Managing tax as a sole trader in Australia can be overwhelming. From tracking income and expenses to preparing for tax time, staying on top of your obligations is crucial for business success. This is where TaxTank shines. Built specifically for Australian sole traders, TaxTank is the ultimate Accounting Software for Sole Traders, simplifying accounting, ensuring compliance, and saving valuable time so you can focus on growing your business.

In this article, we’ll explore why TaxTank is considered the best Accounting Software for Sole Traders in Australia, detailing its features, benefits, and clear advantages over spreadsheets and old-school accounting software.

Why Dedicated Accounting Software for Sole Traders is Needed

As a sole trader, your financial responsibilities sit entirely on your shoulders. Unlike companies, there’s no legal separation between personal and business finances, making accurate record-keeping essential. Common challenges include:

- Tracking income and expenses across multiple channels

- Managing GST obligations if registered

- Calculating tax liabilities accurately, especially with multiple income sources

- Keeping records for deductions such as home office expenses, vehicle usage, and professional subscriptions

- Preparing BAS (Business Activity Statements) efficiently

Traditional spreadsheets, manual bookkeeping, and outdated accounting software can quickly become cumbersome, error-prone, and time-consuming. They don’t offer real-time insights, live tax tracking, or automation, which means you’re always playing catch-up instead of staying ahead.

TaxTank addresses these challenges with smart, automated features built specifically as Accounting Software for Sole Traders.

Comprehensive Features Built for Sole Traders

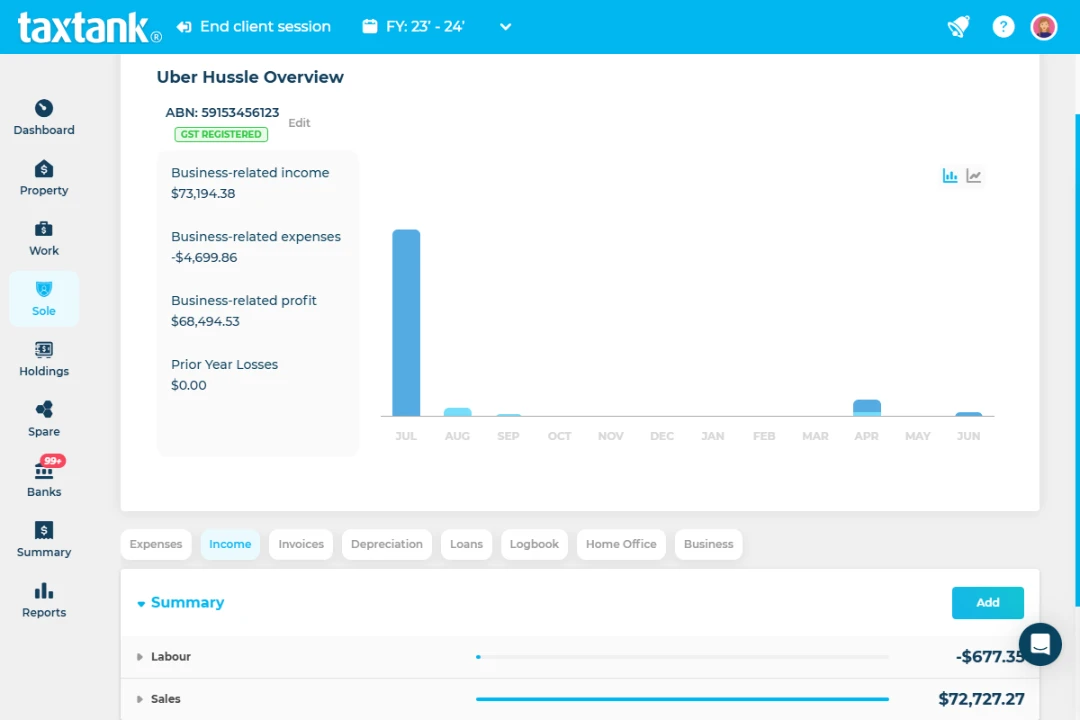

Automated Income and Expense Tracking

TaxTank connects directly to your bank accounts through secure Open Banking integrations, tracking every transaction in real time. Payments via EFT, PayPal, or credit card are automatically categorised, saving hours of manual entry. No more sifting through receipts or reconciling statements – TaxTank, as leading Accounting Software for Sole Traders, handles the heavy lifting for you.

