If you’re still thinking the ATO is just sitting back waiting for your tax return to roll in, it’s time for a reality check.

Right now, they’re in the middle of what you could call a quiet data revolution. And by “quiet,” we mean most Aussies don’t even realise just how much the ATO already knows about them, and how much more it’s planning to know.

According to the ATO’s Second Commissioner, Jeremy Hirschhorn, the goal is to make tax returns disappear entirely for most Australians. You won’t lodge anything, you’ll just confirm what the ATO already thinks is correct.

Sounds simple? Maybe a bit too simple.

Where’s the ATO getting all this data?

Let’s be clear — they’re not just guessing, the ATO is already pulling in data from:

- Banks

- Employers

- Super funds

- Health insurers

- Government agencies

- Platforms like Uber, Airbnb, and even crypto exchanges

- Other institutions

All of this happens in the background, without you doing a thing. Your income, interest, dividends, capital gains, contractor earnings, private health cover — it’s all being matched, cross-checked, and auto-filled.

So while the pre-filled tax return might look like a handy shortcut, it’s actually just the tip of a much bigger, more powerful data iceberg.

But here’s the kicker: it’s not always in your favour

The more the ATO relies on its own data, the harder it is to add anything outside the box.

Say you’ve got a legit work-from-home setup. You’ve got receipts, logs, maybe even a dedicated space carved out in the spare room. But if what you’re claiming doesn’t match their benchmarks? You’ll get flagged with prompts like, “Are you sure you want to claim this much?”

And the burden of proof? That’s all on you.

The ATO assumes its data is right. If you say otherwise, you’d better be ready to back it up — in full, with detailed records.

Third-party data surveillance is now a pillar of tax compliance

Traditionally, tax compliance rested on four pillars: registration, lodgement, payment, and reporting.

Now there’s a fifth: surveillance.

The ATO calls it “data matching,” but let’s call a spade a spade. It’s real-time tracking of your financial life from dozens of sources — all stitched together into one central profile. This isn’t just about catching cheats. It’s about total visibility.

And once that system is running? It’s hard to stay invisible, even when you’ve done nothing wrong.

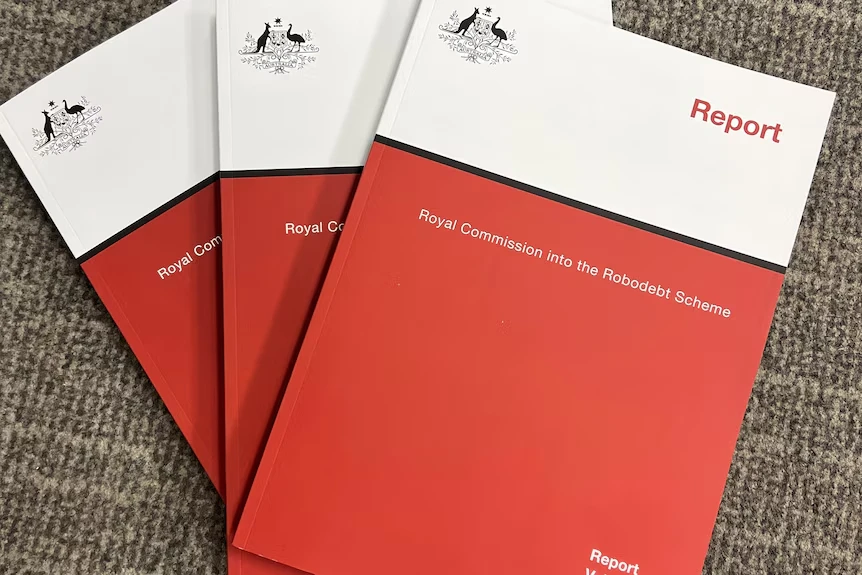

Remember Robodebt? That wasn’t so long ago

It’s impossible to talk about automated data systems in Australia without bringing up Robodebt. That whole debacle showed us what can happen when government departments rely on algorithms and averages instead of human nuance.

The ATO has said it didn’t endorse how its data was used in the Robodebt program. But its systems were used. And that tells us something: once your data is out there, you can’t control how it gets used.

Even the ATO’s own execs have admitted they need to be hyper-vigilant about AI and automated decisions. But the tech’s already moving fast as digital ID becomes more integrated, and AI gets a bigger seat at the table. These aren’t just tax changes. They’re structural shifts in how your financial life is monitored, measured, and judged.

So, what does all this mean for you?

Here’s the short version: the ATO is getting smarter. You need to be smarter too.

If you’re still treating tax like an end-of-year chore or assuming the ATO’s version of your finances is always spot-on, you’re putting yourself at risk.

- You could be missing out on deductions you’re entitled to.

- You could be overpaying tax.

- Or worse, you could get flagged for audit simply for colouring outside their automated lines even when you’ve done everything right. And you’ve only got 28 days to respond.

How to stay ahead of the system

You don’t need to panic, but you do need a plan. Here’s what smart taxpayers are doing in 2025:

Track everything in real time

Don’t wait until tax time to scramble through bank statements and emails. Use tools that track your income and deductions automatically — especially if you’re working from home, investing, or earning from side gigs.

Keep airtight records

If you’re claiming something, make sure you’ve got the documentation to prove it. That means receipts, logbooks, and detailed notes. If the ATO ever asks, you want to be ready.

Stop relying on myTax

It’s built for simplicity, not strategy. If you’re claiming anything beyond the basics, or you’ve got multiple income streams, a smarter tax tool can make a huge difference and save you serious money.

Understand what data the ATO has on you

This is a big one. You can actually access your pre-fill report and data files through the ATO’s online services. Don’t fly blind — know what they’re working with before you lodge.

The system’s changing — don’t get left behind

This isn’t about paranoia. It’s about awareness.

The ATO’s move towards fully automated tax returns isn’t a conspiracy — it’s a convenience. But convenience for them doesn’t always mean control for you. When the system assumes it knows everything, there’s less room for nuance, flexibility, or individual circumstances.

So if you’re a taxpayer who wants to maximise your refund, claim what’s fair, and not get caught in the ATO’s ever-tightening net, now’s the time to pay attention.

Because what the ATO knows is powerful — but what you know could save you.

Enter TaxTank: your weapon against blind compliance

That’s exactly why we spent over five years building TaxTank — to give the power back to you.

In a system that’s becoming more automated, more assumptive, and far less personal, TaxTank gives you control. Real-time tracking. Live bank feeds. Deduction records. Property logs. Business income. Investment data. All in one place. All backed by evidence. All ready if, and when, you need to justify your claims.

It’s like having your own smart tax hub. One that works with the ATO’s legislation, but always with your best interests in mind.

Because when the ATO assumes, you’d better be prepared. With TaxTank, you are.

If you’re ready to take control of your tax return before the ATO takes control of you, start your free trial with TaxTank today.