If you thought the ATO was keeping a close eye on taxpayers before, buckle up, 2025 is shaping up to be the year of peak scrutiny. With advanced data-matching technology, AI-driven audits, and a clear focus on squeezing every dollar out of property investors and sole traders, the ATO crackdown will be going harder than ever. But don’t worry, there are ways to stay ahead of the game and ensure you don’t hand over more than your fair share.

Here’s what’s trending in 2025 and how you can stay compliant and in control.

1. The Rise of Data-Matching and AI Audits

The ATO has significantly ramped up its use of data-matching technology to detect discrepancies in tax returns. This includes cross-referencing bank transactions, share trading platforms, crypto exchanges, and property records with reported income and deductions.

Beyond traditional sources, new data-sharing agreements mean that third-party platforms like PayPal, Stripe, and even Airbnb are providing real-time financial information to the ATO. The goal? To uncover unreported income and ensure compliance, particularly among property investors, sole traders, and gig economy workers.

What this means for you: If your declared income doesn’t align with external financial data, the ATO is likely to flag your return for review.

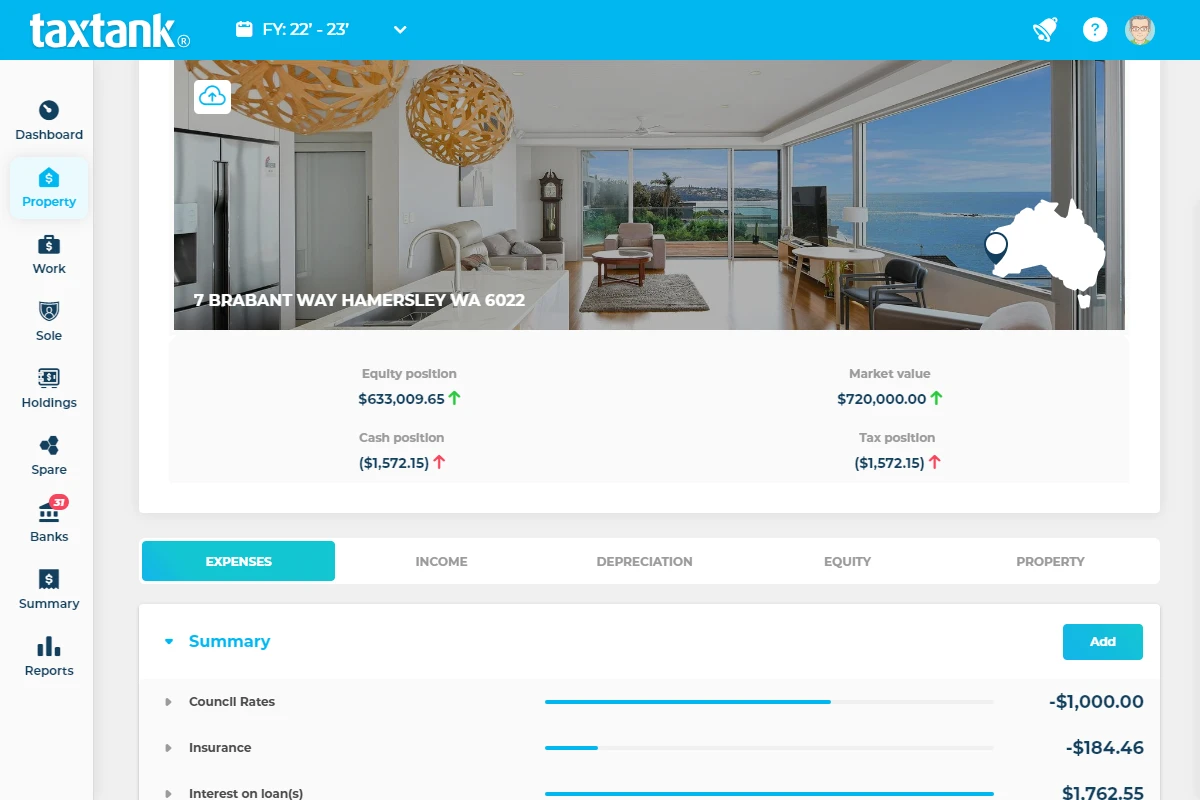

2. Property Investors: ATO is Watching Rental Income

If you own investment properties, expect increased scrutiny. The ATO is focusing on rental income misreporting, excessive deductions, and unclaimed CGT events. They’re cross-referencing data from real estate agents, Airbnb, and rental bond authorities, leaving little room for mistakes.