GST and BAS Made Simple

If registered for GST, TaxTank automatically calculates your obligations and prepares BAS reports in compliance with ATO standards. You can lodge yourself, or through your accountant, plus you can review past reports with ease, reducing stress and audit risk. This is why TaxTank stands out among Accounting Software for Sole Traders.

Live Tax Calculation

TaxTank provides a real-time view of your tax position all year round, factoring in multiple income streams like business income, salary, rental income, and investments. This transparency ensures you never face unexpected liabilities and can plan cash flow efficiently.

Smarter Deductions and Home Office Tracking

From home offices to vehicles, TaxTank ensures you never miss a deduction. Track hours worked from home, log kilometres, and record running costs. The platform applies ATO-compliant methods, making it the most reliable Accounting Software for Sole Traders to maximise deductions.

Asset Depreciation and Instant Write-Offs

Manage business assets with automatic depreciation, instant write-offs, and small business pool management. Claiming eligible deductions has never been easier.

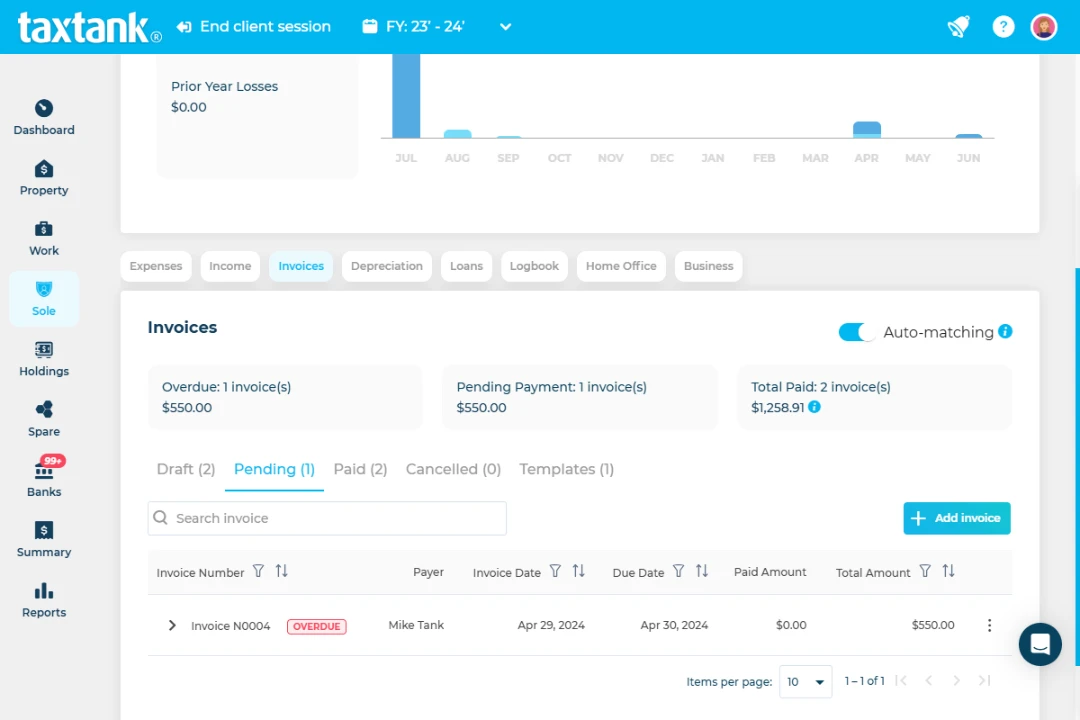

Invoice and Payment Management

Create and send professional invoices in seconds, complete with branding and payment terms. TaxTank matches payments automatically via live bank feeds, so you know who’s paid and what’s outstanding without extra admin. This feature is a must-have in modern Accounting Software for Sole Traders.

Real-Time Financial Insights

TaxTank’s dashboards provide a live view of income, expenses, and profits. Identify spending trends, monitor growth, and make informed decisions at a glance – even if you’re not an accounting expert.

