- Seamless Data Sharing: TaxTank’s cloud-based system ensures that your data is always accessible and can be easily shared with your accountant or advisor.

- No Device Restrictions: Unlike the ATO app, TaxTank’s cloud-based nature means you can access your data from multiple devices without any restrictions.

Why TaxTank is the Better Choice for Australian Taxpayers

When comparing the ATO app to TaxTank, it’s clear that TaxTank offers a more comprehensive and user-friendly experience. While the ATO app’s myDeductions tool is a good starting point for those who need a basic record-keeping solution, it falls short in several key areas. The limitations of local data storage, the inability to consolidate records across devices, and the lack of collaboration features make the ATO app less ideal for those with more complex tax situations.

On the other hand, TaxTank provides a robust, cloud-based platform that not only simplifies tax management but also enhances your overall financial planning. With features like real-time tax calculations, automatic depreciation and CGT calculations, and the ability to collaborate with your accountant and advisors, TaxTank stands out as the superior choice for managing your taxes and finances in Australia.

Final Thoughts

Whether you’re an individual taxpayer, a sole trader, or an investor, choosing the right tax management tool can make a significant difference in how smoothly your tax season goes. While the ATO app is a free and convenient option, TaxTank’s advanced features and cloud-based system make it the better choice for those who want to stay on top of their finances year-round. By opting for TaxTank, you can ensure that your tax records are secure, accessible, and accurate, helping you avoid any last-minute tax time headaches. Ready to take control of your tax and finances? Start your free trial with TaxTank today and experience the difference for yourself!