Pro Tip: Keep detailed records of all rental income and expenses, ensuring they match deposits into your bank account (or even better, are allocated from live bank feeds). If you claim depreciation or repairs, ensure they align with ATO guidelines to avoid red flags.

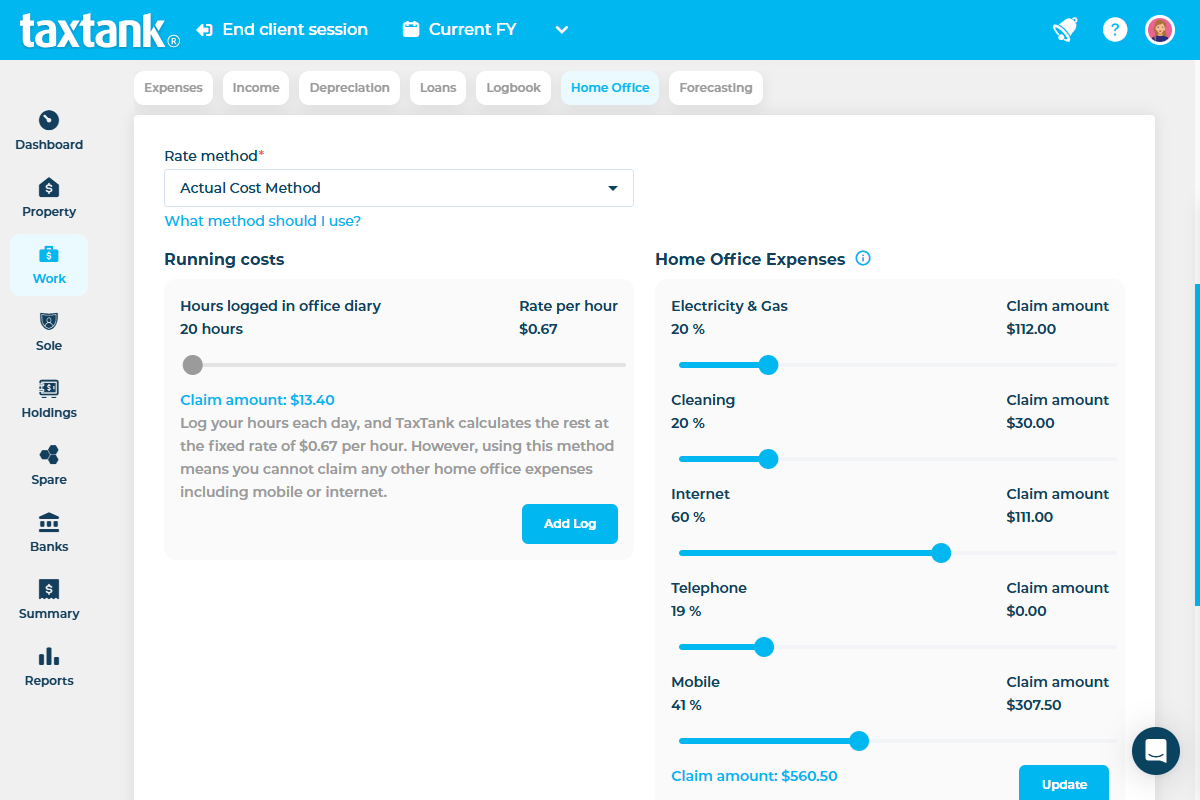

3. Home Office Deductions Under the Microscope

The ATO’s revised fixed-rate method means stricter requirements for home office claims. You now need detailed diaries and logs to back up your deductions.

What you need to do: Maintain records of your work-from-home hours, electricity usage, and office-related expenses to meet the latest compliance requirements.

