The Best Investment Property Tracker

Owning an investment property in Australia can be one of the most rewarding financial decisions you make. With the Australian real estate market often delivering consistent capital growth and rental

Stay updated with the latest tax news, expert tips, and tricks to maximise your returns. Explore our blog for insights on tax strategies, property investment, and more.

Owning an investment property in Australia can be one of the most rewarding financial decisions you make. With the Australian real estate market often delivering consistent capital growth and rental

Navigating the complexities of tax obligations can be challenging for sole traders in Australia. With numerous tax apps on the market, finding the best one that suits your needs is

Every end of financial year, Australians eagerly await a potential tax refund, yet billions of dollars in unclaimed expenses remain on the table. A tax app could be the key

Managing property investments in Australia has evolved significantly, with a plethora of property portfolio apps designed to simplify every aspect of property management. Whether you’re a seasoned investor or just

Investing in property can be a lucrative way to build wealth, but it comes with its own set of tax implications that investors must navigate. Understanding property investment tax is

Discover why Xero may not be the best fit for property investors and how TaxTank’s specialised accounting software for property investors can revolutionise your tax management for just $15 a month.

At TaxTank, we’re thrilled to announce our new partnership with ITP Accounting Professionals (ITP), Australia’s leading income tax refund specialists. This collaboration marks a significant step forward in delivering a

We are thrilled to introduce the TaxTank Property Widget, an innovative custom white-label product developed in collaboration with Hotspotting, one of Australia’s leading property platforms. This cutting-edge tool seamlessly integrates

Navigating your tax return in Australia can be a daunting process, but it doesn’t have to be. Whether you’re a first-time taxpayer or a seasoned lodger, understanding how to calculate

Are you ready to play the tax game and come out on top? The ATO has its eyes set on a few key areas this financial year, but with a

Understanding the powers of the Australian Taxation Office (ATO) in accessing bank account information is crucial for anyone who pays tax in Australia. This article delves into the circumstances under

Capital Gains Tax (CGT) can often be a source of confusion for many taxpayers. With various misconceptions surrounding CGT, it’s important to separate fact from fiction. In this blog, we debunk 10 common myths about Capital Gains Tax and provide clarity on this crucial aspect of taxation.

Explore the impact of Airbnb on property rental in Australia and master the essentials of tax for short-term rentals with TaxTank. Optimise your earnings seamlessly.

Navigating the tax landscape as an Uber driver doesn’t have to be daunting. In this comprehensive guide, we’ll walk you through everything you need to know about managing tax for Uber drivers in Australia.

Are you one of the many people who have missed the tax deadline and are now facing overdue tax returns? Don’t worry, you’re not alone. Many individuals fail to lodge

Investing in real estate has always been a popular strategy for Australians to build wealth. Two key concepts that play a significant role in property investment are Capital Gains Tax

In this article, we will provide you with a comprehensive guide on sole trader expenses in Australia, aimed at helping you manage your finances better, reduce your tax bill, and

In today’s fast-paced world, financial stress is an increasing concern within the workforce, impacting both employees and employers across Australia. A survey by Financial Mindfulness found that financial stress affects

Navigating a divorce can be a challenging experience, especially when it comes to understanding the financial implications. Among these, the impact of Capital Gains Tax (CGT) is often overlooked or misunderstood. In this blog, we uncover five lesser-known aspects of how CGT applies in the context of divorce.

As a savvy property investor, you need more than just great instincts and perfect timing—you need the right tools at your disposal. In this guide, we’ll dive into the best

Managing your financial records and receipts is an important aspect of running a business or personal finances. It is essential to have an organised record-keeping system to avoid any complications or a knock on the door from the ATO. In this article, we will guide you on how to organise your financial records and receipts so you can start the year off on the right foot and be ready well ahead of tax time this June.

In this guide, we will explore the significance of tax return calculators and delve into advanced tools like TaxTank, which automates tax calculations and adds a layer of convenience to your tax and personal finance management.

Explore the significance of financial well-being in employee benefits, its benefits for both individuals and organisations, and strategies for achieving it.

