TaxTank’s Latest Features & Smarter Tax Tools in 2025

EOFY might be nearly over, but we’re just getting started. At TaxTank, we’ve spent the last few months fine-tuning, integrating, and launching features designed to give you more control, more

Stay updated with the latest tax news, expert tips, and tricks to maximise your returns. Explore our blog for insights on tax strategies, property investment, and more.

EOFY might be nearly over, but we’re just getting started. At TaxTank, we’ve spent the last few months fine-tuning, integrating, and launching features designed to give you more control, more

Working from home can come with valuable tax deductions — if you know what you’re entitled to claim. With the ATO tightening up rules around work from home deductions, getting

The ATO may adjust your tax return if it picks up any errors, omissions or inconsistencies — and with EOFY just around the corner, now’s the time to make sure

As the financial year comes to a close, this is your last opportunity to get on top of your share investments and understand what tax implications are — before it’s

If you’re still thinking the ATO is just sitting back waiting for your tax return to roll in, it’s time for a reality check. Right now, they’re in the middle

When it comes to managing investment properties, finding the right property accountant is as important as choosing the right property. With ever-changing ATO regulations, complex deductions, and increasing audit activity,

The ATO’s latest data-matching crackdown on unreported rental income is causing confusion and frustration, with tax agents reporting that some taxpayers have been incorrectly targeted. In a bid to identify

Managing the financial side of an investment property can be tricky, but getting it right is essential for maximising returns and staying on the ATO’s good side. Whether you’re juggling

The Federal Budget has delivered a significant financial boost to the Australian Taxation Office (ATO), allocating an additional $999 million to extend and expand tax compliance activities. While the funding

Many property investors leave money on the table simply because they don’t fully understand investment property deductions. Without claiming eligible expenses, like depreciation, borrowing expenses, land tax, and maintenance costs,

The Australian Taxation Office (ATO) has long maintained that property investors are serial offenders when it comes to tax mistakes, claiming that “9 out of 10 property investors get it

Negative gearing is one of the most widely discussed investment strategies in Australia, especially among property investors. While it can offer significant tax advantages, many misconceptions surround its use and

For too long, property investors have been sidelined and stuck with spreadsheets, manual tax calculations, and software that simply was not built for their unique needs. Now, with the ATO’s

Running a business as a sole trader comes with flexibility and independence, but it also brings tax responsibilities that many get wrong. From inaccurate records to missed deductions, the common

Working from home has its perks—flexible hours, no commute, and an endless supply of coffee. But when it comes to tax time, the ATO isn’t making it easy for you

Ah, property ownership, the dream, the investment, the ever-growing list of things to worry about. Rates, repairs, tenants who somehow think “no pets” doesn’t apply to their emotional support goat…

Repairs, Capital, and Initial Repairs: Understanding the ATO’s Depreciation Guidelines (Before They Do It for You) The ATO depreciation guidelines are key to property investment, determining what you can and

Cryptocurrency is exciting but let’s be honest, taxes are not so much! Whether you’re a casual investor or a crypto trading enthusiast, calculating taxes on your digital assets can feel

When it comes to investment properties, depreciation is your unsung hero. It’s a powerful way to save on tax, boost your cash flow, and make your property work harder for

If you thought the ATO was keeping a close eye on taxpayers before, buckle up, 2025 is shaping up to be the year of peak scrutiny. With advanced data-matching technology,

Owning an investment property can be financially rewarding, but to truly maximise your returns, it’s essential to understand the investment property tax deductions available to Australian property investors. Claiming the

Managing investment properties can be a challenging task, especially when it comes to tracking expenses, calculating tax obligations, and ensuring compliance with Australian Taxation Office (ATO) requirements. While many property

Calculating Capital Gains Tax (CGT) can feel like navigating a financial maze, confusing, time-consuming, and filled with unexpected tax traps. Whether you’re selling property, shares, crypto, or business assets, keeping