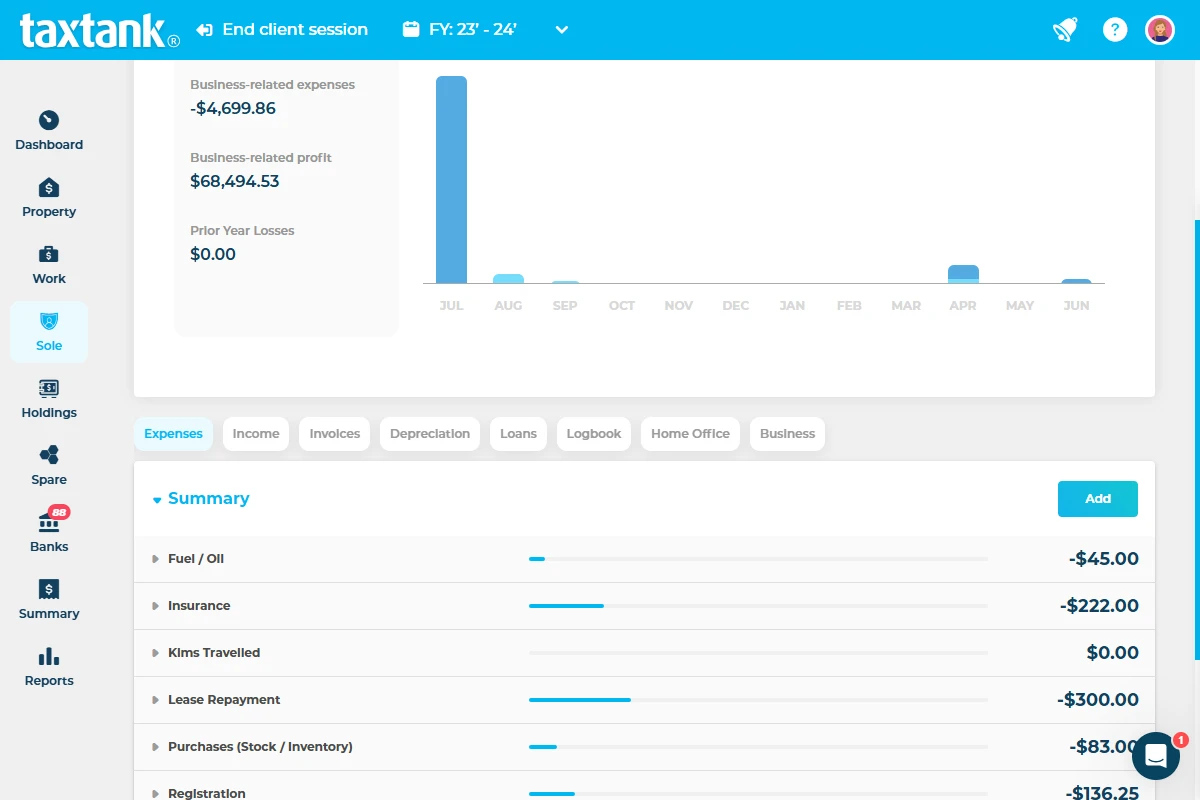

4. Side Hustlers and Sole Traders: Record Everything

The ATO has ramped up monitoring of side hustles and sole traders, particularly those using platforms like Uber, DoorDash, Etsy, and online consulting services. With direct reporting from these platforms, underreporting income is now easily detectable.

What you need to do: Ensure that all revenue streams are documented, including small transactions that may have previously gone unnoticed. Using digital bookkeeping tools to apportion expenses and track income is highly recommended.