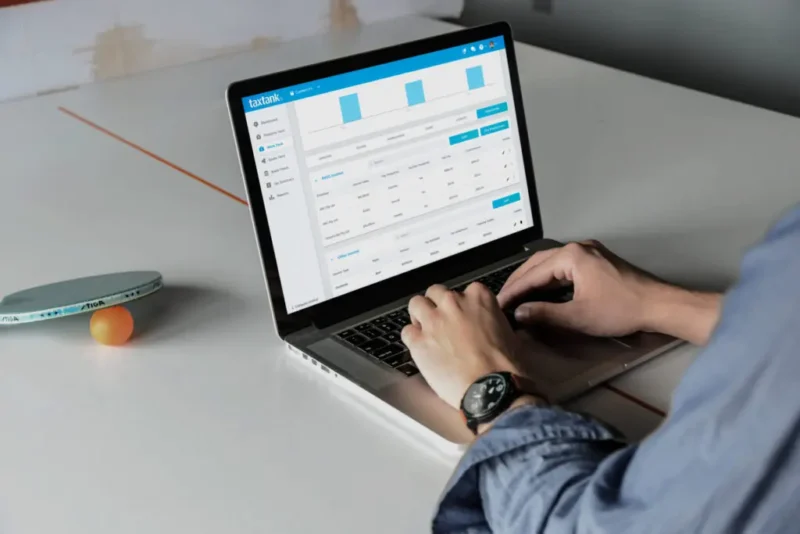

Discover the advantages of utilising tax software for your property investment in Australia. Learn how this tool streamlines processes, enhances accuracy, and maximises returns.

Many people start a side hustle while still working a full-time job or juggling other responsibilities such as family and education. While having a side hustle can be fulfilling and lucrative, balancing it with other responsibilities can be challenging. Here are some tips on how to find balance and avoid burnout.

Switch from Investment Property Spreadsheet Management to Tax Software

Learn how to avoid common tax mistakes during tax time in Australia. Expert advice to ensure a smooth process during tax season.

As cryptocurrencies gain popularity, so does the practice of cryptocurrency mining and staking to earn additional income from investments. While these activities can be lucrative, it’s crucial to understand the tax implications they carry in Australia, especially as the ATO moves to tighten the rules and reporting obligations of platforms.

Shares and cryptocurrency investments can be a rewarding endeavour, however it’s important to stay on top of your tax obligations. In Australia, accurate record-keeping is crucial to ensure you comply with ever evolving tax regulations and avoid unnecessary headaches down the line. In this blog we will provide you with essential tips for maintaining accurate records to effectively manage your shares and crypto tax in Australia.

As the end of the financial year (EOFY) approaches, it’s crucial to embark on early preparations to ensure a seamless and stress-free process. Many individuals in Australia tend to leave their tax return until the last minute, resulting in a rush and unnecessary stress. In this article, we will delve into the top ways you can prepare early for the end of the financial year.

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation. *All TaxTank Subscriptions are paid for on an annual basis.

Copyright © 2026 TaxTank | All Rights Reserved.

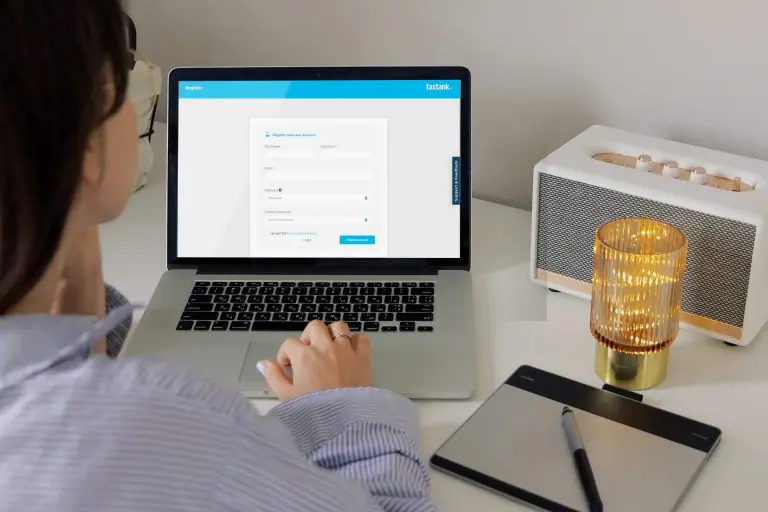

To sign up to receive our tax tips and tricks into your inbox, please complete the form below.