Negative gearing for property investors is a popular strategy in Australia. It’s a way of using borrowed money to invest in property while reducing taxable income. While it’s an effective

Selling a property is exciting, but the mention of Capital Gains Tax (CGT) can dampen the mood. This tax, which applies to the profit made from selling certain assets, can

The journey of a sole trader in Australia offers unparalleled flexibility and control over your career. However, staying on top of tax obligations is essential to maintain financial health and

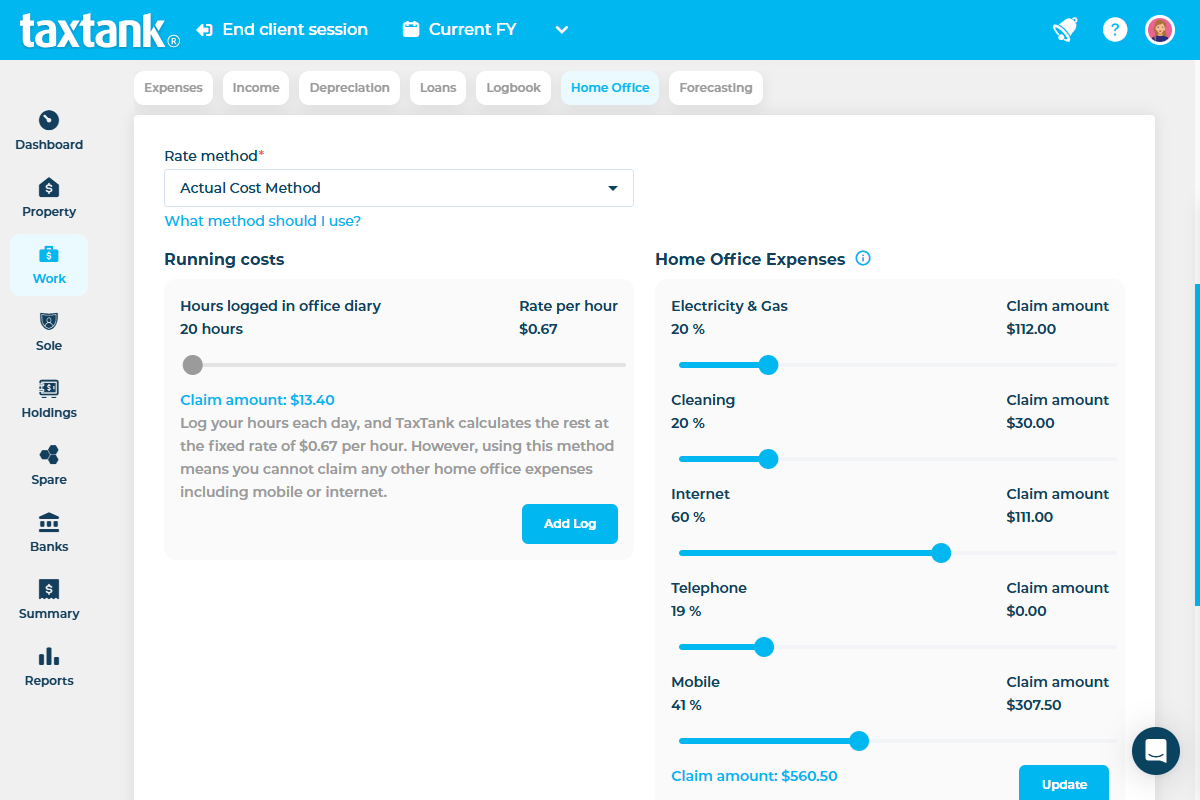

Working from home? Running your business from your living room? You might be missing out on valuable deductions! But not anymore. We’re excited to introduce Australia’s first digital Home Office

When operating as a sole trader in Australia, having an ABN (Australian Business Number) is essential for handling tax obligations. ABN tax calculation can seem complex, but with the right

