Managing the financial side of an investment property can be tricky, but getting it right is essential for maximising returns and staying on the ATO’s good side. Whether you’re juggling multiple properties or just starting out, investment property accounting helps you track income, claim deductions, and make informed decisions about your portfolio.

In this guide, we’ll break down everything you need to know. From key tax implications to the best accounting software. Let’s dive in!

What Is Investment Property Accounting?

Investment properties aren’t just about location and capital growth; they’re also about financial management. Without proper accounting, you could be paying too much tax, missing out on deductions, or struggling to keep up with compliance requirements.

Key Principles for Property Investment Accounting

- Accrual vs. Cash Accounting: Most property investors use cash accounting, meaning income is recorded when received, and expenses are recorded when paid.

- Separate Finances: Mixing personal and property expenses is a recipe for confusion. Keep separate accounts for clarity—unless of course, you use an investment property accounting software that lets you track every cent.

- Depreciation Schedules: A good depreciation schedule can mean thousands in tax savings each year.

Tax Implications of Investment Property Accounting

Rental Income and Tax Obligations

The ATO considers rental income taxable. This includes rent payments, bond money retained, and reimbursements for expenses. Keeping detailed records ensures accurate tax reporting.

Deductible Expenses for Property Investors

The good news? You can deduct a range of expenses, including:

✅ Interest on your investment loan

✅ Council rates and body corporate fees

✅ Repairs and maintenance (but not initial improvements)

✅ Property management fees

✅ Depreciation on assets like carpets and appliances

Depreciation and Capital Allowances

Depreciation is often overlooked but can significantly reduce taxable income. Two types apply:

- Capital Works Deduction: Covers structural improvements (e.g., renovations).

- Plant and Equipment Depreciation: Covers removable assets like blinds, carpets, and air conditioners.

Common Plant and Equipment Depreciation for Investment Properties

| Asset | Effective Life | Prime cost rate | Diminishing value |

| Packaged air-conditioning units | 15 years | 6.67% | 13.33% |

| Hot water systems | 12 years | 8.33% | 16.67% |

| Bathroom exhaust fans | 10 years | 10% | 20% |

| Carpet | 8 years | 12.50% | 25% |

| Smoke alarms | 6 years | 16.67% | 33.33% |

| Light fittings | 5 years | 20% | 40% |

Managing Your Investment Property Accounting

Setting Up an Effective Record-Keeping System

Good record-keeping simplifies tax time and protects you in case of an audit. Use accounting software, spreadsheets, or even apps that integrate with your bank.

Budgeting for Maintenance and Unexpected Costs

Unexpected expenses like urgent repairs or vacancies can hurt cash flow. Budgeting for these ensures you’re never caught off guard.

Calculating Return on Investment (ROI) and Cash Flow

Understanding your numbers is key to making profitable decisions. Two key metrics:

- ROI: (Net Profit / Total Investment) × 100

- Cash Flow: Rental Income – Expenses

Best Accounting Software and Tools for Property Investors

Key Features to Look For in Accounting Software

Not all accounting tools are created equal! Look for software that offers:

✔️ Bank feed integration

✔️ Expense tracking and categorisation

✔️ Depreciation calculations

✔️ Tax reporting features

Comparison of Popular Accounting Tools

| Software | Key Features | Pricing |

| TaxTank | Specialised for Australian property investors, tax planning, and automation | Starts at $15/month |

| Xero | General business accounting | Starts at $70/month |

| MYOB | Business-focused, lacks property-specific features | Starts at $30/month |

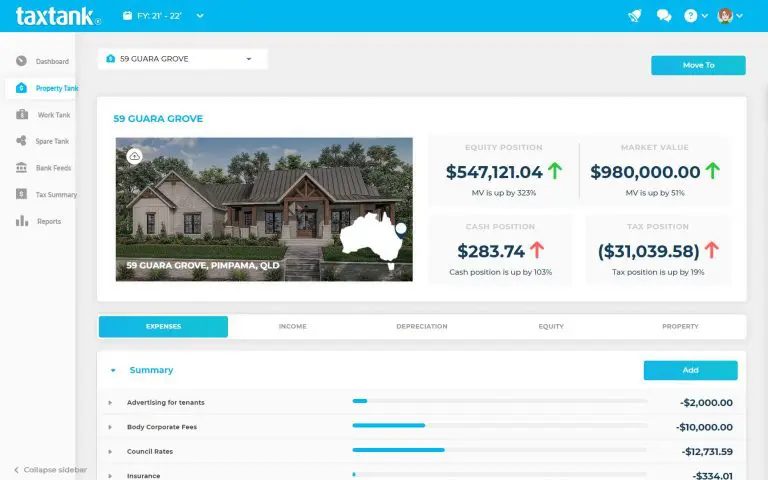

How TaxTank Simplifies Property Accounting

Unlike generic accounting tools, TaxTank is designed specifically for Australian property investors. It tracks rental income, automates expense categorisation, and ensures you claim every deduction available.

📌 Want to make property accounting stress-free? Try TaxTank today!

Real-World Applications of Investment Property Accounting

Case Study: Maximising Tax Benefits with Accurate Accounting

Sarah owns two investment properties but wasn’t tracking expenses properly. After switching to TaxTank, she identified $5,000 in missed deductions and optimised her cash flow, increasing her ROI.

Common Mistakes Investors Make and How to Avoid Them

🚫 Mixing personal and investment finances

🚫 Forgetting to claim depreciation

🚫 Not keeping receipts for deductible expenses

Working with an Accountant vs. DIY Property Accounting

While software makes self-managing your property finances easier, complex portfolios may still benefit from professional advice. A hybrid approach (DIY software + accountant review) is often the best of both worlds.

Frequently Asked Questions

Do I need an accountant for investment property accounting?

Not necessarily! With the right software, many investors manage their finances themselves. However, an accountant can help optimise tax strategies.

Can I claim renovation costs as deductions?

It depends. Repairs are deductible, but renovations are considered capital improvements and must be depreciated over time.

What’s the best way to track investment property expenses?

Use software like TaxTank that integrates with your bank to automate expense tracking and categorisation.

Final Thoughts

Mastering investment property accounting isn’t just about compliance, it’s about maximising returns, reducing tax liabilities, and making smarter financial decisions. Whether you’re using software like TaxTank or working with an accountant, having a solid system in place makes all the difference.

🚀 Ready to simplify your investment property accounting? Sign up for TaxTank today and take the hassle out of tax time!