Property investment in Australia can be a lucrative venture, but managing taxes and financial records can be complex and time-consuming. Luckily, the benefits of using a tax software for your property investment portfolio are numerous. This article delves into the advantages of adopting tax software, offering insights, tips, and expert advice to help you make the most out of switching to a digital option.

Managing your investment property taxes becomes significantly more efficient when you incorporate a specialised tax software. Using new technology designed to simplify the complex tax landscape also offers a range of benefits, including:

Enhanced Accuracy and Compliance

Australia’s tax system is one of the most complicated in the world and is subject to frequent updates to tax law and regulations. A tax software is programmed to stay updated with the latest changes, reducing the risk of errors and ensuring your tax returns are accurate and compliant.

Time and Cost Savings

Traditional methods of tax preparation involve manual data entry, hours of calculations and time spent trying to find and save receipts. Tax software can help automate these tasks, saving you valuable time and reducing the need for hiring expensive tax professionals.

Streamlined Record-Keeping

Tax software provides a centralised platform to store and organise all your financial records related to your property investment. This streamlines the process of retrieving information if the ATO comes knocking requesting an audit or when making financial decisions.

Maximising Deductions

One of the key benefits of using tax software for property investment is its ability to identify potential deductions. The software is equipped with auto calculations to ensure you’re claiming every deductible expense, helping you maximise your returns and minimise your tax liability. This would wipe out the

Real-Time Insights

Modern tax software often comes with real-time tracking and reporting features. This allows you to monitor your equity and financial performance, track expenses, and forecast tax obligations, empowering you to make informed investment decisions. You’ll never have to worry about selling the wrong property or making an uninformed decision again.

Easy Collaboration

If you’re working with partners or accountants, tax software facilitates seamless collaboration. Multiple users can access and update the software simultaneously, enhancing communication and coordination.

Minimising Risk of Audits

By ensuring accurate and compliant tax filings, a tax software reduces the likelihood of audits from tax authorities. In case of an audit, having well-organised digital records can make the process smoother and less stressful.

Frequently Asked Questions (FAQs)

Can tax software handle complex tax scenarios?

Absolutely. Tax software like TaxTank is designed to handle a wide range of tax scenarios, from simple to complex. It incorporates algorithms and regulations to ensure accurate calculations even in intricate situations.

Is tax software suitable for beginners?

Yes, tax software comes with user-friendly interfaces and guides to assist beginners. Many options offer step-by-step instructions and tooltips to make the process smooth and understandable.

Can I still consult a tax professional when using software?

Absolutely. While tax software streamlines the process, consulting a tax professional can provide additional insights and assurance, especially for intricate financial situations.

Are updates included in most tax software?

Yes, most tax software providers offer regular updates to keep up with changing tax laws and regulations. These updates are crucial for accurate and compliant tax filings.

How secure is my financial data?

Top-tier tax software employs advanced encryption and security protocols to safeguard your financial data. Make sure to choose a reputable software provider to ensure data protection.

Is tax software a one-time purchase?

It depends on the software provider. Some offer one-time purchases, while the majority operate on a subscription basis. Compare options to find the best fit for your investment strategy.

Final Thoughts

In the world of property investment, optimising your taxes is a vital aspect of maximising returns. The benefits of using a tax software for your property investment portfolio cannot be overstated. From accuracy and time savings to streamlined record-keeping and real-time insights, tax software offers a comprehensive solution to the complexities of property investment taxes. By embracing this new technology, you’ll not only simplify your financial processes but also position yourself for greater success in the competitive property market.

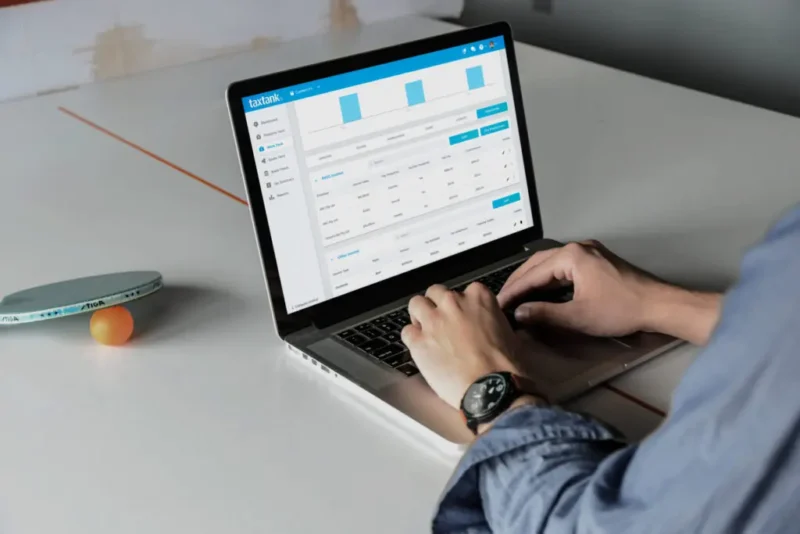

If you’re looking for custom-built software to help you manage your tax and properties in real-time, look no further than TaxTank. TaxTank is a smart cloud based software with live bank feeds and built-in automated tax tools to help you manage your investment portfolio live. Sign up for a free 14-day trial today.