Cryptocurrency is exciting but let’s be honest, taxes are not so much!

Whether you’re a casual investor or a crypto trading enthusiast, calculating taxes on your digital assets can feel like navigating a maze blindfolded. That’s where crypto tax calculators come in. These tools are like your personal tax superheroes, swooping in to save you from spreadsheets, headaches, and potential audits. In this guide, we’ll explore the best tools for crypto tax calculations and CGT calculations, including TaxTank, and show you how to make tax season a breeze.

Why Accurate Crypto Tax Calculations Matter

Let’s start with the basics. Why should you care about crypto tax calculations? Well, the Australian Taxation Office (ATO) takes crypto tax reporting seriously. If you’re trading, staking, or even just swapping crypto, you need to report your gains and losses accurately. Get it wrong, and you could face penalties, audits, or worse, unnecessary accountant fees!

This is where crypto tax calculators shine. They automate the tedious process of tracking transactions, calculating capital gains, and generating reports. No more manual spreadsheets or second-guessing your math. These tools ensure you stay compliant with the ATO while saving you time and stress.

Key Features to Look for in a Crypto Tax Calculator

Not all crypto tax tools are created equal. Here’s what to look for when choosing the right one for your needs:

- Automation: The best tools import your trades in bulk or from exchanges and wallets.

- Real-Time Reporting: Instant updates on your tax liabilities are a game-changer.

- User-Friendly Interface: Because no one wants to wrestle with clunky software.

- Affordability: Crypto tax calculations shouldn’t cost you a fortune.

- Flexibility: Ideally a tax calculator that also handles shares and other assets in the same dashboard.

Best Crypto Tax Calculation and CGT Tools

Now, let’s dive into the top crypto tax tools, including TaxTank, to help you conquer crypto taxes.