Sole Tank – Your All-in-One Business Hub

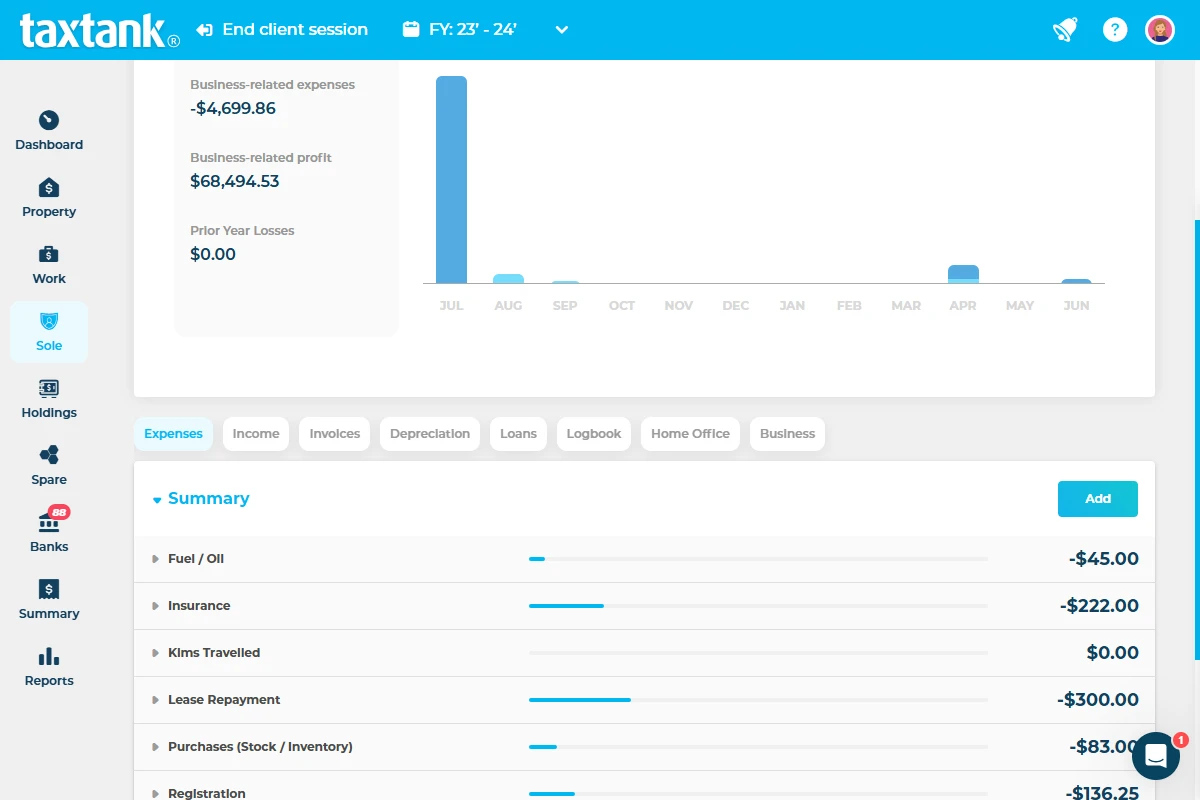

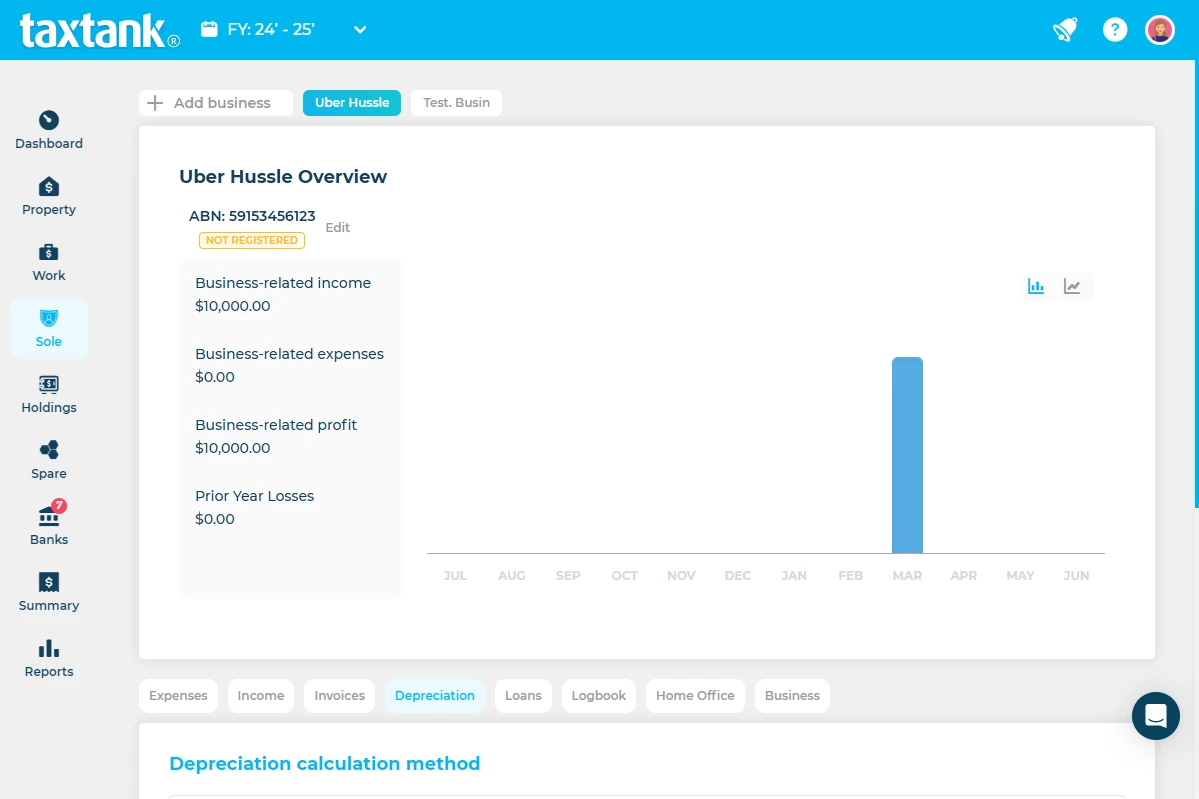

TaxTank’s Sole Tank module is designed for sole traders running multiple businesses or complex operations. Key features include:

- Track live tax position year-round to avoid surprises

- Manage multiple sole trader businesses under a single subscription

- Allocate business expenses automatically from bank feeds

- Track PSI income, labour hire, and other assessable income

- Automate vehicle loans and logbook tracking

- Manage home office deductions and business assets with ATO-compliant tools

- Access live BAS reporting to manage GST and ATO lodgements

- Store all business documents securely in the Spare Tank

Sole Tank gives sole traders a complete operational overview, saving time while ensuring compliance.

General Tax Tools for Complete Financial Clarity

TaxTank goes beyond business accounting with General Tax Tools that give a full picture of your finances:

- Connect bank accounts with live feeds for real-time visibility

- Monitor HECS/HELP balances and repayments as part of your tax position

- Automate recurring transactions with custom rules

- Access full tax reports anytime

These tools make it easy to see how your business, salary, investments, and other income interact, giving you a holistic view of your financial position. TaxTank is truly Accounting Software for Sole Traders who need clarity across all income streams.

Tax Preparation & Support

TaxTank supports sole traders all year round, making tax time stress-free:

- Interactive tax reports for easy insights

- Invite your accountant or advisor for collaboration anytime

- Clean, complete records for faster return preparation

- Use the myTax or BAS report to self-lodge confidently

By keeping everything organised and in one place, TaxTank eliminates the common frustrations associated with old-school tax preparation. It’s a complete Accounting Software for Sole Traders solution.

Why TaxTank Outperforms Spreadsheets and Old Accounting Software

Spreadsheets and legacy accounting tools may work in theory, but they don’t adapt to real-time business needs. TaxTank outperforms these systems because:

- Designed for Sole Traders: Every feature addresses sole trader requirements, not generic business use

- Automation at Its Core: Live bank feeds, smart rules, and automated categorisation save hours every week

- Live Tax Compliance: Always ATO-compliant, reducing risk of errors or penalties

- Affordably Priced: Get enterprise-level features without the cost

- Australian-Focused Support: Speak with experts who understand small business realities

With TaxTank, sole traders can finally ditch spreadsheets and stop wasting time on manual bookkeeping. It is the go-to Accounting Software for Sole Traders in Australia.