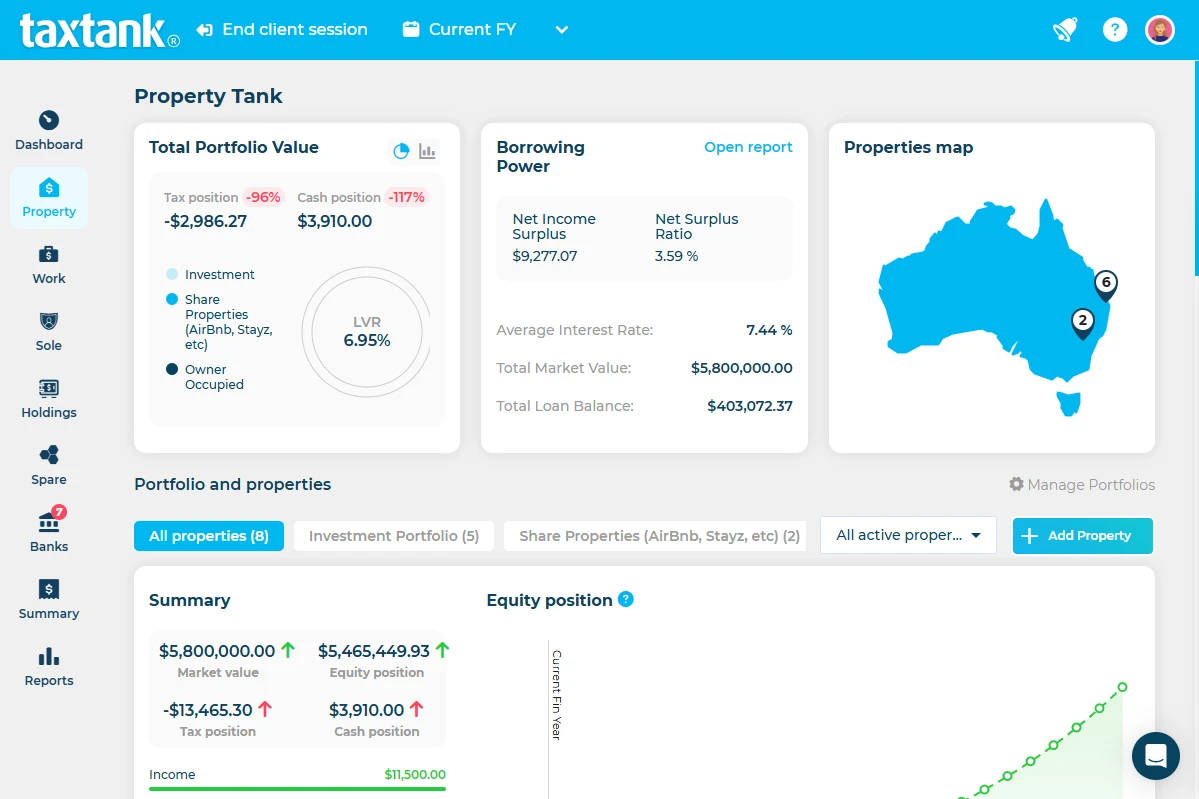

TaxTank revolutionises property tax and compliance by providing unmatched oversight and control, no matter your investment structure. With an intuitive interface, you can seamlessly navigate from a high-level property portfolio

Managing rental properties in Australia can be an overwhelming task, especially when it comes to keeping track of income, expenses, and tax obligations. That’s where rental property accounting software comes

Tax Tips and Tricks

Subscribe to receive regular tax tips and tricks so you’re confident you’re paying the least amount of tax possible.

TaxTank Pty Ltd ABN 43 633 617 615 is not a registered tax agent, a registered Business Activity Statement agent or a registered tax (financial) adviser as defined under the Tax Agent Services Act 2009. Any advice provided on the TaxTank platform (including this website) is only of a general nature and does not take into account your personal needs, objectives and financial circumstances. You should consider whether it is appropriate for your situation.

Copyright © 2025 TaxTank | All Rights Reserved.

To sign up to receive our tax tips and tricks into your inbox, please complete the form below.