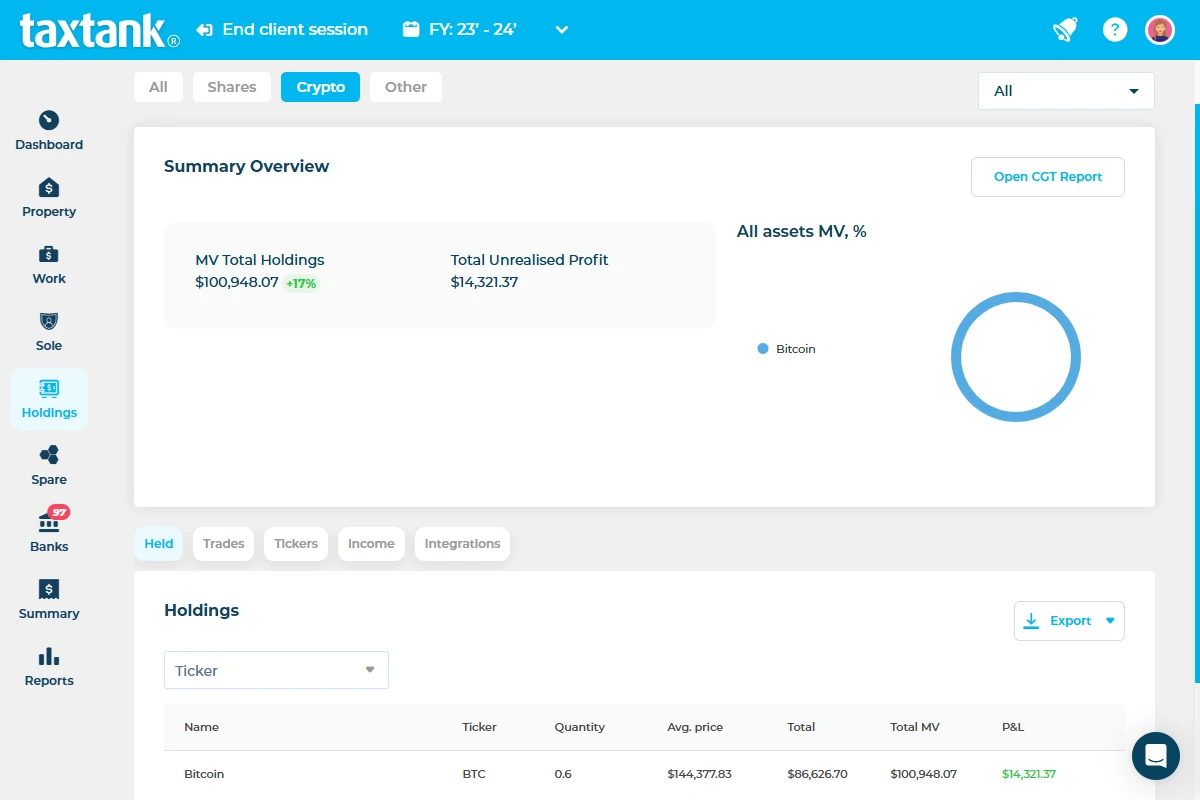

1. TaxTank: The Aussie Crypto Tax Calculation Hero

If you’re looking for a tool that’s easy to use and tailored for Australian crypto investors, TaxTank is your go-to. Here’s why:

Pros:

- Designed specifically for Australian tax laws.

- Affordable pricing, making it perfect for individual investors.

- Supports bulk imports of trades from any platform..

- User-friendly interface, no accounting degree required!

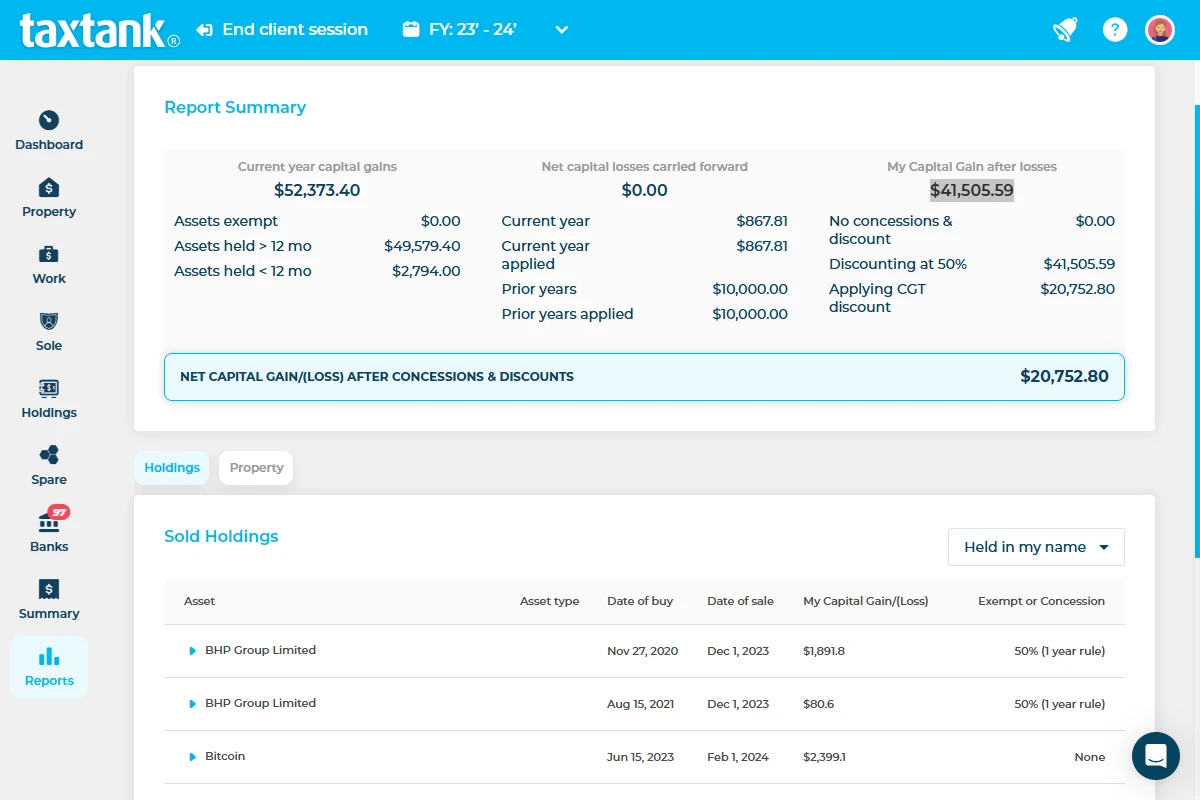

- Calculates CGT for cryptos, shares, property, and other assets on the fly, ensuring any losses are applied favourably for tax 😉

- ATO Compliant tax reports are available 24/7, so no tax time surprises.