Time-Saving Automation

Automation lets you focus on running your business, not chasing paperwork:

- Smart Transaction Categorisation: Income and expenses allocated automatically

- Live Tax Calculations: Updated with every transaction

- Secure Receipt Storage: All receipts and documents in one place

Tasks that once took hours are now completed in minutes, keeping your books live, accurate, and audit-ready with Accounting Software for Sole Traders.

See the Whole Picture of Your Finances

What truly sets TaxTank apart is its ability to integrate your entire financial world:

- Business income and expenses

- Salary from employment

- Rental income

- Shares and investment portfolios

- Cryptocurrency holdings

- Any other income

With TaxTank, you can:

- View your complete tax position across all income streams

- Track performance of property, shares, and crypto alongside your business

- See how different income sources impact your overall tax

- Make informed decisions with total visibility

TaxTank transforms accounting from transaction tracking into a strategic tool for Accounting Software for Sole Traders.

Security and Compliance You Can Trust

TaxTank uses bank-grade encryption and secure Australian servers. All data is encrypted, backed up, and handled according to Australian privacy standards. ATO-compliant reporting ensures your tax obligations are met accurately and on time, making it reliable Accounting Software for Sole Traders.

Simple Pricing That Works for Every Sole Trader

TaxTank offers one affordable plan at $9 per month, giving sole traders everything they need:

- Bank feed integration

- Live tax calculations

- BAS and GST support

- Invoice and expense tracking

- Depreciation, instant asset write-offs, and small business pool management

- Home office expense diary and vehicle logbooks

- Real-time dashboards

Getting Started with TaxTank

Starting is simple:

- Sign up online

- Connect your bank accounts securely

- Begin tracking and automating your finances immediately

Within minutes, you’ll have a live view of income, expenses, and tax position, all in a single, intuitive dashboard. Accounting Software for Sole Traders has never been this easy.

Conclusion: TaxTank is the Best Accounting Software for Sole Traders in Australia

For Australian sole traders, TaxTank is more than just accounting software – it’s your financial control centre. With real-time tracking, automation, and complete visibility across all income streams, TaxTank empowers you to stay compliant, plan ahead, and make smarter financial decisions every day.

Forget spreadsheets and outdated software that slow you down. TaxTank is modern, intuitive, and designed for the way sole traders actually work.

Take control of your business and your entire financial life – switch to TaxTank today and experience the leading Accounting Software for Sole Traders in Australia.

Frequently asked questions

What is TaxTank and how does it help sole traders?

TaxTank is Australian built accounting software for sole traders. It automates income tracking, GST, BAS reporting, invoices, and tax calculations, giving you a complete view of your finances all year round.

Can TaxTank track my business and personal finances together?

Yes. TaxTank integrates your business income, salary, rental income, shares, and crypto into a single live tax position, helping you understand your full financial picture.

Is TaxTank compliant with the Australian Tax Office (ATO)?

Absolutely. TaxTank generates ATO-compliant BAS reports, tracks live tax calculations, and ensures deductions are calculated correctly, giving you peace of mind during tax season.

Can I connect my bank accounts to TaxTank?

Yes. TaxTank uses secure Open Banking integrations to automatically import transactions from Australian banks, saving time on manual data entry and keeping your finances up to date in real time.

Can I manage multiple sole trader businesses in TaxTank?

Yes. The Sole Tank module allows you to track multiple businesses under a single subscription, with live tax reporting, expense allocation, and document storage for each business.

Does TaxTank help me claim deductions for home office and vehicles?

Yes. TaxTank includes a Home Office Diary and vehicle logbook functionality, automatically calculating home office deductions and asset depreciation in line with ATO requirements.

Can I send invoices and track payments with TaxTank?

Yes. You can create professional invoices, customise branding, set payment terms, and automatically match payments received through your live bank feeds.

Is TaxTank secure for my financial data?

Yes. TaxTank uses bank-grade encryption and secure Australian servers. All data is encrypted, backed up, and handled according to Australian privacy standards, keeping your information safe and audit-ready.

How much does TaxTank cost for sole traders?

TaxTank is available at a simple $9 per month, giving sole traders access to live tax tracking, BAS support, invoice management, and real-time dashboards. Optional add-ons include asset tracking, property monitoring, and share/crypto management.

Can I invite my accountant to use TaxTank?

Yes. You can invite your accountant or advisor at any time to view live reports, collaborate on tax preparation, and lodge returns efficiently.