Running a business as a sole trader comes with flexibility and independence, but it also brings tax responsibilities that many get wrong. From inaccurate records to missed deductions, the common mistakes in sole trader tax returns can lead to penalties, audits, or lost savings. To help you stay compliant and maximise your tax benefits, we’ve outlined the top 10 errors and how to avoid them using smart strategies and tools like TaxTank.

1. Failing to Keep Accurate and Complete Records

The Australian Taxation Office (ATO) requires sole traders to maintain financial records for at least five years. Many fail to do so, leading to incorrect claims and penalties.

How to avoid this mistake:

- Use cloud-based software like TaxTank to automate record-keeping and ensure accurate financial tracking.

- Keep digital copies of receipts to prevent loss.

- Maintain separate business and personal accounts or use TaxTank to correctly allocate transactions.

2. Claiming Ineligible or Exaggerated Deductions

Overclaiming or missing out on deductions is one of the most common mistakes in sole trader tax returns. The ATO closely scrutinises unusually high claims.

How to avoid this mistake:

- Understand what’s deductible: Business-related expenses like internet, office supplies, and equipment qualify, but personal expenses do not.

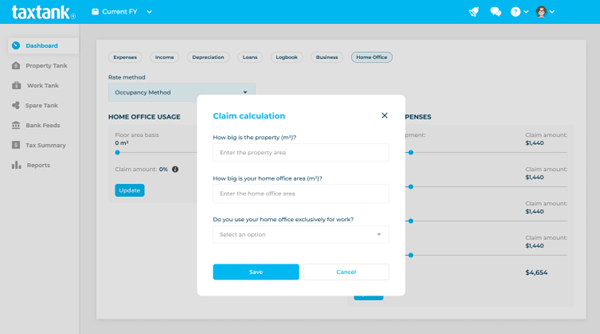

- Use TaxTank’s home office diary to track and justify home office deductions accurately.

- Claim only the business-related portion of mixed-use expenses like car and phone costs.

3. Forgetting to Declare All Income

All income, including cash payments, must be reported. Failing to do so can trigger an ATO audit.

How to avoid this mistake:

- Track all income sources, whether received via cash, bank transfers, or online platforms.

- Use TaxTank’s automatic bank feed integration to ensure every transaction is captured.

- Cross-check invoices and deposits to confirm no income is omitted.

4. Misreporting GST (If Registered)

If your business turnover exceeds $75,000, GST registration is mandatory. Many sole traders either fail to register or report GST incorrectly.

How to avoid this mistake:

- Register for GST as soon as your turnover reaches $75,000.

- Use TaxTank to track GST on invoices and ensure compliance.

- Submit Business Activity Statements (BAS) on time to avoid penalties.

5. Not Paying Superannuation for Yourself

Sole traders aren’t required to pay super, but neglecting contributions can impact retirement savings.

How to avoid this mistake:

- Make voluntary contributions and claim tax deductions where eligible.

- Take advantage of government co-contributions if earning under $58,445 (2023-24).

- Consider setting up a Self-Managed Super Fund (SMSF) for greater control.

6. Incorrectly Reporting Vehicle and Travel Expenses

Car expenses are often misreported, with many sole traders either overclaiming or underclaiming their business use.

How to avoid this mistake:

- Use the correct ATO-approved method:

- Cents per kilometre method: Claim up to 5,000 business kilometres per year at 85 cents per km.

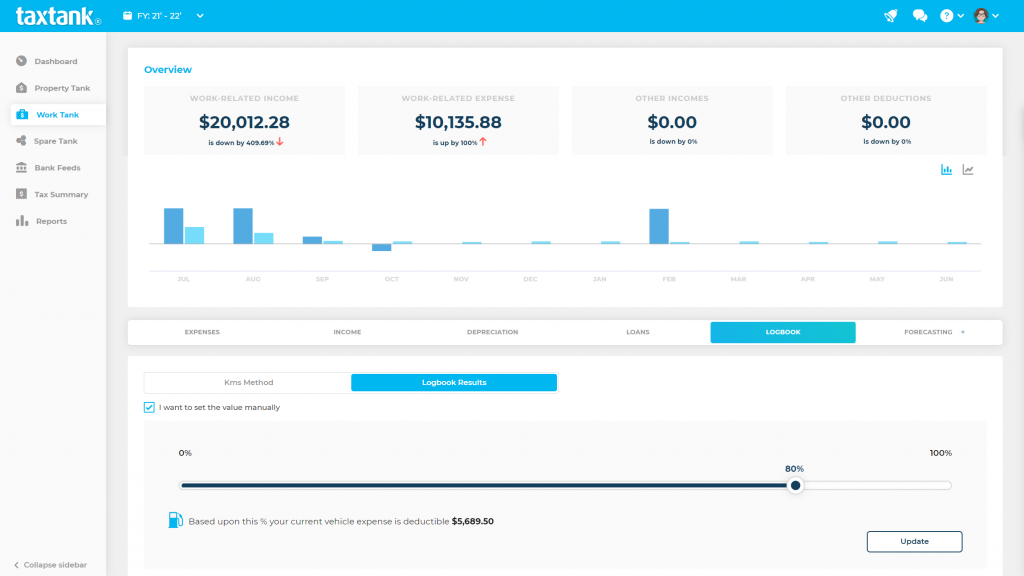

- Logbook method: Maintain a 12-week logbook to claim actual business use percentage.

- TaxTank’s vehicle logbook ensures you claim only what you’re entitled to.

7. Ignoring Tax Deadlines and Failing to Lodge on Time

Late lodgements attract fines and interest charges. Many sole traders procrastinate and struggle to meet tax deadlines.

How to avoid this mistake:

- Mark key dates: Sole traders must lodge tax returns by 31 October unless using a registered tax agent.

- Use TaxTank‘s simple BAS reports to say in top of deadlines.

- Engage a tax agent for deadline extensions if needed.

8. Not Planning for Tax Payments

Since tax isn’t withheld from sole trader income, failing to set aside money can lead to financial stress when tax bills arrive.

How to avoid this mistake:

- Set aside 30-35% of your income for tax, GST, and PAYG instalments.

- Use TaxTank’s live tax position tracking to always know how much you owe.

- Prepay deductible expenses before June 30 to reduce taxable income.

9. Overlooking the Instant Asset Write-Off

The instant asset write-off allows immediate deductions for eligible business purchases, yet many sole traders miss out.

How to avoid this mistake:

- Check the current write-off threshold (in 2024-25, it’s $20,000 per asset).

- Ensure assets are installed and in use by June 30 to qualify.

- Use smart tax planning to time large purchases for maximum deductions.

10. Not Seeking Professional Advice

Managing tax alone can lead to errors, missed deductions, and audits.

How to avoid this mistake:

- Use a registered tax agent to ensure compliance and maximise deductions.

- Regularly review finances to stay on top of obligations.

- Automate compliance using TaxTank, which keeps your tax position up to date.

Final Thoughts

Avoiding these common mistakes in sole trader tax returns will save you money, reduce stress, and keep you compliant with the ATO. With TaxTank, you can track expenses, automate tax calculations, and ensure you never miss a deduction.

Ready to take control of your sole trader tax return? Sign up for TaxTank today and make tax time a breeze!