- Stackable with other low cost subscriptions to manage all your incomes and investments in one place.

Cons:

- Limited advanced features for complex portfolios.

- Limited integrations (but they’re coming!).

Pricing:

TaxTank offers competitive pricing plans, starting at just $6 per month. It’s one of the most affordable solutions, offering unlimited transactions and ATO-compliant tax reports year round.

Ideal For:

Individual investors looking for a simple, cost-effective solution to manage tax and monitor investment in one powerful solution.

🚀 Ready to simplify your crypto taxes? Check out TaxTank and get started today!

2. Crypto Tax Calculator: The Budget-Friendly Option

Crypto Tax Calculator is another excellent choice, especially for those looking for affordability without compromising on features.

Pros:

- Simple and intuitive interface.

- Supports multiple exchanges and wallets.

- Generates ATO-compliant tax reports

- Affordable pricing, making it accessible for beginners.

Cons:

- Crypto-only focus: If you’ve traded other asset classes, such as stocks or property, you won’t be able to consolidate your tax position or offset losses across different investments.

- Limited tax planning capabilities: Designed primarily as a once-a-year tax tool, it lacks proactive features to help you plan and optimize tax obligations throughout the year.

Pricing:

Crypto Tax Calculator operates on a yearly subscription model starting from $49 AUD, payable upfront for the entire year. Additionally, the 100 transaction count limit applies across all financial years, which could be a costly limitation over time traders.

Ideal For:

Those with simple crypto portfolios and a low-to-moderate transaction count looking for a straightforward way to generate tax reports for crypto only.

3. Koinly: The All-Rounder

Koinly is another popular choice, known for its versatility and robust features.

Pros:

- Supports over 700 exchanges and wallets.

- Handles complex transactions like DeFi and staking.

- Generates ATO-compliant tax reports.

Cons:

- Customer Support Limitations: Some users have reported challenges in receiving timely assistance, indicating potential limitations in customer support responsiveness.

- Single-Asset Limitation: If you have investments beyond crypto, such as shares or real estate, you won’t be able to integrate and balance your overall tax position or offset losses across different asset classes.

- Reactive Tax Reporting: Primarily built for end-of-year tax calculations, this tool offers little in the way of proactive tax planning, making it harder to optimize your tax strategy throughout the year.

Pricing:

- Koinly operates on an annual subscription model, starting at $49 USD per year for 100 transactions. Plans with tax reporting begin at $69 USD per year, scaling up based on transaction volume. Costs can rise significantly for high-volume traders or those needing multi-year reports.

Ideal For:

Investors with diverse portfolios and complex transactions.

Tips for Choosing the Right Crypto Tax Calculation Tool

Here’s how to pick the perfect tool for your needs:

- Assess Your Needs: Are you a casual investor or a crypto trading enthusiast?

- Do you need advanced features or just the basics?

- Compare Pricing: Look for tools that fit your trade volume and budget now and in future years.

- ATO Compliant Reports: Make sure that you choose a tool that adheres to Australian tax law and supplies compliant CGT reports.

- Read Reviews: See what other users are saying.

- Do you have other investments or incomes that you want to centrally manage for tax and planning?

Future Trends in Crypto Tax Calculation Tools

The future of crypto tax tools is bright. Expect to see:

- AI-Powered Calculations: Smarter tools that predict tax liabilities and optimise your portfolio.

- Blockchain Analytics: Better tracking of transactions across multiple blockchains.

- Regulatory Updates: Tools that adapt to changing crypto tax laws in real time.

Conclusion

Crypto tax calculations don’t have to be a nightmare. With the right tools, you can automate calculations, ensure compliance, and save time. Whether you’re a casual investor or crypto trading enthusiast, there’s a solution for you. And if you’re in Australia, TaxTank is a fantastic choice to simplify your crypto tax reporting plus a whole lot more!.

🚀 Ready to take the stress out of crypto taxes? Visit TaxTank today and start your free trial!

FAQs

What is a crypto tax calculator?

A crypto tax calculator automates the calculation of taxes on cryptocurrency transactions, making it easier to stay compliant with tax laws.

How does TaxTank compare to other crypto tax tools?

TaxTank is designed specifically for Australian investors, offering unlimited transactions and real-time tax calculations.

Do I need to report every crypto transaction to the ATO?

The ATO requires you to report all taxable events, including trading, staking, and earning interest on crypto assets.