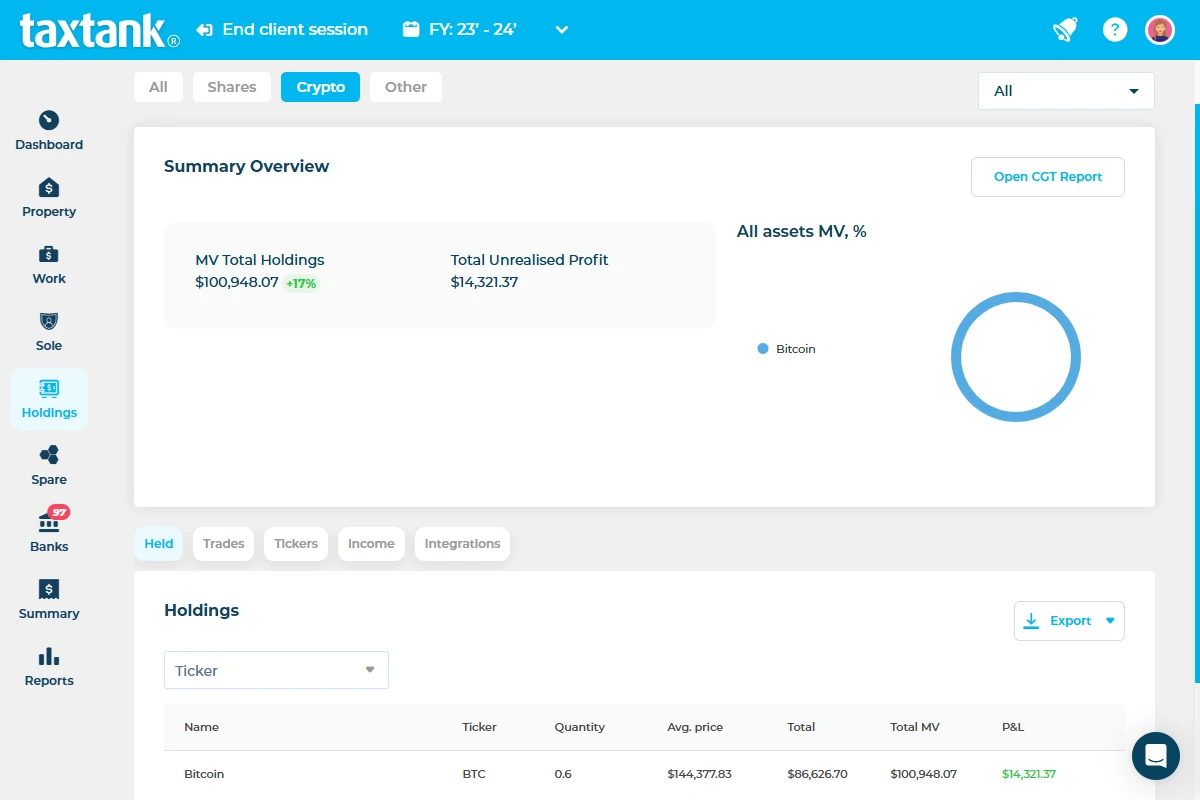

5. Crypto and Share Traders: Full Transparency Required

With mandatory reporting from exchanges, crypto and share traders have nowhere to hide. The ATO is now actively collecting transaction data from local and international trading platforms to ensure that all taxable events, including gains and staking rewards, are properly declared.

Action Item: Keep accurate records of every trade, including transaction costs and capital gains calculations. Failing to report accurately can lead to amended tax assessments and penalties.

How TaxTank Helps

To make crypto and share trading compliance easier, TaxTank has introduced automated buy and sell import features that allow users to seamlessly upload trade histories. Our Sharesight integration ensures that every trade and CGT is accounted for in real time, reducing manual tracking and errors. With these updates, you can ensure your records align perfectly with ATO expectations.

6. The ATO Loves a Paper Trail..

The ATO is cracking down on deductions, and having a bulletproof record of expenses is your best defense.

What you should do: Digitise receipts, maintain organised records, and ensure expenses align with your declared income and work-related activities.

Final Thoughts on the ATO Crackdown

2025 is all about staying proactive, not reactive. The ATO’s increasing reliance on data-matching technology means that real-time tax tracking and compliance are more crucial than ever.

TaxTank is leading the way in tax technology, ensuring that individuals, investors, and sole traders can navigate compliance effortlessly with automation and transparency.

By keeping detailed records and staying informed about compliance changes, you can avoid unnecessary scrutiny and ensure a smoother tax experience.

Don’t wait until it’s too late—take control of your tax compliance now! TaxTank makes it easy to track income, manage deductions, and stay audit-ready with real-time automation.

Sign up today and make tax time stress-free!