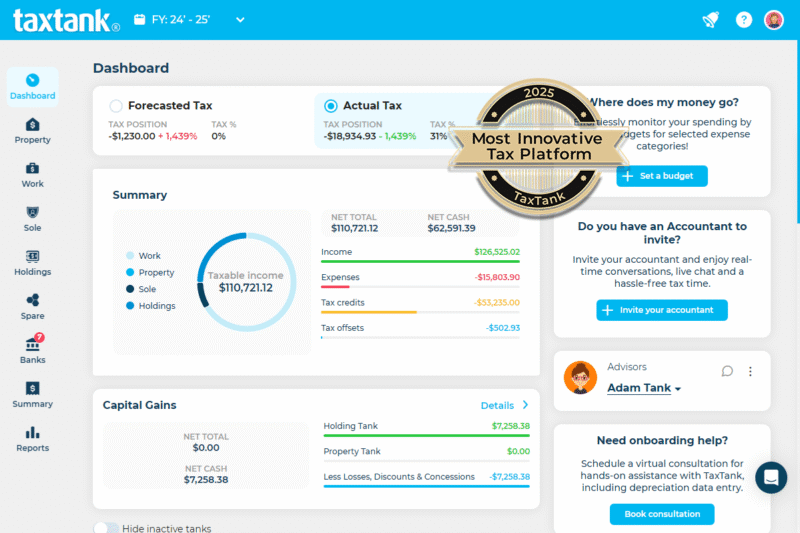

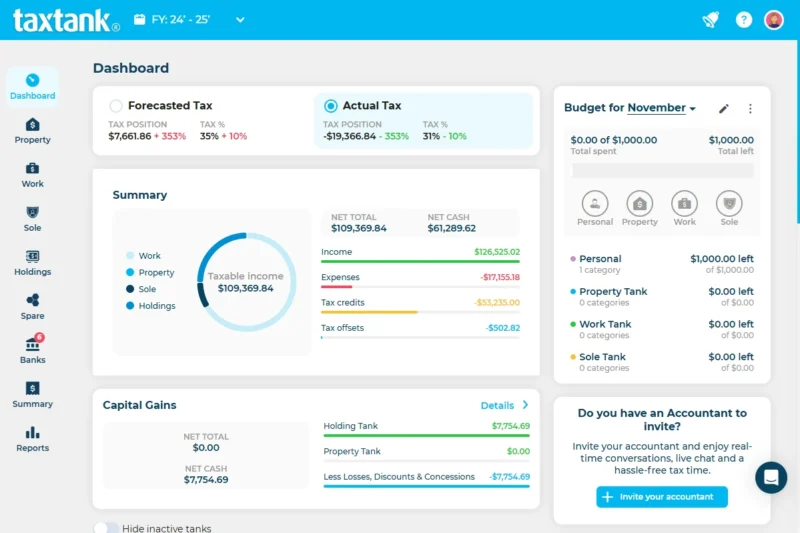

Why You Don’t Need an Accounting App and a Budgeting Tool to Keep Things Separate

For years, the standard advice has been simple. Use a self employed accounting software for business. Use a budgeting tool for personal finances. Keep everything separate. That thinking is so